Best Finance AI Chatbots

Time is money, and that’s especially true in the world of finance — which is why banks and fintech organizations are investing in finance AI chatbots to automate tasks, enhance security, and improve user experience.

But with so many available options, finding the right finance AI chatbot for your needs can be a challenge. To help guide your search, we’ve compiled a list of top financial chatbot choices for easy comparison.

What is a finance AI chatbot?

Finance AI chatbots are digital assistants that help financial institutions manage customer relationships, transactions, and interactions using machine learning and natural language processing (NLP). Unlike standard AI chatbots, they handle finance-specific functions, such as detecting fraudulent transactions and providing clients with guidance on investing or financial planning.

Key benefits of AI chatbots in finance

Chatbots can enhance your institution’s customer service process from end to end. These solutions go far beyond answering simple questions, using your internal data to provide

- 24-7 customer support and instant responses: Today’s clients expect answers faster than ever. Financial chatbots can act as an instantaneous assistant to handle customer service issues at all hours of the day.

- Fraud detection and security enhancements: Finance AI chatbots can protect your institution and your clients’ data from fraudulent activity.

- Automated financial planning and investment advice: Finance chatbots can use your internal data to provide automated advice to clients.

- Cost savings and operational efficiency: By delegating busywork to an AI chatbot, your team can work more efficiently and focus on higher-value tasks.

- Personalized banking and financial insights: AI-powered chatbots can leverage data to provide customized recommendations and insights to clients.

Challenges and limitations of finance AI chatbots

While AI assistants have lots of advantages, they also present several challenges, especially for financial institutions that handle sensitive data. Some common issues include

- Privacy and data security concerns: For financial institutions, the internal data used to train AI is highly sensitive, requiring robust security measures. Make sure the AI tool you’re considering has the credentials to meet your security standards.

- Complex financial questions: While advanced, financial AI chatbots still struggle to assist with complex issues. However, by handling routine inquiries, they free up human agents to focus on more difficult client concerns.

- Compliance and regulatory requirements: Because of strict regulations in banking and finance, it’s essential to choose a chatbot that meets the necessary certifications and offers the right tools to ensure compliance.

- Integration challenges with legacy banking systems: Some AI chatbots struggle to connect with legacy systems, even those specifically designed for financial purposes. Check your potential solution’s integration list to see if your tech stack is compatible.

Pro Tip

Add Jotform’s AI Chatbot for WordPress, an AI chatbot plugin for WordPress, to clarify services, fees, and eligibility in plain language, then collect details through secure forms for follow-up.

How to choose the right AI chatbot for your financial business

With the amount of finance AI chatbot options available in today’s market, it can be challenging to sort through everything and decide which solutions are right for your business. That’s why you need a clear set of criteria to help weed out solutions that don’t meet your needs. Before you start your search, make a list of your top considerations, keeping these factors in mind:

Business needs

What do you hope to achieve by adding a finance chatbot to your workflow? Clarifying your goals and core needs will help you prioritize the features that matter most when choosing the best solution for your business.

AI capabilities and integrations

Finance AI chatbots have a wide range of capabilities, but not all AI features will be helpful for your business. Decide which features will provide the most value, which might include one or more of the following:

- Fraud detection

- KYC automation

- Financial education

- Customer relationship management

It’s also important to narrow your search to AI assistants that integrate with your current tech stack.

Security and compliance features

For financial institutions, security and compliance are of the utmost importance. Verify which certifications, encryptions, and compliance frameworks your chosen AI chatbot meets. Depending on your compliance needs, this could significantly impact the number of options that fit your criteria.

Cost and scalability

Cost is a top consideration when deciding which AI chatbot is right for your business. While finding the best price is important, it’s also crucial to determine whether a solution can scale with your business, as you don’t want to redo this process again in the future.

The best AI chatbots for finance

We’ve found the top solutions on the market today and listed some key factors that will help guide your decision. (Note: Prices are shown as monthly rates but are billed annually, unless indicated otherwise.)

1. Jotform AI Agents

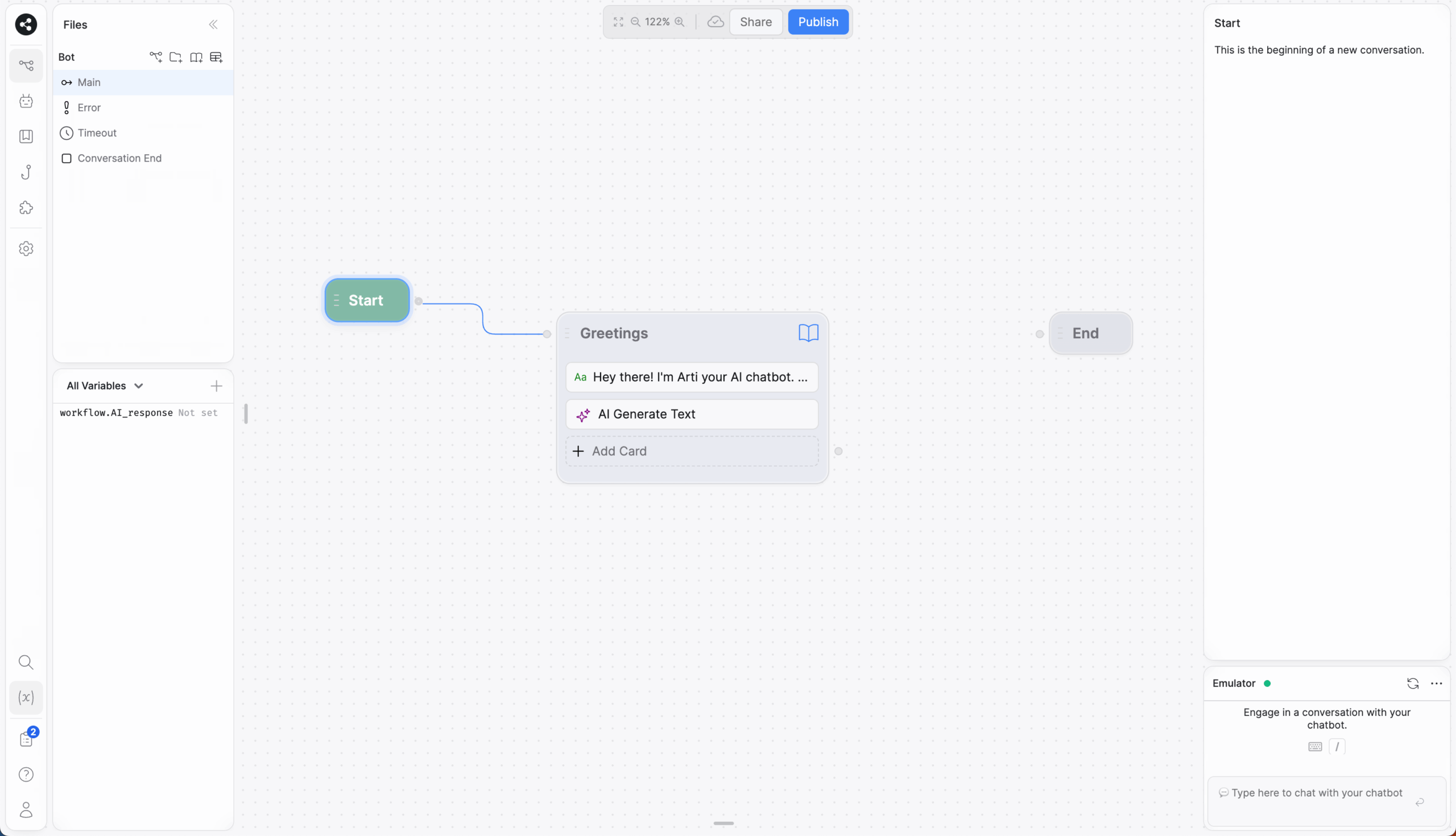

For an easy-to-use finance AI chatbot experience, Jotform AI Agents can’t be beat. Through the Jotform AI Chatbot Builder, you can create a custom finance chatbot with just a few clicks. You don’t need any experience or coding knowledge — a drag-and-drop system makes building your AI agent simple and stress-free.

If you want to save even more time, Jotform offers finance-oriented AI agent templates that can be deployed in seconds. These ready-to-use finance AI chatbot templates cover roles specific to financial businesses, such as an accounting AI chatbot for accounting firms.

Jotform AI Agents are easily trainable and can quickly learn using internal knowledge bases, URLs, uploaded documents, frequently asked questions, or manually entered information. You can even run practice conversations with your financial chatbot to make sure you’re getting the right responses.

Jotform AI Agents also connect to the full Jotform suite of products, allowing you to integrate your digital forms with your AI chatbots so you can streamline onboarding, use Jotform Tables to store internal data and manage tasks, automate workflows with Jotform Workflows, and collect e-signatures with Jotform Sign.

- Best for: Customizing AI chatbots

- Developer: Jotform

- Limitations: Lacking some advanced finance features

- Key features: Custom AI agents; more than 100 finance AI agent templates; voice and SMS agents

- Pros: Wide range of integrations; user-friendly; connection to Jotform suite

- Cons: Newer to the market; fewer advanced finance features; not finance-specific

- Plans/Pricing:

- Free: Five agents; 100 monthly conversations; 10,000 monthly sessions

- Bronze: $34 per month for 25 agents; 1,000 monthly conversations; 100,000 monthly sessions

- Silver: $39 per month for 50 agents; 2,500 monthly conversations; 1,000,000 monthly sessions

- Gold: $99 per month for 100 agents; 10,000 monthly conversations; 2,000,000 monthly sessions

- G2 Rating: 4.6/5

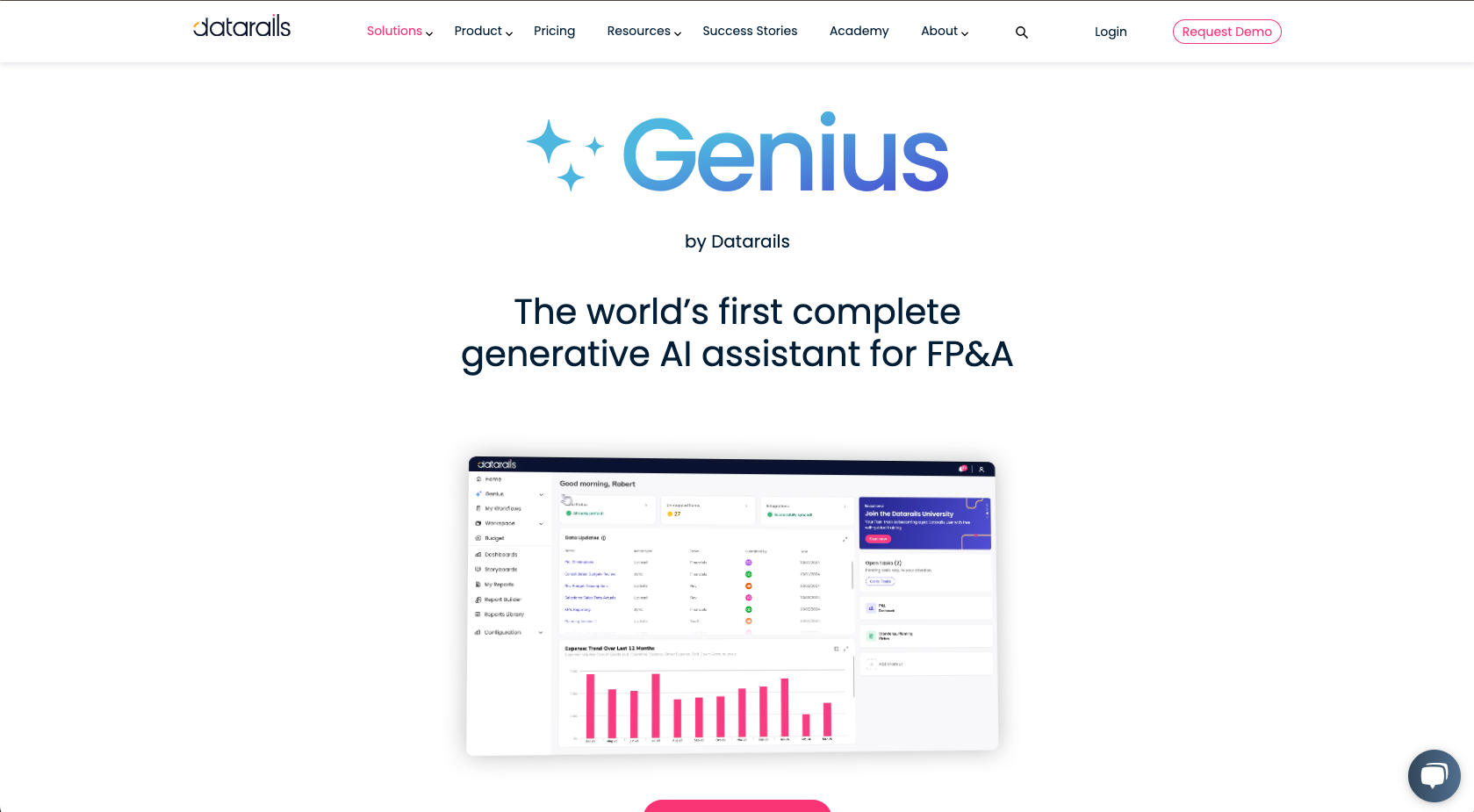

2. Datarails FP&A Genius

For banks and fintech businesses wanting a clearer picture of their internal finances, Datarails FP&A Genius can act as a digital financial advisor, turning internal data into easy-to-understand, comprehensive insights. However, as an internal tool, this finance AI chatbot doesn’t provide the client-facing services that many of the other solutions on this list offer.

- Best for: Financial planning and analysis

- Developer: Datarails

- Limitations: Not a customer-facing solution

- Key features: Internal data insights; data storyboarding; knowledge base chat

- Pros: Streamlines data analysis; visually appealing reporting; finance-specific

- Cons: No customer-facing features; steep learning curve; long onboarding time

- Plans/Pricing: Contact sales for custom pricing

- G2 Rating: 4.6/5

3. Tidio

Tidio is a live chat solution that includes financial chatbots, a help desk, and workflow automation tools to enhance your business process and improve your client experience. While the base live chat tool is effective, AI agent access costs extra, ranging anywhere from $33 to $583 per month depending on your monthly conversation volume.

- Best for: Live chat

- Developer: Tidio

- Limitations: AI agents cost extra on top of base plans

- Key features: Live chat; Lyro AI chatbot; help desk

- Pros: Comprehensive live chat solution; AI copilot; user-friendly

- Cons: Expensive; pay-to-play AI agent; lack of finance-specific features

- Plans/Pricing:

- Starter: About $24 per month for 50 Lyro AI conversations; 100 billable conversations; basic analytics

- Growth: About $49 per month for 50 Lyro AI conversations; up to 2,000 billable conversations; advanced analytics

- Plus: $749 per month for up to 5,000 Lyro AI conversations; a custom quota of billable conversations; multilingual bots

- Premium: $2,999 per month for up to 10,000 Lyro AI conversations; unlimited billable conversations; guaranteed 50 percent Lyro AI resolution rate

- G2 Rating: 4.7/5

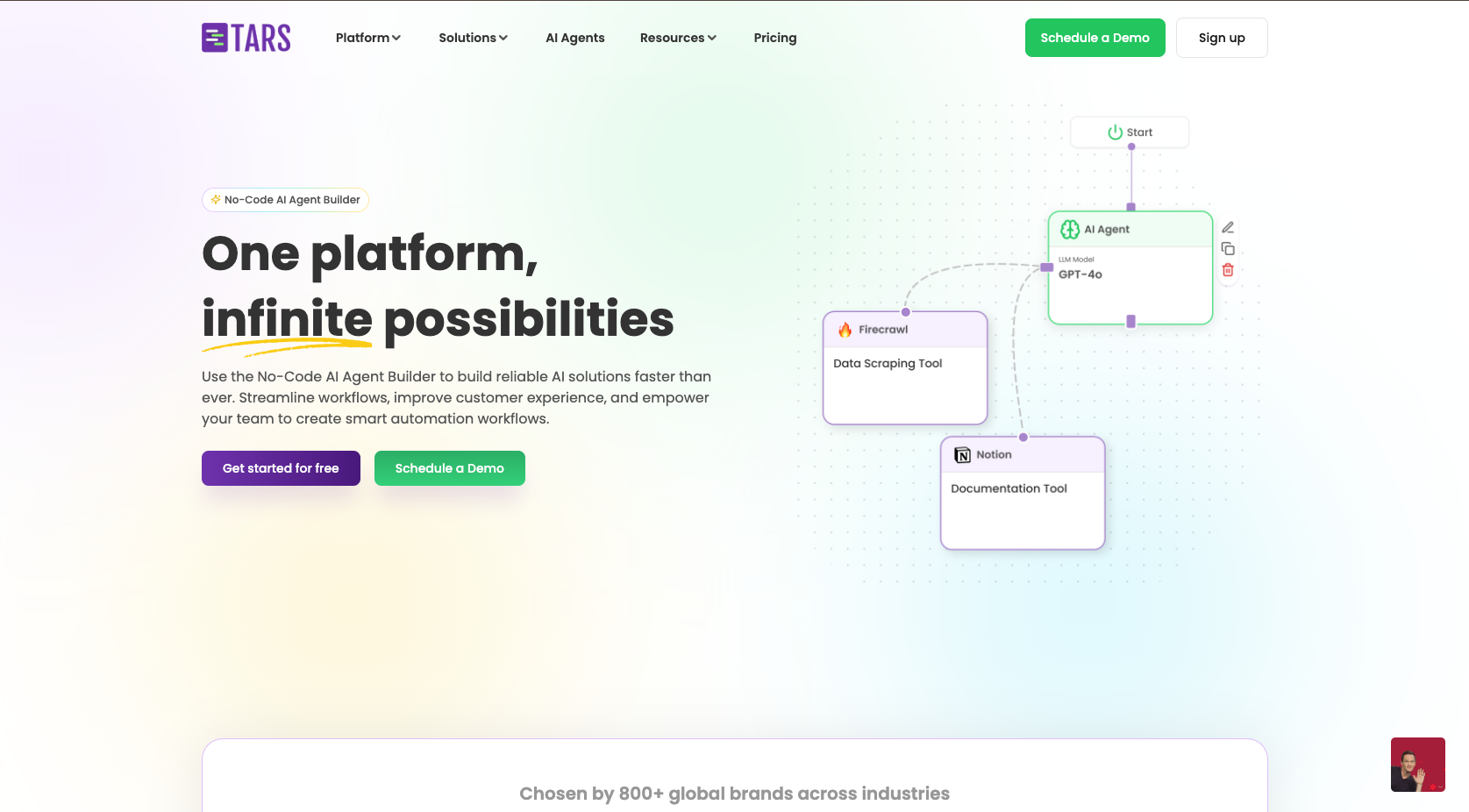

4. Tars

Tars is a no-code custom AI agent builder that offers both internal- and external-facing AI agents as well as some finance-specific features, including integrations with banking systems. The Tars platform is simple to navigate and effective to use; however, due to this simplicity, it doesn’t offer some of the more complex features that other solutions provide.

- Best for: Simple AI chatbots

- Developer: Tars

- Limitations: Lack of integrations

- Key features: AI chatbot builder; knowledge base; analytics

- Pros: Easy to use; affordable; finance-oriented tools

- Cons: Limited features; limited integrations; limited customization

- Plans/Pricing:

- Freemium: 50 messages per month

- Pro: $20 per month for 500 messages per month; multi-platform deployment

- Business: $30 per month for 500 messages per month; advanced security compliance

- G2 Rating: 4.6/5

5. Haptik

Fintech businesses looking to boost conversion rates and improve customer care might prefer Haptik‘s user-friendly, customizable platform, which includes tools designed to help fintech users with high-quality service, sales, and marketing. However, its AI chatbots offer fewer finance-specific features than other comparable solutions.

- Best for: Fintech chatbots

- Developer: Haptik

- Limitations: Limited AI and finance features

- Key features: GPT-powered chatbots; pre-built conversion workflows; multilingual support

- Pros: Supports more than 130 languages; streamlines conversations; improves engagement

- Cons: Lack of advanced features; complex setup; limited AI

- Plans/Pricing: Contact sales for custom pricing

- G2 Rating: 4.4/5

6. Kasisto

Kasisto is an AI agent tailored specifically for banking. Through the KAI AI platform, Kasisto offers your clients access to quick and accurate answers to their banking questions, acting as your front line of service. However, because of Kasisto’s banking-specific nature, there’s a more complex setup and usage experience. It can also be expensive, especially for smaller businesses.

- Best for: Banking AI chatbots

- Developer: Kasisto

- Limitations: Complex compared to other solutions

- Key features: AI answers; AI agents; analytics

- Pros: Banking-specific platform; omnichannel support; banking integrations

- Cons: Difficult implementation; complex integration; narrow focus

- Plans/Pricing: Contact sales for custom pricing

- G2 Rating: N/A

7. Kore.ai

Built using three NLP models, Kore.ai offers enterprise-grade banking agents that act as personal assistants to your team and increase the level of personalization you can provide to your clients. However, some users have encountered issues with this advanced solution, including slow performance and a more complex user interface compared to other similar programs. Its usage-based model can also be limiting, depending on your budget.

- Best for: NLP

- Developer: Kore.ai

- Limitations: Usage-based model

- Key features: Self-service agents; 24-7 support; chatbot builder

- Pros: Banking-specific features; advanced NLP; smart recommendations

- Cons: Complex; slow; usage-based

- Plans/Pricing: Contact sales for custom pricing

- G2 Rating: 4.7/5

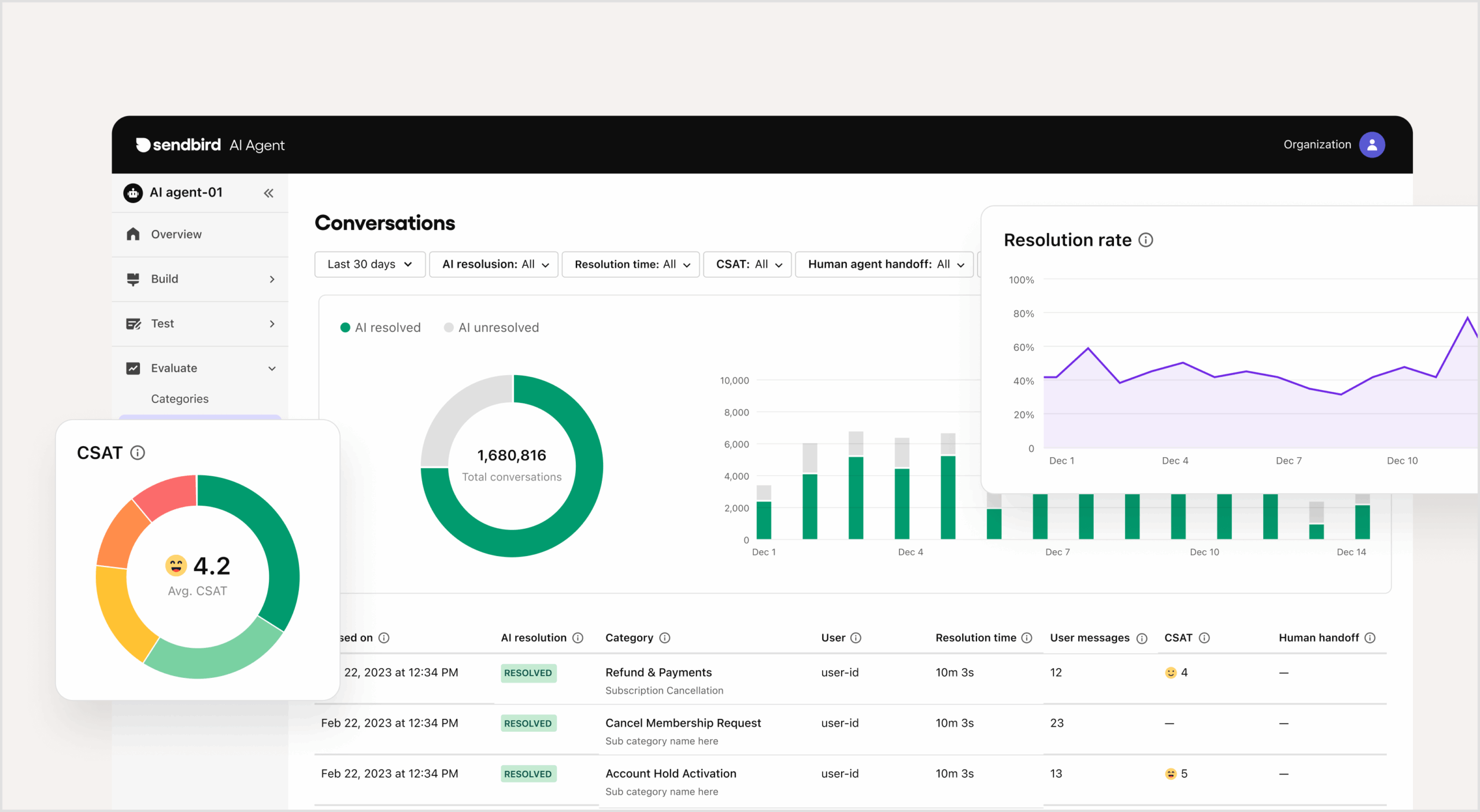

8. Sendbird

Sendbird is an omnichannel finance AI chatbot with a customer-friendly interface that keeps your clients connected, wherever they are — from social media transactions to in-app secure messaging. Although SendBird’s pricing is not publicly available, some users have reported higher-than-expected quotes. Users also report that this finance chatbot is updated frequently, which can sometimes result in bugs and missing features.

- Best for: Omnichannel support

- Developer: Sendbird

- Limitations: Advanced features require additional development skills

- Key features: Omnichannel AI support; agent builder; identity-based transactions

- Pros: Advanced security; user-friendly interface; social interactions

- Cons: Limited integrations; expensive; frequent updates

- Plans/Pricing: Contact sales for custom pricing

- G2 Rating: 4.6/5

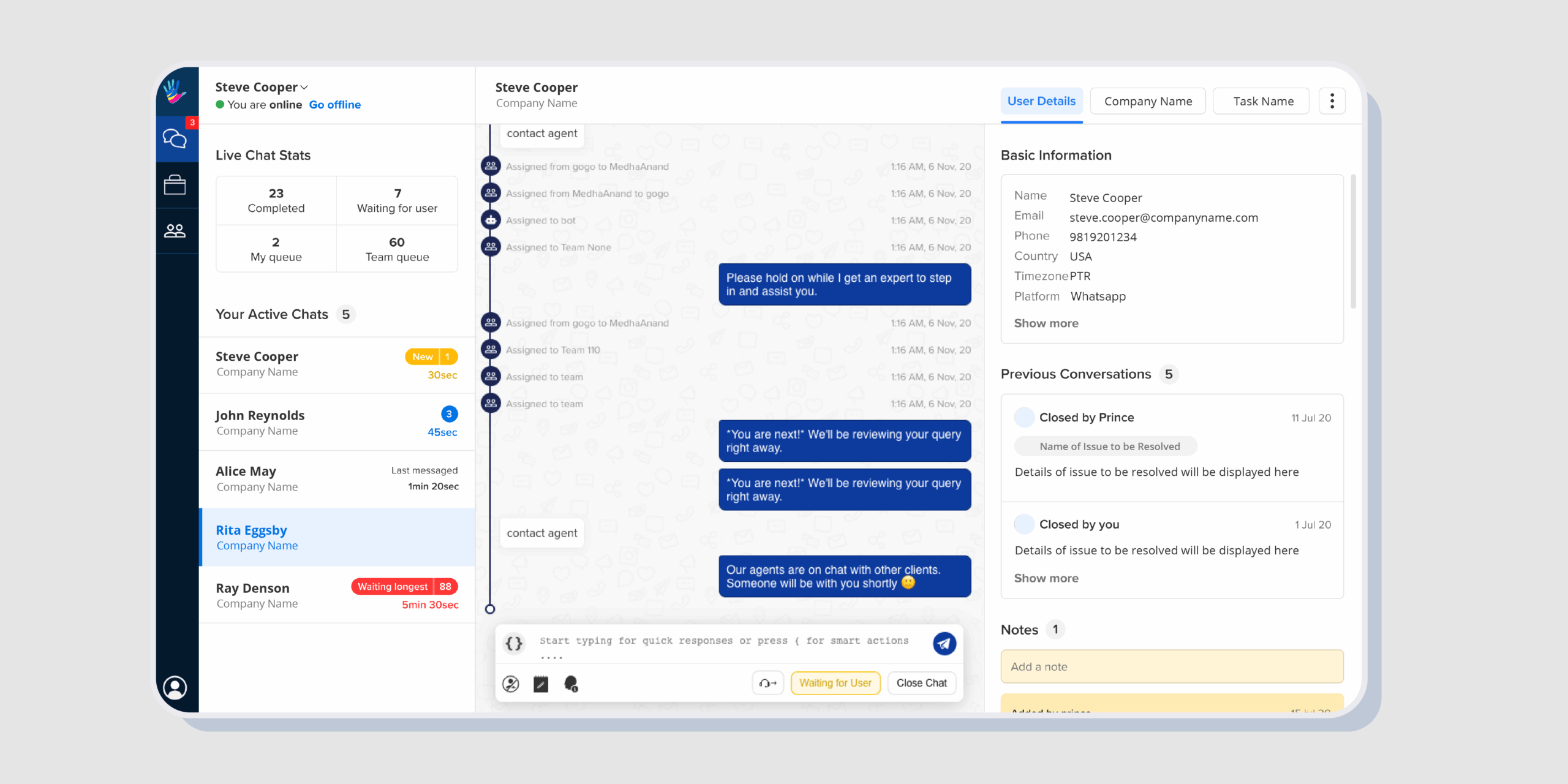

9. Freshchat

Part of the Freshworks platform, Freshchat is a live chat software that provides a proactive and centralized experience for both your clients and your team. With a unified agent workspace, Freshchat helps keep customer interactions organized and uses AI chatbots to streamline self-service.

However, this solution’s AI tools aren’t as robust as other options on this list, and it doesn’t offer any finance-specific capabilities. Freshchat’s Freddy AI features are also limited to 500 sessions, and additional sessions are $100 per 1,000 sessions.

- Best for: Unified agent workspace

- Developer: Freshworks

- Limitations: Lack of finance-specific features

- Key features: Live chat; AI chatbots; analytics

- Pros: Free version; omnichannel live chat; unified system

- Cons: Chat issues; limited usage on AI tools; less-advanced AI

- Plans/Pricing:

- Free: Live chat; email; team inbox

- Growth: $19 per agent per month for social media; SMS

- Pro: $49 per agent per month for multilingual conversation; custom dashboards

- Enterprise: $79 per agent per month for skill-based ticket assignment; audit logs

- G2 Rating: 4.4/5

10. IBM watsonx Assistant

The watsonx Assistant is an advanced AI agent solution that runs using IBM’s Watson AI. It’s a powerful and reliable AI assistant that uses industry-leading large language models (LLMs) to personalize and automate your client’s banking experience. While watsonx Assistant does offer a free model, this package is limited in its functionality.

- Best for: Large language models

- Developer: IBM

- Limitations: Difficult for inexperienced teams to understand

- Key features: Pre-built banking templates; conversational AI; visual builder

- Pros: Advanced data security; industry-leading AI; powerful integrations

- Cons: Learning curve; expensive; complex

- Plans/Pricing:

- Lite: Free for three assistants; webchat

- Plus: $140 per month for 10 assistants; phone and SMS integration

- Enterprise: Custom pricing for 30 assistants; activity tracking

- G2 Rating: 4.4/5

11. Fin by Intercom

Intercom is a customer service solution primarily known for its popular AI agent, Fin, which can be customized, trained, and implemented alongside the Intercom Help Desk suite or independently. This flexibility makes it a popular choice for those looking for a standalone agent solution. However, to use this finance AI chatbot, you’ll pay for each resolved conversation Fin conducts, so costs can ramp up quickly as you scale.

- Best for: Independent AI agent

- Developer: Intercom

- Limitations: Pay-as-you-go AI solution

- Key features: Customizable AI agent; performance reporting; multimedia support

- Pros: Advanced AI model; easy to use; customizable system

- Cons: Expensive at scale; lack of finance features; limited functionality

- Plans/Pricing:

- Fin AI: $0.99 per resolution with a minimum of 50 resolutions per month for Fin AI chatbot only

- Fin AI + Intercom Help Desk: $0.99 per resolution plus $29 per help desk seat per month for Fin AI tool; shared inbox; omnichannel support

- G2 Rating: 4.5/5

12. Zendesk AI Agents

One of the newest features from Zendesk, Zendesk AI Agents are autonomous chatbots that can provide 24-7 service. These solutions allow for omnichannel service in over 30 languages, using Zendesk’s proprietary intent models and generative AI.

While these solutions don’t offer finance-specific features, they are included with most Zendesk customer service plans. That said, those looking to save with Zendesk’s base support team tier won’t be able to access this feature.

- Best for: Customer service

- Developer: Zendesk

- Limitations: Only included with upper-tier plans

- Key features: Omnichannel support; analytics suite; conversation flows

- Pros: Integrations through Zendesk; generative AI; easy implementation

- Cons: Expensive; limited availability; limited features

- Plans/Pricing:

- Suite Team: $55 per agent per month for AI agents; knowledge base; live chat

- Suite Professional: $115 per agent per month for AI agents; custom analytics; SLAs

- Suite Enterprise: Custom pricing for AI agents; sandbox; audit logs

- G2 Rating: 4.3/5

13. Drift

Drift is a more sales-oriented AI chatbot solution than some of the other solutions on this list. While many other finance chatbots focus on client services, this AI assistant prioritizes turning potential leads into loyal clients for your business.

AI chat agents can provide accurate answers, leads, and metrics to keep your financial business running smoothly. However, Drift doesn’t offer finance-specific solutions and is relatively limited in its overall functionality.

- Best for: Converting leads

- Developer: Salesloft

- Limitations: AI agents are a new feature

- Key features: AI agents; revenue-driving tools; analytics

- Pros: Lead generation features; live chat capabilities; advanced reporting

- Cons: Limited AI capabilities; notification issues; learning curve for advanced features

- Plans/Pricing: Contact sales for pricing

- G2 Rating: 4.4/5

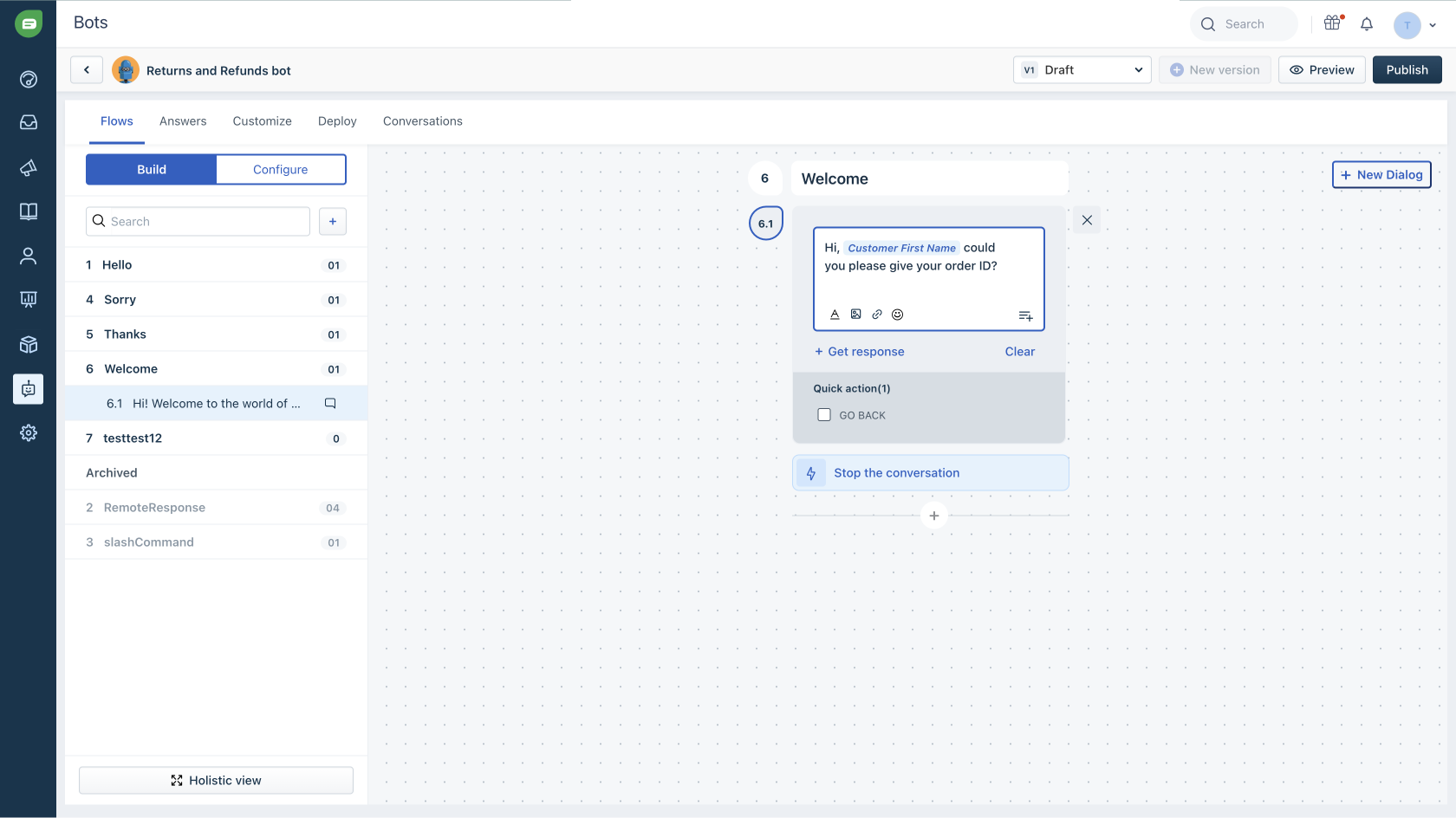

14. ChatBot

ChatBot takes the ease of chatbot building to the next level with options to create a finance chatbot from scratch using its visual builder tool, use a finance-oriented template, or automatically generate one using your internal data.

This can save time, but the convenience comes at a cost. The base price for this solution is significantly higher than that of many other chatbot-only solutions, and its functionality remains relatively limited.

- Best for: Automatic AI chatbot generation

- Developer: Text

- Limitations: Not much native integration depth

- Key features: Automated agent setup; AI-generated answers; visual builder

- Pros: Customization tools; automation; easy to use

- Cons: Expensive; limited features; few integrations

- Plans/Pricing:

- Starter: $52 per month for one active chatbot; 12,000 chats per year

- Team: $142 per month for five active chatbots; 60,000 chats per year

- Business: $424 per month for unlimited active chatbots; 300,000 chats per year

- G2 Rating: 4.5/5

Botpress is a leading all-in-one chatbot builder that lets you create custom AI agents to perform financial tasks, such as regulatory compliance, KYC automation, credit scoring, fraud detection, and risk assessment. While it’s a powerful solution, users have reported that it’s challenging to use and many features are offered as add-ons, raising the already high price.

- Best for: Building AI agents

- Developer: Botpress

- Limitations: Limited number of bots per package

- Key features: Agent studio; knowledge base; data tables

- Pros: Powerful finance features; customizable; multiple LLMs

- Cons: Expensive; steep learning curve; limited AI usage

- Plans/Pricing:

- Pay-as-you-go: Start for free for one bot; 500 messages per month; one seat

- Plus: $79 per month for two bots; 5,000 messages per month; two seats

- Team: $445 per month for three bots; 50,000 messages per month; three seats

- G2 Rating: 4.6/5

Future trends in AI chatbots for banking and fintech

While AI is already an advanced solution, this technology changes by the day, making the future difficult to predict. AI chatbots for finance, in particular, could see many potential changes:

- Advancement of conversational AI: As AI chatbots advance, they’ll get better at replicating human empathy, enabling them to provide more personalized experiences and handle more complex tasks for humans.

- AI-powered advisors: With future advancements in data processing and machine learning, financial AI chatbots may eventually be able to mimic the role of an investment or financial advisor.

- Financial security enhancements: Finance AI chatbots are also improving data safety. Using blockchain and AI fraud detection technology, these solutions can adopt new ways to protect against hackers, scams, and other potential financial threats.

To stay ahead of the curve, you need a financial AI chatbot that can evolve with your business needs. Jotform AI Agents offer banks and financial institutions a secure, customizable, and user-friendly solution to elevate their service in the present, future, and beyond.

This article is tailored for professionals in the banking, financial services, and fintech sectors who are exploring ways to enhance customer support, streamline operations, and leverage AI-powered automation.

Send Comment: