If you’re familiar with terms like APR, escrow, collateral, and interest rate, you likely have some experience with the world of loans. Common types of loans include mortgage, business, and personal loans. An increasingly popular type is the signature loan.

Personal lending is the fastest-growing category of consumer lending. A signature loan is a type of personal loan — an agreement to borrow money that you pay back in fixed monthly payments.

Unlike mortgage or auto loans, you’re allowed to spend the funds from a signature loan in any way you see fit. Signature loans are unsecured (meaning they don’t require collateral) and structured based on the lender’s credit rating and/or employment.

Borrowers can spend the money from a signature loan on any item or service they choose. Common uses include large purchases, emergency expenses, and debt consolidation. Need some extra cash to pay for a wedding, home improvement project, or large medical bill? These are all ways to use a signature loan.

Imagine you have credit card debt accruing interest at 20 percent or more. A bank might offer you a signature loan at a lower interest rate. After you pay off your credit cards with the loan, you then pay back the loan amount to the bank. You save money because the debts are consolidated and you get a lower interest rate with the loan.

The fact that signature loans are unsecured is another benefit. In contrast, a secured loan holds specific assets that you own as collateral to ensure repayment. For example, a mortgage is a common type of secured loan that holds your home as collateral.

However, because there’s no collateral for signature loans, a financial provider might demand a higher interest rate or a more stringent repayment schedule.

Now that you know what is a signature loan is, let’s look at how they work, how to qualify for one, and what else you need to know about them.

Send my document for signature

File type is not allowed.

Maximum file size limit exceeded. (5MB)

Something went wrong.

How does a signature loan work?

A signature loan is sometimes referred to as a “good faith loan” or “character loan” since they only require your signature to demonstrate your commitment to pay back the money.

Many loans, such as auto loans, require an asset (e.g., your car) as collateral to secure the loan. With a signature loan, however, there’s no collateral involved. So if you fail to make payments on the loan, the lender can’t go after your assets to recover their losses.

Failure to pay a signature loan isn’t without consequences, though. If you miss payments, this will negatively impact your credit score. This consequence may seem minor until you try to rent the perfect apartment or apply for your favorite store’s credit card. A poor credit score will hurt all of your future credit applications — and even your chances of getting a job.

How do you qualify for a signature loan?

Since signature loans aren’t secured with collateral, a key factor in the qualification process is your credit score. However, good credit isn’t the only thing lenders assess in a loan application. Following are the four primary criteria for qualifying for a signature loan.

- Good credit: Your credit score is a three-digit number ranging from 300 to 850, with 850 being the best. This score is based on the information in your credit files and represents your creditworthiness (i.e., how likely you are to repay a debt). Credit scores are important when you’re applying to borrow money from an institution.

So what credit score do you need to get a signature loan?

Different lenders have different credit score requirements for signature loans. In general, 630–689 is considered a fair credit score. Within this range, it’s more difficult to obtain a loan than if you had good or excellent credit, but it’s still feasible. Some lenders will accept credit scores between 600–630, but your options will be limited.

- Adequate income: When you apply for a signature loan, your lender needs to know that you can pay off your debt. Having a stable source of sufficient income increases a lender’s confidence in your ability to make your loan payments. Lenders have different views on what constitutes “adequate” income.

However, the documents required to prove your income are fairly standard and typically include

- Pay stubs

- A W-2 or tax return

- Direct deposit statements

Other potential document types include payroll schedules, statements demonstrating retirement income, or a signed letter from your employer.

- Little existing debt: While income is an important piece of the loan application, lenders will also look at your debt-to-income ratio. Even if you make good money, having a lot of existing debt is problematic for your loan application.

Lenders look for individuals who manage debt responsibly by keeping credit card balances low and maintaining debt at a reasonable level. In general, it’s best to keep your credit card balances under 10 percent of your credit limit. - Permanent address and job: Another factor lenders consider is the perceived stability of your situation. Having a permanent address is essential. Also, a consistent paycheck implies that your income will remain constant throughout the term of the loan. Additionally, individuals with a family and other local obligations are less likely to disappear to avoid payment.

What’s the typical interest rate on a signature loan?

Since there’s no collateral, the interest rates for signature loans are often higher than other types of credit. Additionally, the annual percentage rate (APR) will depend on your credit score. Interest rates range anywhere from 5–36 percent and depend on the payer’s circumstances and credit record. Individuals with higher credit scores may be able to secure more favorable APRs.

Here’s a breakdown of the average interest rates for personal loans (as of March 2023):

- Excellent credit score (750–850): 12.14 percent APR

- Good credit score (700–749): 16.14 percent APR

- Fair credit score (640–699): 22.02 percent APR

What are repayment methods of signature loan?

