Despite the high-speed internet connections and Bloomberg terminals found on financial trading floors, the broader banking industry — and retail banking in particular — is incredibly labor intensive. Most interactions with the public take place in branches, employees approve loans manually, and there are still reams of physical paperwork.

This makes the industry ripe for automation, says Maria Schuld, an executive of banking solutions in the Americas division at FIS. “Automating labor-intensive processes enables financial services organizations to realize time savings, leverage scarce resources, and focus on creating unique customer experiences — while eliminating redundant work and tedious tasks.”

Achieving these benefits is a case of understanding where to focus your automation efforts and what tools are available to help.

Interested in exploring how automation can further streamline banking processes? Take a look at this white paper on digitalization in finance for expert guidance on transforming finance operations.

Why is banking ripe for automation?

Digital banking is the future. Almost one-third of bank customers surveyed by PWC would prefer to avoid branches completely.

To this end, banks have spent a great deal of time and effort digitizing the front-office, customer-facing experience, writes Keith Pearson, the global head of financial services for ServiceNow. While that’s great, he says, the vast majority of the customer experience depends on back-office functionality — and that still needs attention.

The early automation efforts banks have made leave a lot to be desired, write McKinsey’s Federico Berruti, Emily Ross, and Allen Weinberg.

“Some have installed hundreds of bots — software programs that automate repeated tasks — with very little to show in terms of efficiency and effectiveness. Some have launched numerous tactical pilots without a long-range plan, resulting in confusion and challenges in scaling. Other banks have trained developers but have been unable to move solutions into production.”

But their forecast on the future of automation in the banking industry is still bright.

What are examples of automation in banking?

Automation in banking doesn’t have to be complicated, and it can come in many forms:

- Customer onboarding: Collect the data you need from customers and automate backend workflows to ensure customers get onboarded fast.

- Credit applications: Simplify the credit or loan application process for customers using an online form. Store that data securely online and share it with colleagues to ensure no application goes missing.

- Paperwork automation: Avoid breakdowns in communication by digitizing paperwork and automating the approval process.

- Customer service: Provide the kind of customer service users demand by digitizing customer feedback surveys and automatically sending issues to development and customer support teams.

How can Jotform help with automation in banking?

You can use Jotform to automate processes at almost every step of the customer journey.

Acquire and onboard new customers

New customers want access fast when they sign up for a bank account. This can be difficult to achieve with manual processes, but it’s straightforward when you have a digitized system for data collection and an automated workflow. Jotform gives you both.

Use one of Jotform’s prebuilt onboarding templates to collect the data you need. That data will automatically be stored in a Jotform table. You can use Jotform’s automated approval templates for finance to ensure each submission goes to the correct person who can approve the request and make the necessary arrangements to onboard the customer. At each stage, automated responses can be sent to the applicant, letting them know how their application is progressing.

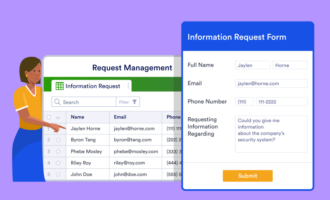

Collect and store customer applications

Banks receive thousands of loan, credit card, and mortgage applications every month. Manual processes for managing these applications are hugely inefficient, and they’re made worse if applicants submit them using paper rather than doing it online.

With Jotform, banks can digitize and automate much of the application process. Dozens of customizable banking form templates make it easy to collect the information you need from customers. Jotform is GDPR and CCPA compliant and protected with a 256-bit SSL connection, so your customers’ information will be safe.

Improve customer service

Your bank’s digitization efforts may not always go smoothly, which is why it’s important to collect feedback and have a streamlined customer service process. Use one of Jotform’s customer feedback templates or follow-up surveys to digitize the process and use a Jotform table to analyze the data.

These aren’t the only ways to use Jotform to give customers the digital banking experience they want. Discover how Jotform Tables and Jotform Apps can streamline your bank’s workflows.

Photo by Tyler Franta on Unsplash

Send Comment: