Benefits of using QuickBooks

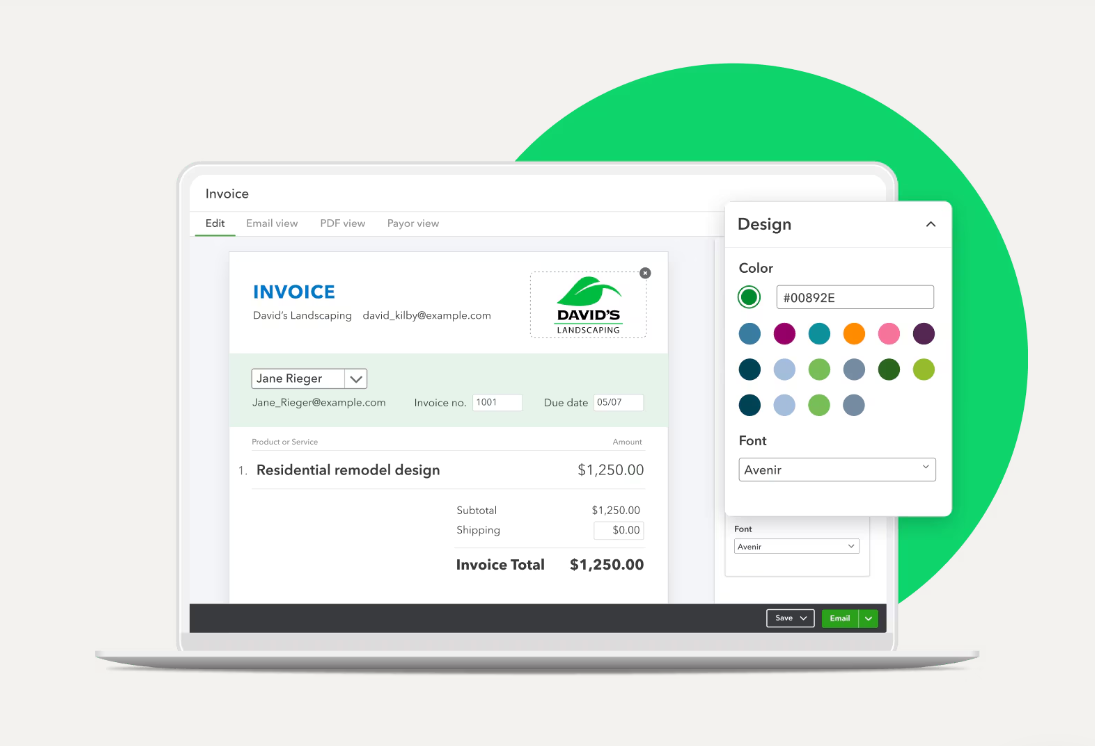

- Custom invoices and quotes

- Progress invoicing for larger projects

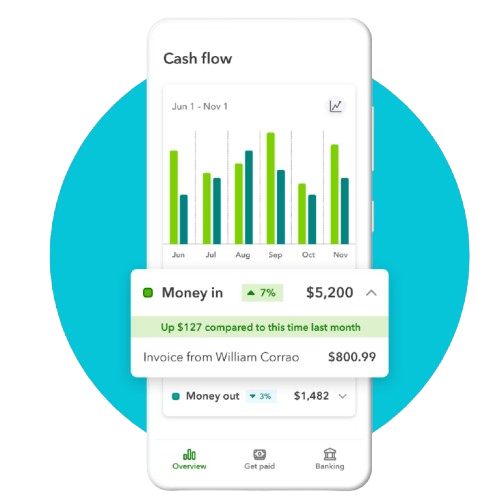

- Income tracking

- Mobile invoice creation

- Expense tracking and categorization

- Photo receipts

- Management of recurring bills

- Easy-to-create reports

- Secure data storage

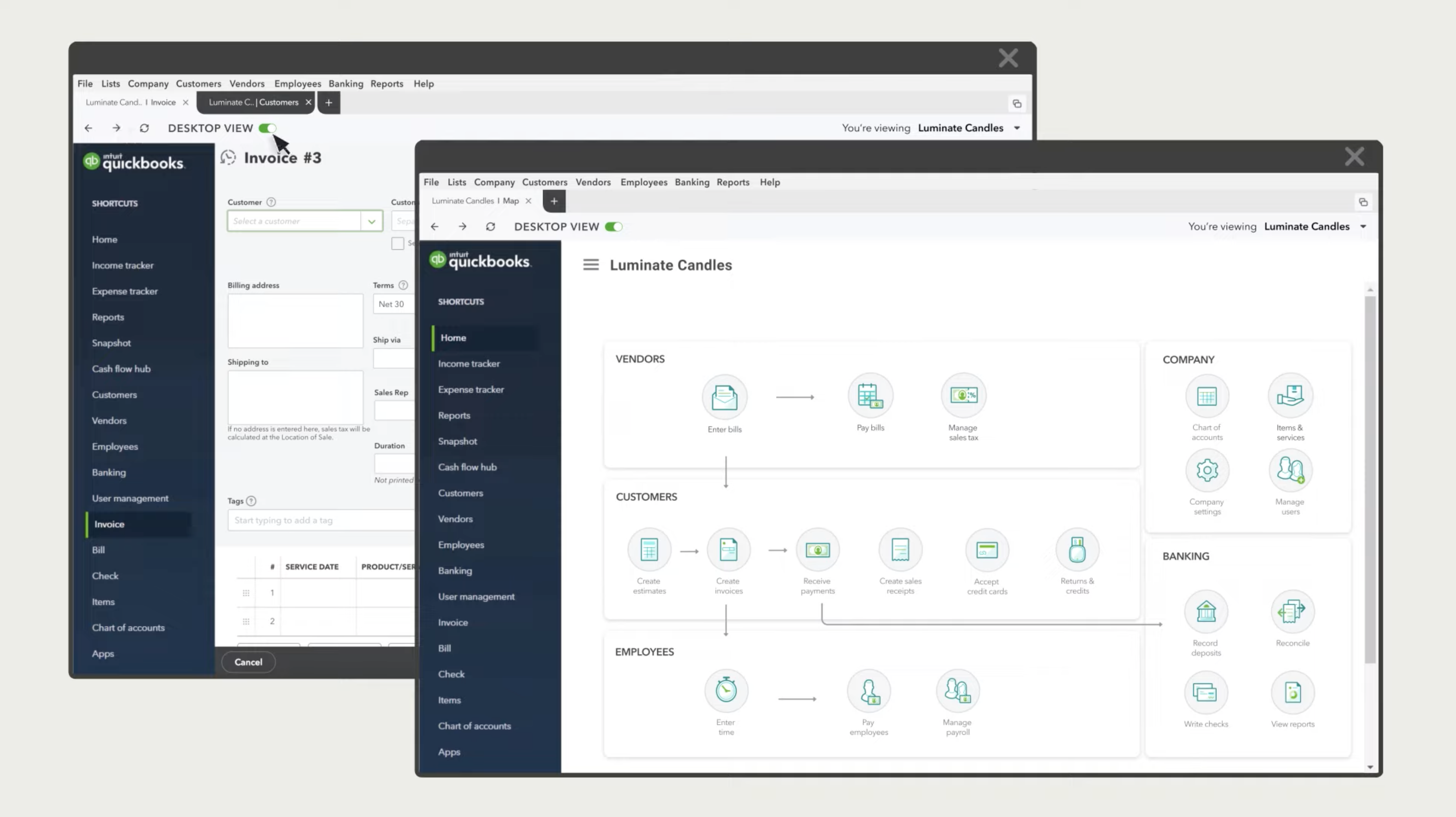

- Data syncing across devices

- Automatic backup of your data

- Access data from the cloud

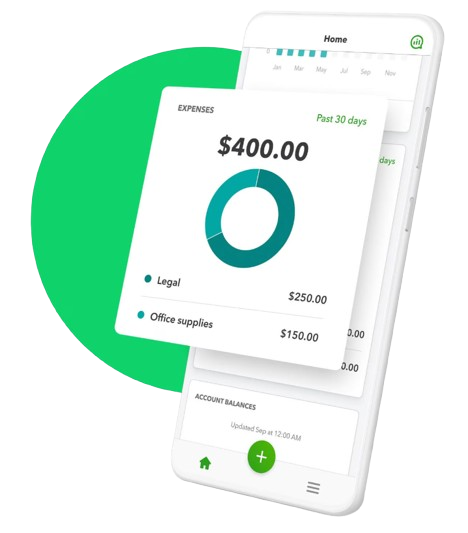

QuickBooks, an accounting software platform, helps small and large businesses track and organize their finances. The platform helps with everything from tracking income and expenses to processing payroll and filing taxes. QuickBooks is a highly popular platform, and for good reason — it’s versatile and offers many benefits.

QuickBooks products and pricing

With so many QuickBooks products available, chances are there’s a product that’s right for your business and your budget. Here’s a list of them:

- Simple Start: $35 per month

- Essentials: $65 per month

- Plus: $99 per month

- Advanced Online: $235 per month

- Solopreneur: $20 per month

- Money: $0 per month; per-transaction fee

- Payroll Core: $50 per month, plus $6 per employee per month

- Payroll Premium: $85 per month, plus $9 per employee per month

- Payroll Elite: $130 per month, plus $11 per employee per month

- Contractor Payments: $15 per month for 20 contractors, plus $2 per additional contractor

- Time Premium (for time-tracking with payroll): $85 per month, plus $9 per employee per month

- Time Elite (for time-tracking with payroll): $130 per month, plus $11 per employee per month

- Desktop Enterprise: Gold, $1,922 for first year; Platinum, $2,363 for first year; Diamond, $4,668 for first year

- QuickBooks Online Accountant: Same as Simple Start, Essentials, Plus, and Advanced

- Premier ProAdvisor Software Bundle: $799 per year

- Enterprise Software Bundle: $1,299 per year

The many benefits of QuickBooks

Whether you’re a solopreneur or running a larger business, you’ll find many benefits to using QuickBooks.

Benefits for invoicing

- Custom invoices and quotes. QuickBooks gives you the ability to create and send professional quotes, estimates, and invoices. You can track those invoices to monitor payments and send personalized automated reminders to any customers who are late making a payment.

- Progress invoicing for larger projects: QuickBooks progress invoicing allows you to easily split up estimates into multiple invoices for different milestones or project stages. This feature can help improve your cash flow.

- Income tracking: QuickBooks’ cash flow statements provide data on your income and cash flow, and they can help you make predictions about your future cash flow.

- Mobile invoice creation: With the QuickBooks app, you can create and send invoices no matter where you are. You can also track payments using the app. Plus, you can send invoices using WhatsApp to ensure they reach your customers.

Benefits for expenses

- Expense tracking and categorization: By connecting QuickBooks to your bank account, you can automatically import and categorize expenses. You can also create customizable categories to keep your expenses organized.

- Photo receipts: With the QuickBooks Online mobile app, you can take photos of receipts to create digital records. These digital records can make it easier to stay organized and prepare for tax filings.

- Management of recurring bills:. Depending on the QuickBooks plan that you choose, you may be able to set up recurring payments. This feature can save you time entering each payment. It also helps you avoid overlooking expenses.

- Easy-to-create reports: QuickBooks’ built-in reports, including profit-and-loss statements, make it easy to quickly review your financial data. You can share the reports with your accountant and use them to make informed business decisions.

Benefits for cloud accounting

- Secure data storage: QuickBooks uses advanced safeguards and AES 256-bit encryption to protect your data in the cloud, giving you peace of mind.

- Data syncing across devices: Since your data is stored in the cloud, you don’t have to worry about whether you’re accessing out-of-date information. You’ll be able to retrieve real-time data across all of your devices, ensuring your records are accurate.

- Automatic backup of your data: QuickBooks gives you the ability to set up automatic and continuous online backups to help protect your data. You can use the audit logs to track changes and even restore your data to a certain date if needed to help ensure your information is accurate.

- Access data from the cloud: With your financial data stored in the cloud, you can access it from anywhere, at any time. Such convenient access is ideal when you’re working remotely or when you need your finance team to be able to use QuickBooks whether they’re in or out of the office.

An enhanced QuickBooks experience with Jotform

Jotform integrates with QuickBooks, so you can automatically send information collected through Jotform forms to QuickBooks, adding it to your records. You can even create QuickBooks invoices from your Jotform submissions, streamlining the invoice creation process. You can also send purchase orders and payment information through your online forms, and QuickBooks will automatically populate the information so you don’t have to enter it manually.

The integration will save you from having to manually transfer your information between your two accounts, saving you valuable time. It also helps to prevent data entry errors, keeping your information and invoices accurate.

To help you get started, Jotform already has QuickBooks form templates. These ready-made templates are easy to use, and you can customize them with the drag-and-drop form builder. There’s no coding required, and making the forms your own is simple and easy.

Use the bookkeeping client intake form to collect information about a new client. You can post this form on your website or share it through an email to gather new client information. Then you can import that information into your QuickBooks account.

The invoice upload form simplifies the process of creating an invoice. You can add any custom fields to the form that you want to appear on your invoices, then fill out the form when you need to create an invoice. The data will be synced with your QuickBooks account, creating a QuickBooks invoice that you can then send to your client and track for payment. When you send invoices through QuickBooks, you can also use features like sending automated reminders for unpaid invoices.

The product purchase order form template is equally easy to use. Record information about each product and its price to track purchases. This information will be synced with your QuickBooks account and reflected in your reporting.

Jotform can also help with your expense tracking. The expense tracking form templates are fully customizable and allow you to track expense reimbursements.

For example, the expense reimbursement form with calculations can track reimbursements, including mileage. The business expense reimbursement approval template sends a reimbursement form submission through the members of your business’s approval flow. As the form automatically moves through the approval process, the data is recorded in your QuickBooks account.

QuickBooks is a powerful platform that supports your business finance tracking, and it’s made more powerful when you integrate it with Jotform. Together, these platforms can help increase the accuracy of your financial data and streamline your recordkeeping.

Photo by Jonathan Francisca on Unsplash

Send Comment: