Moduli Domanda Prestito

Informazioni su Moduli Domanda Prestito

I moduli di richiesta di prestito sono strumenti essenziali utilizzati da istituti finanziari, istituti di credito, cooperative di credito e persino piattaforme di prestito peer-to-peer per raccogliere informazioni dettagliate da privati o aziende che richiedono un prestito. Questi moduli in genere raccolgono informazioni come i dati del richiedente, informazioni su impiego e reddito, l'importo del prestito richiesto, la finalità del prestito, le garanzie offerte e il consenso per le verifiche del credito. I moduli di richiesta di prestito semplificano il processo di valutazione dell'idoneità, la valutazione del rischio e il processo decisionale informato in materia di prestiti. Sono utilizzati in una varietà di scenari, tra cui prestiti personali, prestiti aziendali, mutui, prestiti auto, prestiti studenteschi e microprestiti.

Con Jotform, gli utenti possono creare, personalizzare e gestire facilmente i moduli di richiesta di prestito online, senza alcuna conoscenza di programmazione. L'intuitivo generatore di moduli drag-and-drop di Jotform consente di aggiungere o modificare campi, integrare gateway di pagamento e impostare la logica condizionale per personalizzare il modulo in base alle proprie specifiche esigenze. Le risposte vengono automaticamente organizzate nelle tabelle Jotform, semplificando la revisione delle domande, il monitoraggio degli stati e la collaborazione con il team. Che siate un piccolo istituto di credito o un grande istituto finanziario, le funzionalità di Jotform vi aiutano a semplificare il processo di acquisizione dei prestiti, migliorare l'accuratezza dei dati e ottimizzare l'esperienza cliente.

Casi d'uso dei moduli di richiesta di prestito

I moduli di richiesta di prestito servono a una vasta gamma di scopi nel settore finanziario e non solo. La loro flessibilità consente di adattarli a diverse tipologie di prestito, profili dei richiedenti ed esigenze organizzative. Ecco come possono essere utilizzati e personalizzati:

Possibili casi d'uso:

- Richieste di prestito personale per individui che cercano fondi per varie esigenze

- Richieste di prestiti aziendali per startup o aziende consolidate

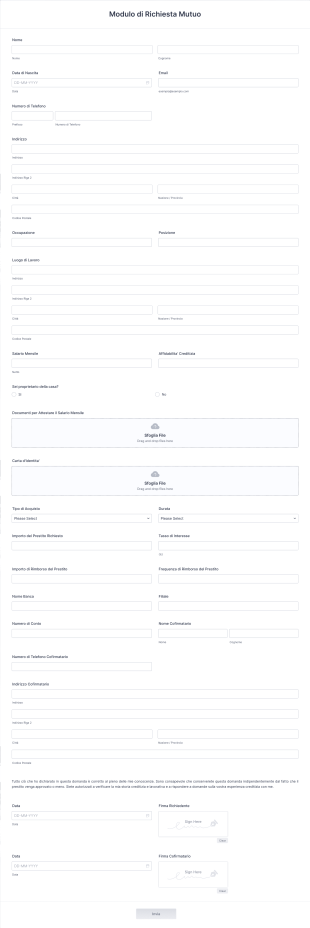

- Richieste di mutuo o prestito immobiliare per l'acquisto di immobili

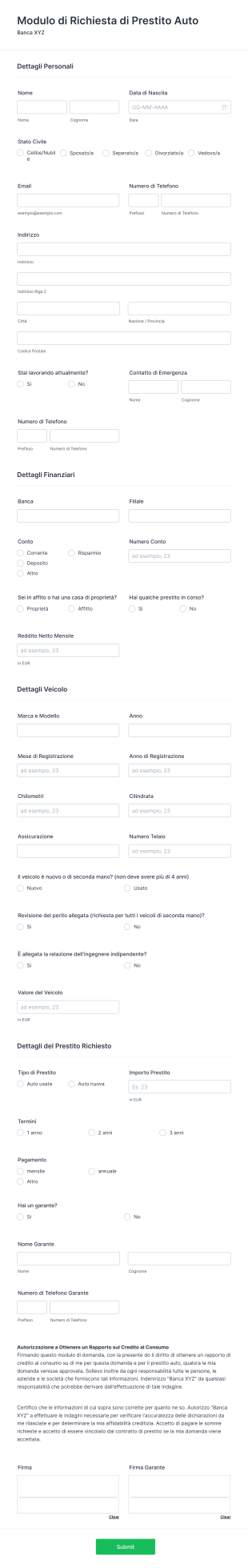

- Richieste di prestito auto per il finanziamento di veicoli

- Richieste di prestiti agli studenti per spese educative

- Richieste di microprestiti per piccoli imprenditori o programmi di prestito comunitario

Punti di risoluzione dei problemi:

- Standardizza il processo di raccolta dati, riducendo errori e omissioni

- Consente rapidi controlli di verifica e idoneità

- Facilita la conformità ai requisiti normativi acquisendo i consensi necessari

- Semplifica i flussi di lavoro di revisione e approvazione interna

Possibili proprietari e utenti:

- Banche, cooperative di credito e istituti di credito online

- Mediatori di mutui e agenzie immobiliari

- Concessionarie auto e società di finanziamento auto

- Istituzioni scolastiche e fornitori di borse di studio

- Organizzazioni non profit e di microfinanza

Differenze nei metodi di creazione:

- I moduli per prestiti personali possono concentrarsi su occupazione, reddito e storia creditizia

- I moduli di prestito aziendale spesso richiedono dati finanziari aziendali, documenti fiscali e piani aziendali

- I moduli per i mutui includono dettagli sulla proprietà, informazioni sul pagamento iniziale e sezioni relative al co-richiedente

- I moduli per il prestito auto potrebbero richiedere informazioni sul veicolo e dettagli sulla concessionaria

- I moduli per i prestiti agli studenti in genere richiedono l'iscrizione scolastica e i documenti accademici

In sintesi, i moduli di richiesta di prestito possono essere personalizzati per adattarsi a diversi scenari di prestito, garantendo che vengano raccolte le informazioni giuste per ogni specifico utilizzo.

Come creare un modulo di richiesta di prestito

Creare un modulo di richiesta di prestito con Jotform è un processo semplice e personalizzabile per adattarsi a qualsiasi scenario di prestito, dai prestiti personali ai finanziamenti aziendali. Ecco una guida passo passo per aiutarti a progettare un modulo di richiesta di prestito efficace e intuitivo:

1. Parti da un modello già pronto o da un modulo vuoto

Accedi al tuo account Jotform e clicca su "Crea" nella tua pagina "Il mio Workspace". Scegli "Modulo" e inizia da zero o seleziona un modello di richiesta di prestito pertinente dall'ampia libreria di Jotform. Scegli il layout: il modulo classico (tutte le domande su una pagina) è ideale per le richieste più complete, mentre il modulo cartolina (una domanda per pagina) può rendere la procedura meno complessa per i richiedenti.

2. Aggiungi campi modulo essenziali

Utilizza il Costruttore di Moduli con funzione trascina e rilascia per aggiungere campi come:

- Nome completo del richiedente, informazioni di contatto e indirizzo

- Stato occupazionale, dettagli del datore di lavoro e reddito mensile

- Importo del prestito richiesto e scopo del prestito

- Informazioni secondarie (se applicabili)

- Caselle di consenso per controlli di credito e privacy dei dati

- Campi di caricamento file per documenti di supporto (ad esempio, buste paga, dichiarazioni dei redditi, piani aziendali)

Per i prestiti aziendali, includi i campi relativi a ragione sociale, tipo di attività, bilanci e codice fiscale. Per mutui o prestiti auto, aggiungi i dettagli dell'immobile o del veicolo.

3. Personalizza il design del modulo

Clicca sull'icona del rullo per aprire il Designer Modulo. Regola colori, font e layout per adattarli al tuo brand e creare un aspetto professionale. Aggiungi il logo della tua organizzazione e personalizza l'URL del modulo per garantire la riconoscibilità del brand.

4. Imposta la logica condizionale e le integrazioni

Utilizza la logica condizionale per mostrare o nascondere i campi in base alle risposte del richiedente (ad esempio, visualizza i campi nascosti solo se è stato selezionato un prestito garantito). Integralo con i gateway di pagamento se hai bisogno di commissioni di iscrizione. Connettiti con CRM o strumenti di flusso di lavoro per automatizzare il monitoraggio delle domande.

5. Configurare le e-mail di notifica e di risposta automatica

Imposta notifiche istantanee per il tuo team quando viene inviata una nuova candidatura. Invia email di conferma ai candidati con i passaggi successivi o una copia della loro candidatura.

6. Pubblica e condividi il tuo modulo

Clicca su "Pubblica" e copia il link del modulo per condividerlo via email, sul tuo sito web o sui social. Incorpora il modulo direttamente sul tuo sito web per un accesso senza interruzioni.

7. Testare e gestire le risposte

Utilizza la funzione Anteprima per testare il modulo e assicurarti che tutti i campi e la logica condizionale funzionino come previsto. Esamina e gestisci le candidature nelle Tabelle Jotform, dove puoi filtrare, ordinare e collaborare con il tuo team.

Seguendo questi passaggi, puoi creare un modulo di richiesta di prestito personalizzato in base al tuo caso d'uso specifico, che raccolga tutte le informazioni necessarie e semplifichi il processo di revisione sia per i richiedenti che per la tua organizzazione.

Domande Frequenti

1. Che cos'è un modulo di richiesta di prestito?

Un modulo di richiesta di prestito è un documento o modulo online utilizzato dagli istituti di credito per raccogliere informazioni da privati o aziende che richiedono un prestito. Raccoglie i dettagli necessari per valutare l'idoneità ed elaborare la richiesta di prestito.

2. Perché i moduli di richiesta di prestito sono importanti?

Standardizzano il processo di raccolta dati, garantiscono che vengano raccolte tutte le informazioni necessarie e aiutano i creditori a prendere decisioni informate, mantenendo al contempo la conformità alle normative.

3. Quali informazioni sono solitamente richieste in un modulo di richiesta di prestito?

I campi comuni includono i dati personali del richiedente, informazioni su occupazione e reddito, importo e scopo del prestito, garanzie (se applicabili) e consenso per i controlli del credito.

4. Esistono vari tipi di moduli di richiesta di prestito?

Sì, i moduli possono essere personalizzati per prestiti personali, prestiti aziendali, mutui, prestiti auto, prestiti studenteschi e microprestiti, ognuno dei quali richiede informazioni specifiche pertinenti al tipo di prestito.

5. Chi può utilizzare i moduli di richiesta di prestito?

Banche, cooperative di credito, istituti di credito online, mediatori di mutui, concessionarie di automobili, istituti scolastici e organizzazioni non profit possono tutti utilizzare i moduli di richiesta di prestito per semplificare i loro processi di erogazione dei prestiti.

6. In che modo i moduli di richiesta di prestito contribuiscono alla conformità e alla privacy?

Possono includere caselle di spunta per il consenso, informative sulla privacy e metodi sicuri di raccolta dati per favorire la conformità ai requisiti legali e normativi.

7. I moduli di richiesta di prestito possono essere personalizzati per diversi tipi di prestito?

Certamente. I moduli possono essere adattati per raccogliere informazioni specifiche in base al tipo di prestito, al profilo del richiedente e alle esigenze organizzative.

8. È sicuro inviare informazioni sensibili tramite un modulo di richiesta di prestito online?

Quando si utilizza una piattaforma sicura come Jotform, i dati vengono crittografati e protetti, garantendo così che le informazioni sensibili rimangano riservate e sicure durante l'intero processo di candidatura.