Darlehensantragsformulare

Über Darlehensantragsformulare

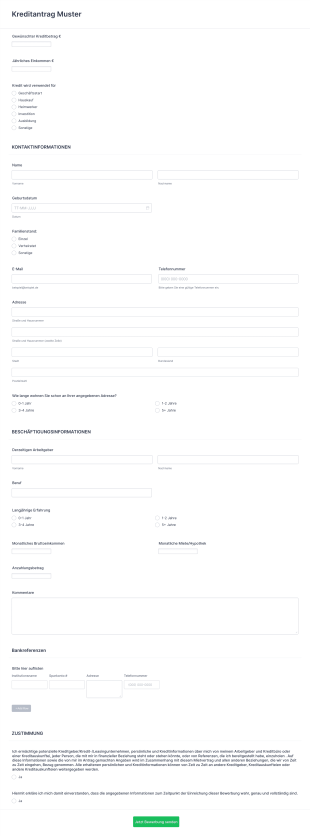

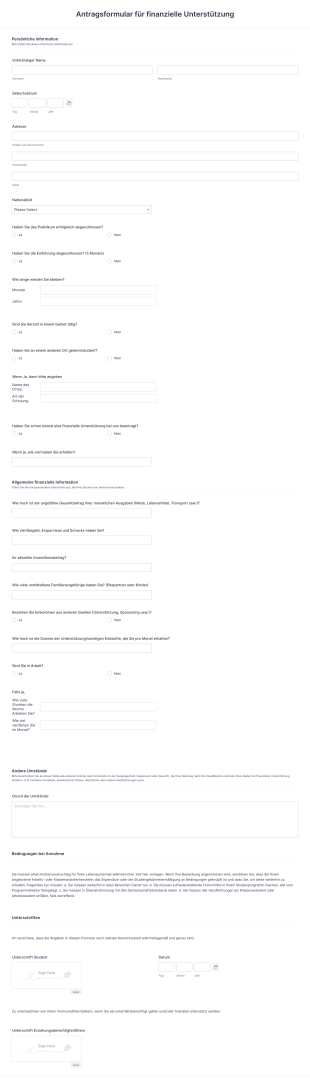

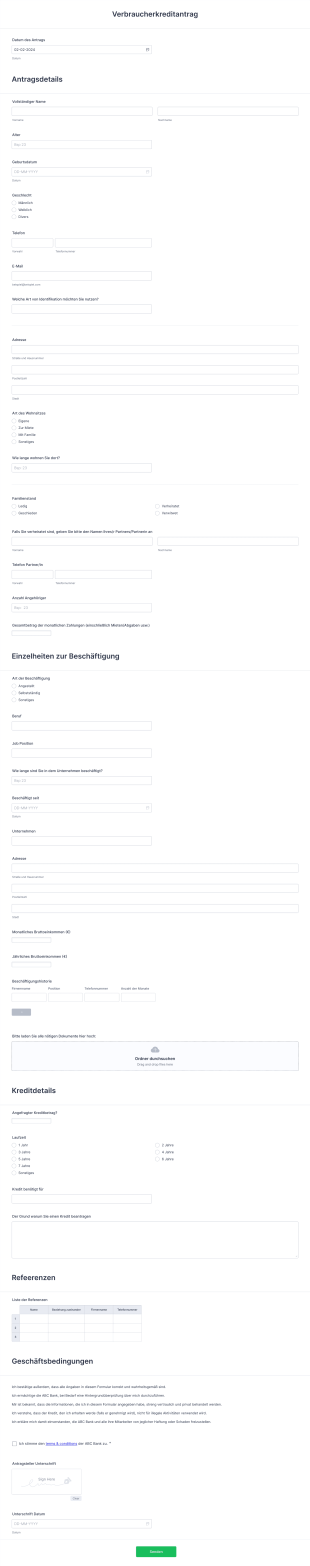

Darlehensantragsformulare sind wichtige Tools, die von Finanzinstituten, Kreditgebern, Kreditgenossenschaften und sogar Peer-to-Peer-Kreditplattformen verwendet werden, um detaillierte Informationen von Privatpersonen oder Unternehmen zu erfassen, die ein Darlehen beantragen. In diesen Formularen werden in der Regel Daten wie Angaben zum Antragsteller, Informationen zu Beschäftigung und Einkommen, die beantragte Darlehenssumme, der Zweck des Darlehens, angebotene Sicherheiten und die Einwilligung zur Bonitätsprüfung erfasst. Darlehensantragsformulare optimieren den Prozess der Prüfung der Kreditwürdigkeit, der Risikobewertung und der fundierten Kreditentscheidung. Sie werden in einer Vielzahl von Szenarien verwendet, darunter Privatkredite, Geschäftskredite, Hypothekenanträge, Autokredite, Studentenkredite und Mikrokredite.

Mit Jotform können Benutzer ganz einfach Darlehensantragsformulare online erstellen, anpassen und verwalten – ohne Programmierkenntnisse. Mit dem intuitiven Drag-and-Drop Formulargenerator von Jotform können Sie Felder hinzufügen oder ändern, Zahlungsportale integrieren und bedingte Logik einrichten, um das Formular an Ihre spezifischen Anforderungen anzupassen. Die Antworten werden automatisch in Jotform Tabellen organisiert, wodurch es einfach ist, Anträge zu prüfen, den Status zu verfolgen und mit Ihrem Team zusammenzuarbeiten. Egal, ob Sie ein kleiner Kreditgeber oder ein großes Finanzinstitut sind – die Funktionen von Jotform helfen Ihnen dabei, den Kreditantragsprozess zu optimieren, die Datengenauigkeit zu verbessern und die Antragstellererfahrung zu steigern.

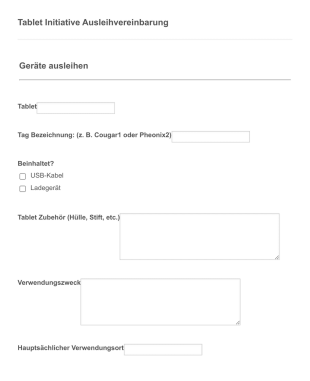

Anwendungsbeispiele für Darlehensantragsformulare

Darlehensantragsformulare dienen einer Vielzahl von Zwecken im gesamten Finanzsektor und darüber hinaus. Dank ihrer Flexibilität können sie an verschiedene Arten von Darlehen, Bewerberprofile und organisatorische Anforderungen angepasst werden. Hier erfahren Sie, wie sie verwendet und angepasst werden können:

Mögliche Use Cases:

- Persönliche Darlehensanträge für Privatpersonen, die Mittel für verschiedene Zwecke benötigen

- Anträge auf Darlehen für Start-ups oder etablierte Unternehmen

- Hypotheken- oder Wohnungsbaudarlehen für den Erwerb von Immobilien

- Anträge auf Darlehen zur Finanzierung von Fahrzeugen

- Anträge auf Studienkredite für Bildungsausgaben

- Mikrokreditanträge für Kleinunternehmer oder kommunale Kreditprogramme

Lösungspunkte:

- Standardisiert den Datenerfassungsprozess und reduziert Fehler und Auslassungen

- Ermöglicht eine schnelle Vorqualifizierung und Überprüfung der Teilnahmeberechtigung

- Erleichtert die Compliance mit regulatorischen Anforderungen durch Erfassung erforderlicher Disclosures und Einwilligungen

- Optimiert interne Überprüfungs- und Genehmigungs-Workflows

Mögliche Eigentümer und User:

- Banken, Kreditgenossenschaften und Online-Kreditgeber

- Hypothekenmakler und Immobilienagenturen

- Autohändler und Autokreditunternehmen

- Bildungseinrichtungen und Stipendiengeber

- Gemeinnützige Organisationen und Mikrofinanzinstitute

Unterschiede zwischen den Erstellungsmethoden:

- Formulare für Privatdarlehen können sich auf die Beschäftigung, das Einkommen und die Bonität konzentrieren

- Für Geschäftskredite sind häufig Unternehmensfinanzen, Steuerunterlagen und Businesspläne erforderlich

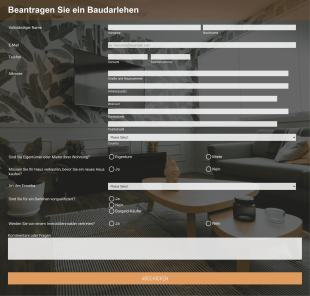

- Hypothekenformulare enthalten Angaben zur Immobilie, Informationen zur Anzahlung und Abschnitte für Mitantragsteller

- In Formularen für Autokredite werden möglicherweise Angaben zum Fahrzeug und zum Autohaus abgefragt

- In Formularen für Studienkredite werden in der Regel Angaben zur Immatrikulation und zum akademischen Werdegang verlangt

Zusammenfassend lässt sich sagen, dass Darlehensantragsformulare an verschiedene Kreditszenarien angepasst werden können, um sicherzustellen, dass die richtigen Informationen für jeden individuellen Use Case erfasst werden.

So erstellen Sie ein Darlehensantragsformular

Die Erstellung eines Darlehensantragsformulars mit Jotform ist ein unkomplizierter Prozess, der an jedes Kreditvorhaben angepasst werden kann – von privaten Darlehen bis hin zur Unternehmensfinanzierung. Hier ist eine Schritt-für-Schritt-Anleitung, die Ihnen hilft, ein effektives und benutzerfreundliches Darlehensantragsformular zu erstellen:

1. Beginnen Sie mit der richtigen Vorlage oder einem leeren Formular

Melden Sie sich in Ihrem Jotform-Konto an und klicken Sie auf Ihrer My Workspace Seite auf „Erstellen“. Wählen Sie „Formular“ und beginnen Sie entweder ganz neu oder wählen Sie eine passende Darlehensantragsvorlage aus der umfangreichen Bibliothek von Jotform. Entscheiden Sie sich für das Layout: Das klassische Formular (alle Fragen auf einer Seite) ist ideal für umfassende Anträge, während das Kartenformular (eine Frage pro Seite) den Prozess für Antragsteller weniger überwältigend erscheinen lässt.

2. Wichtige Formularfelder hinzufügen

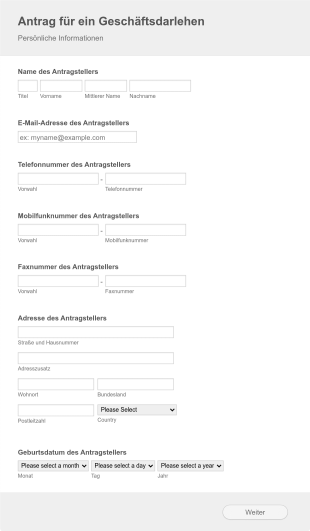

Verwenden Sie den Drag-and-Drop Formulargenerator, um Felder hinzuzufügen, wie:

- Vollständiger Name, Kontaktdaten und Anschrift des Antragstellers

- Beschäftigungsstatus, Angaben zum Arbeitgeber und monatliches Einkommen

- Beantragter Kreditbetrag und Verwendungszweck des Kredits

- Zusätzliche Informationen (falls zutreffend)

- Checkboxen für die Einwilligung zur Bonitätsprüfung und zum Datenschutz

- Felder für den Datei-Upload von unterstützenden Dokumenten (z. B. Gehaltsabrechnungen, Steuererklärungen, Businesspläne)

Fügen Sie bei Geschäftskrediten Felder für Firmenname, Art, Jahresabschlüsse und Steuer-ID hinzu. Bei Hypotheken- oder Autokrediten geben Sie bitte Angaben zur Immobilie oder zum Fahrzeug an.

3. Formular-Design anpassen

Klicken Sie auf das Farbrollen-Symbol, um den Formular Designer zu öffnen. Passen Sie Farben, Schriftarten und Layout an Ihr Branding an und sorgen Sie für ein professionelles Erscheinungsbild. Fügen Sie das Logo Ihres Unternehmens hinzu und passen Sie die Formular-URL an, um die Markenkonsistenz zu gewährleisten.

4. Bedingte Logik und Integrationen einrichten

Nutzen Sie bedingte Logik, um Felder basierend auf den Antworten des Antragstellers ein- oder auszublenden (z. B. Sicherheiten-Felder nur anzeigen, wenn ein besicherter Kredit ausgewählt wurde). Integrieren Sie Zahlungsportale, falls Sie Antragsgebühren erheben. Verbinden Sie CRM- oder Workflow-Tools zur automatischen Antragsverfolgung.

5. E-Mail-Benachrichtigungen und automatische Antworten konfigurieren

Richten Sie direkte Benachrichtigungen für Ihr Team ein, wenn eine neue Bewerbung eingeht. Senden Sie Bewerbern Bestätigungs-E-Mails mit den nächsten Schritten oder einer Kopie ihrer Antwort.

6. Formular veröffentlichen und teilen

Klicken Sie auf „Veröffentlichen“ und kopieren Sie den Formularlink, um ihn per E-Mail, auf Ihrer Website oder in Social Media zu teilen. Betten Sie das Formular direkt in Ihre Website ein, um einen nahtlosen Zugriff zu ermöglichen.

7. Antworten testen und verwalten

Verwenden Sie die Vorschau, um das Formular zu testen und sicherzustellen, dass alle Felder und die Logik wie vorgesehen funktionieren. Überprüfen und verwalten Sie Bewerbungen in Jotform Tabellen, wo Sie filtern, sortieren und mit Ihrem Team zusammenarbeiten können.

Mit diesen Schritten können Sie ein Darlehensantragsformular erstellen, das auf Ihren spezifischen Use Case zugeschnitten ist, alle erforderlichen Informationen erfasst und den Überprüfungsprozess sowohl für Antragsteller als auch für Ihr Unternehmen optimiert.

Häufig gestellte Fragen

1. Was ist ein Darlehensantragsformular?

Ein Darlehensantragsformular ist ein Dokument oder ein Online-Formular, das von Kreditgebern verwendet wird, um Informationen von Personen oder Unternehmen einzuholen, die ein Darlehen beantragen. Es enthält alle Angaben, die zur Prüfung der Berechtigung und zur Bearbeitung des Darlehensantrags erforderlich sind.

2. Warum sind Darlehensantragsformulare wichtig?

Sie standardisieren den Datenerfassungsprozess, stellen sicher, dass alle erforderlichen Informationen erfasst werden, und unterstützen Kreditgeber dabei, fundierte Entscheidungen zu treffen und gleichzeitig die Compliance-Vorschriften einzuhalten.

3. Welche Angaben sind in der Regel in einem Darlehensantragsformular erforderlich?

Zu den üblichen Angaben gehören die persönlichen Daten des Antragstellers, Angaben zu Beschäftigung und Einkommen, Höhe und Zweck des Darlehens, Sicherheiten (falls zutreffend) und die Einwilligung zur Bonitätsprüfung.

4. Gibt es verschiedene Arten von Darlehensantragsformularen?

Ja, Formulare können für Privatkredite, Geschäftskredite, Hypotheken, Autokredite, Studentenkredite und Mikrokredite angepasst werden, wobei jeweils spezifische Informationen erforderlich sind, die für die jeweilige Kreditart relevant sind.

5. Wer kann Darlehensantragsformulare verwenden?

Banken, Kreditgenossenschaften, Online-Kreditgeber, Hypothekenmakler, Autohändler, Bildungseinrichtungen und gemeinnützige Organisationen können Darlehensantragsformulare verwenden, um ihre Kreditvergabeprozesse zu optimieren.

6. Inwiefern unterstützen Darlehensantragsformulare die Compliance und den Datenschutz?

Dazu können Checkboxen für die Einwilligung, Datenschutzhinweise und sichere Methoden zur Datenerfassung gehören, um die Compliance mit gesetzlichen und regulatorischen Anforderungen zu gewährleisten.

7. Können Darlehensantragsformulare für verschiedene Darlehensprodukte angepasst werden?

Selbstverständlich. Die Formulare können angepasst werden, um spezifische Informationen je nach Art des Darlehens, Bewerberprofil und organisatorischen Anforderungen zu erfassen.

8. Ist es sicher, sensible Daten über ein Online-Darlehensantragsformular zu übermitteln?

Bei der Verwendung einer sicheren Plattform wie Jotform werden Daten verschlüsselt und geschützt, sodass sensible Informationen während des gesamten Bewerbungsprozesses vertraulich und sicher bleiben.