Before taking out a loan, always compare different financial providers, the products they provide, and the fees they charge. Shop around to find the best option for your situation.

Consider a loan’s repayment method, or the way you pay off the principal amount and interest. Repayment methods for signature loans can vary, but they include the following:

- Variable rate: The interest rate is based on a changing index and can fluctuate over time.

- Fixed rate: The interest rate remains the same for the life of the loan.

- Payday: Also called cash advances, these small, short-term loans often have higher interest rates.

- Convertible: This type of loan can convert into shares or stock and often has lower interest rates.

- Single-payment: Borrowers pay the principal and interest on this type of loan in one payment on an exact date.

Some financial providers consider more information than a borrower’s credit score, like your occupation, education, and whether you have a cosigner.

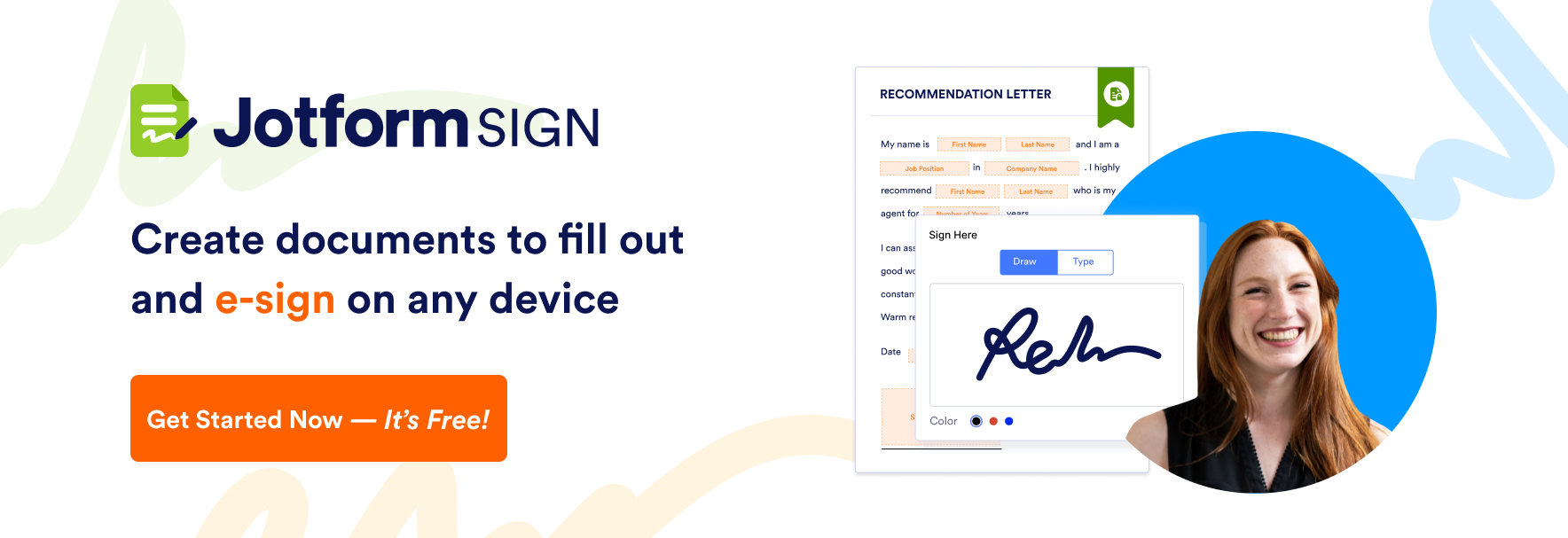

Can e-signatures be used for financial documents?

As the name suggests, signatures are an essential aspect of a signature loan. Since there’s no collateral, your signature represents your promise to repay the loan. Given the emphasis on the signature, you may be wondering if an electronic signature is sufficient for a document of this importance. The answer is usually yes.

E-signatures are now commonplace in the financial world, and they’ve been legally valid since since the E-Sign Act was signed into law in 2000.

E-signatures have notable advantages over traditional, pen-and-paper signatures. They’re more convenient, and they make the document-signing process faster. This convenience also makes the loan application process significantly easier.

For this reason, electronic signatures are well suited to signature loans. They carry the same weight as pen-and-paper signatures but lack the hassles associated with printing and scanning documents or having to visit a bank in person.

Pro Tip

Use Jotform Sign Mobile to scan paper disclosures, collect multiple signatures in one session, and track loan document status in Sign Inbox with instant notifications.

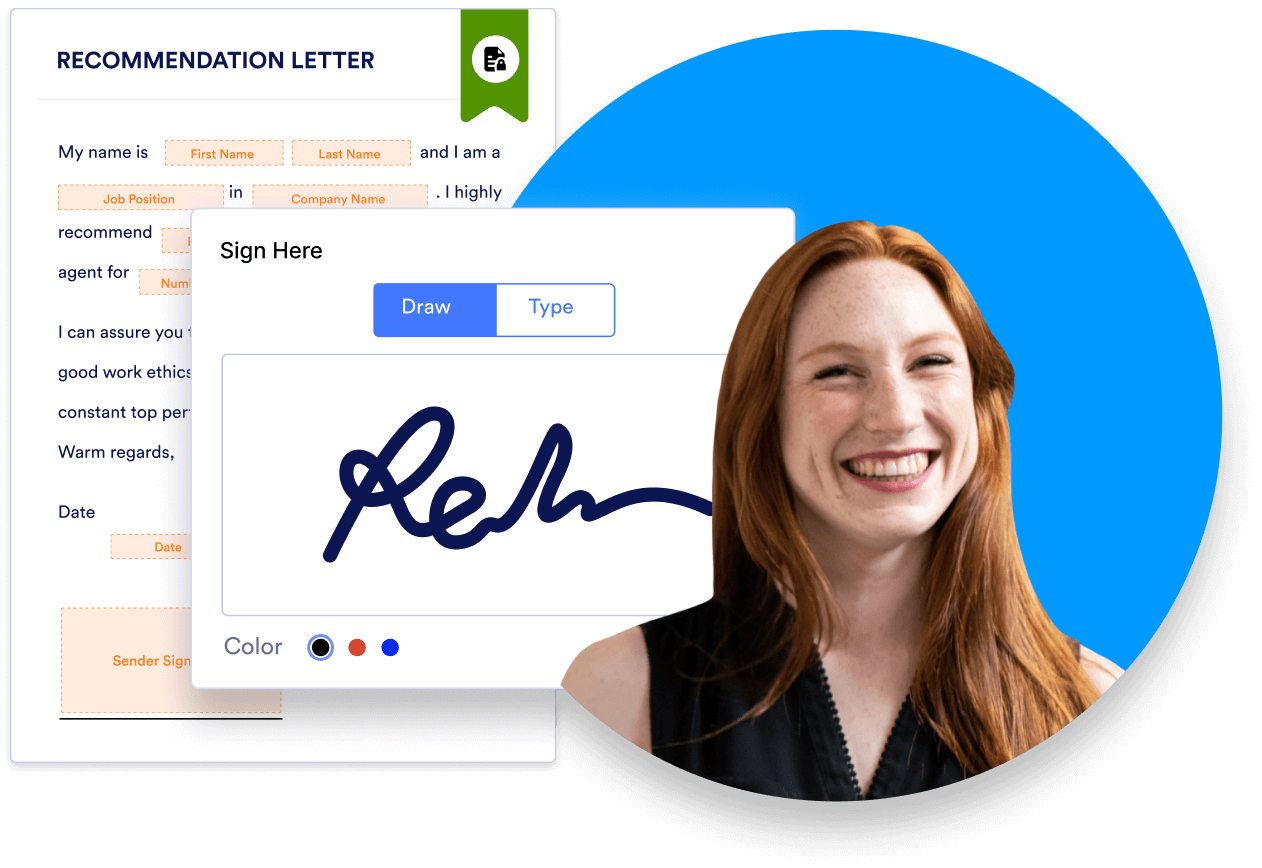

How Jotform Sign makes collecting loan e-signatures easy

E-signatures make processing a signature loan easy for both lenders and borrowers, and Jotform Sign makes collecting e-signatures even easier. Designed for simplicity and security, Jotform Sign lets you build documents to fit your terms using Jotform’s drag-and-drop Form Builder. You can also choose from more than 600 premade document templates.

Looking to use the same document multiple times for similar loans? Send any document multiple times via

- Embedded web forms

- Emails

- Apps, using Jotform Apps

- Links

After you collect your signatures, Jotform helps keep them safe and readily available. Jotform Sign integrates with a wide variety of popular cloud storage systems — including Google Drive and Dropbox. Use Jotform Tables and Jotform Report Builder to track, organize, analyze, and share your e-signature data with your team for optimal performance as well.

AS ALWAYS, CONSULT AN ATTORNEY BEFORE RELYING ON ANY FORM CONTRACT OR CONTRACT TEMPLATE. THE CONTENT ABOVE IS FOR INFORMATIONAL PURPOSES ONLY.

Send Comment: