Verzekering Formulieren

Over Verzekering Formulieren

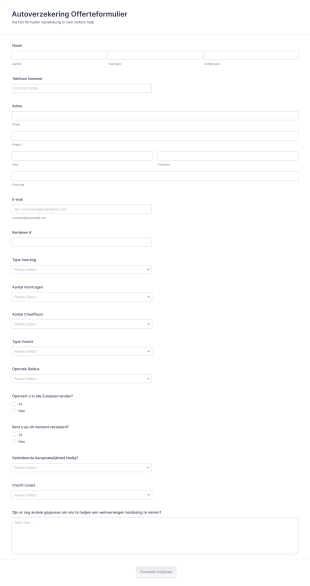

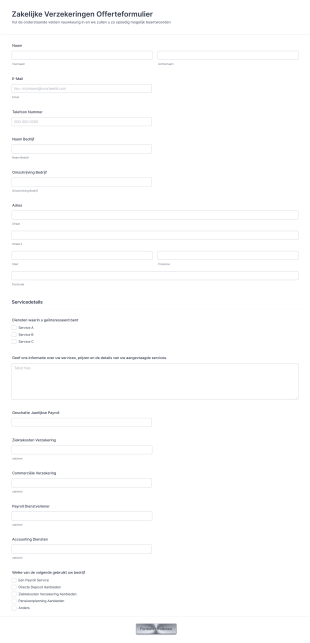

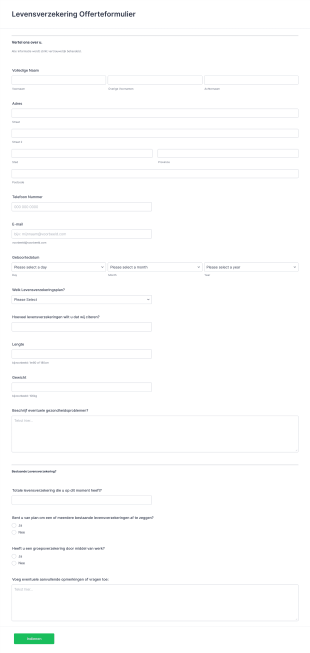

Vereenvoudig het ontvangen van verzekeringsoffertes en informatie met een verzekeringsformulier sjabloon. Met volledig aanpasbare sjablonen voor verzekeringsformulieren kunt u processen stroomlijnen en het papierwerk weghalen door de informatie te ontvangen die u nodig hebt. Verzekeringsgegevens worden secuur en veilig verzameld en netjes opgeslagen in uw Jotform dashboard. U kunt uw gegevens ook integreren met uw favoriete bedrijfshulpmiddelen, zodat uw gegevens automatisch de tools vullen die u dagelijks gebruikt. Het enige wat je hoeft te doen is een sjabloon selecteren (of een nieuw formulier maken), het naar wens aanpassen en publiceren! Uw verzekeringsformulier zal binnen een mum van tijd offertes verzamelen.

Veelgestelde vragen

1. Wat is een verzekeringsformulier?

Een verzekeringsformulier is een document dat wordt gebruikt om informatie te verzamelen over verzekeringen, claims, aanvragen of updates. Het helpt verzekeraars om op efficiënte wijze de benodigde gegevens van klanten of polishouders te verzamelen.

2. Waarom zijn digitale verzekeringsformulieren belangrijk?

Digitale verzekeringsformulieren verminderen papierwerk, minimaliseren fouten, versnellen verwerkingstijden en bieden een gemakkelijkere ervaring voor zowel klanten als verzekeringsprofessionals.

3. Welke informatie is doorgaans vereist op een verzekeringsformulier?

Veelvoorkomende velden zijn persoonlijke gegevens, polisnummers, incidentbeschrijvingen, ondersteunende documentatie en handtekeningen. De exacte informatie is afhankelijk van het doel van het formulier (bijv. claims, aanvragen).

4. Zijn er verschillende soorten verzekeringsformulieren?

Ja, er zijn verschillende soorten, zoals beleidsaanvraagformulieren, claimformulieren, formulieren voor het bijwerken van begunstigden, vragenlijsten voor risicobeoordeling en feedbackenquêtes.

5. Wie kan verzekeringsformuliersjablonen gebruiken?

Verzekeringsmaatschappijen, makelaars, onafhankelijke agenten, schade-experts, HR-afdelingen en zelfs polishouders kunnen deze templates gebruiken om hun processen te stroomlijnen.

6. Hoe wordt privacy en databeveiliging geregeld bij verzekeringsformulieren?

Jotform gebruikt veilige gegevensopslag, versleuteling en compliance met industriestandaarden om gevoelige informatie die via verzekeringsformulieren wordt verzameld te beschermen.

7. Kunnen verzekeringsformulieren worden aangepast voor verschillende soorten verzekeringen?

Absoluut. Formulieren kunnen worden aangepast voor gezondheids-, auto-, eigendoms-, levens-, reis- en andere soorten verzekeringen door velden toe te voegen of aan te passen aan specifieke vereisten.

8. Wat zijn de voordelen van het gebruik van online verzekeringsformulieren voor klanten?

Klanten profiteren van snellere verwerking, minder papierwerk, directe bevestiging van inzendingen en de mogelijkheid om formulieren vanaf elk apparaat in te vullen, wat de algehele tevredenheid verbetert.