Buy Now, Pay Later Online Forms with Jotform

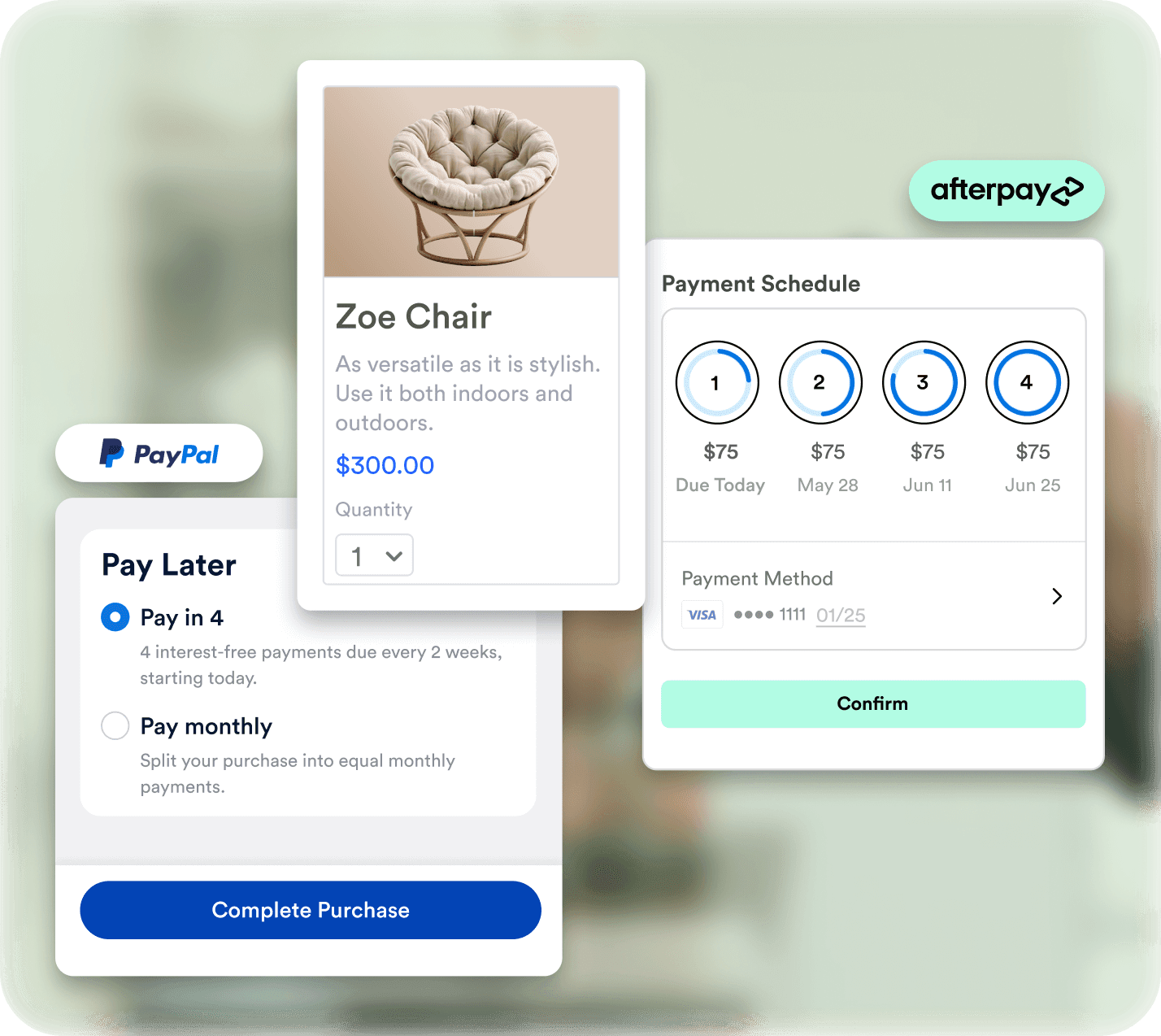

Give your customers more flexibility at checkout with Jotform’s secure Buy Now, Pay Later options. Offer customers the option to pay in installments. Just integrate Afterpay (via Square) and PayPal payment gateways into your forms. Boost sales and customer satisfaction while benefiting from the simplicity and reliability Jotform is known for.

No Additional Transaction Fees

Jotform will never charge you extra fees for collecting payments through your forms.

Buy Now Pay Later Form Templates

Don’t want to build your payment form from scratch? Customize a free, ready-made template to meet your every need and integrate your Afterpay or PayPal Account — no coding required.

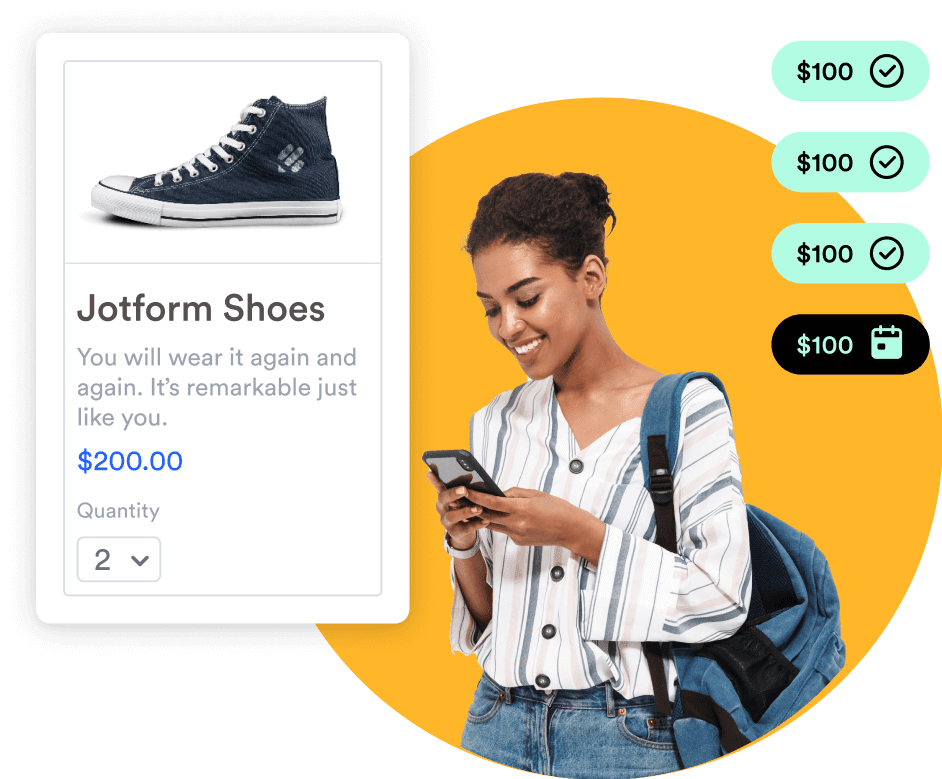

Flexible Payment Terms

Turn browsers into buyers with more ways to pay. Buy Now, Pay Later plans increase shoppers’ buying power.

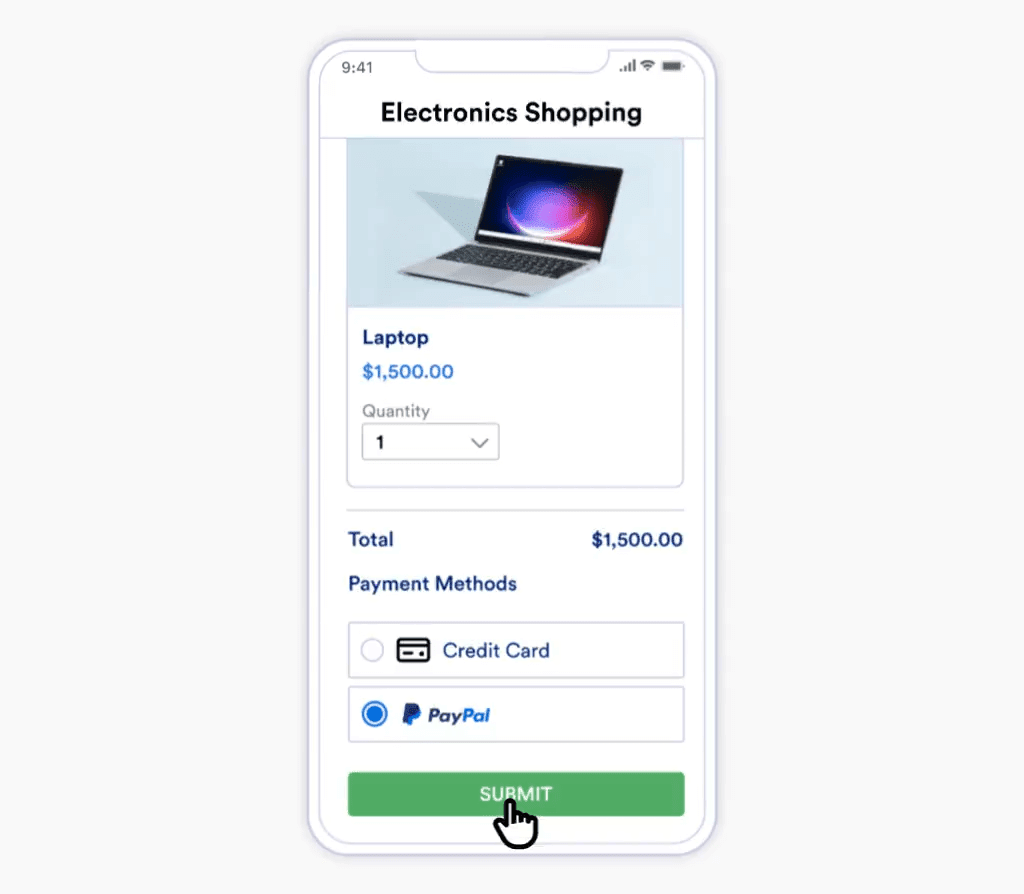

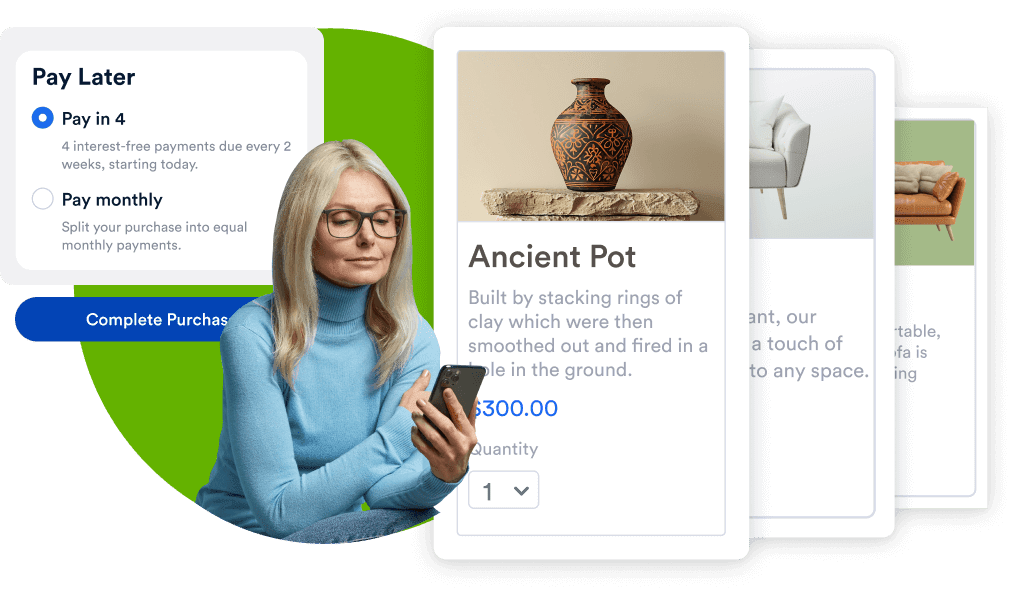

Pay in 4 by PayPal

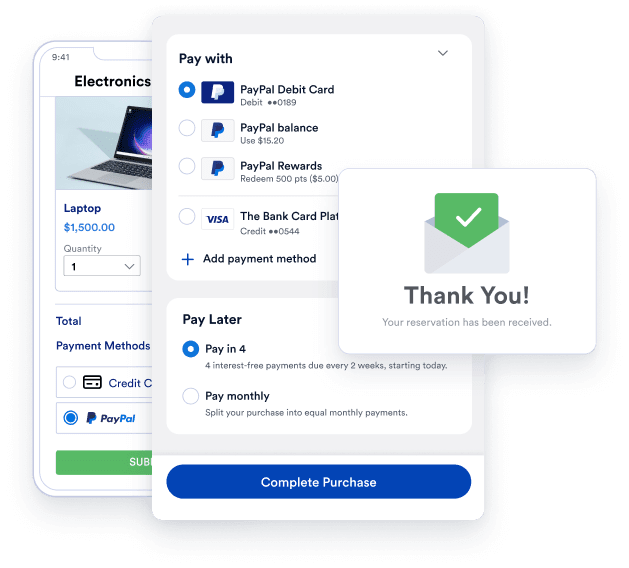

Offer shoppers the convenience of paying in four interest-free installments with Pay in 4 by PayPal. This flexible Buy Now, Pay Later plan allows customers to spread out payments so they can commit to purchases without financial strain.

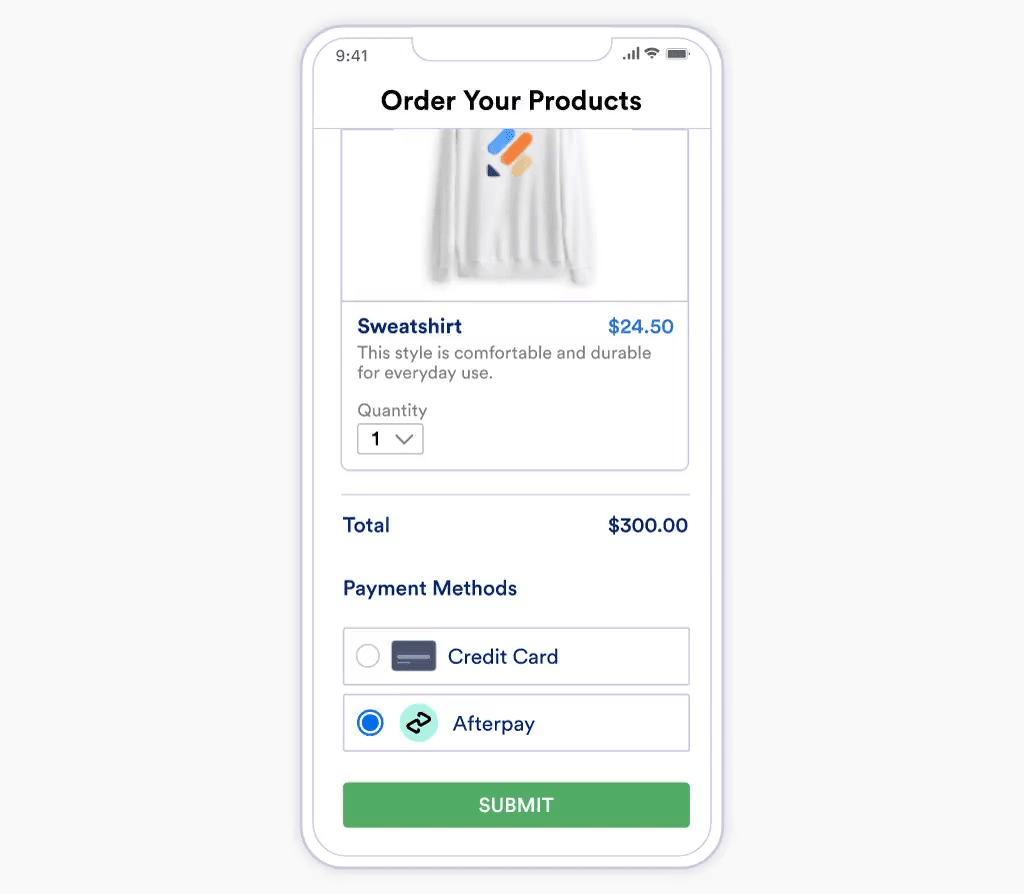

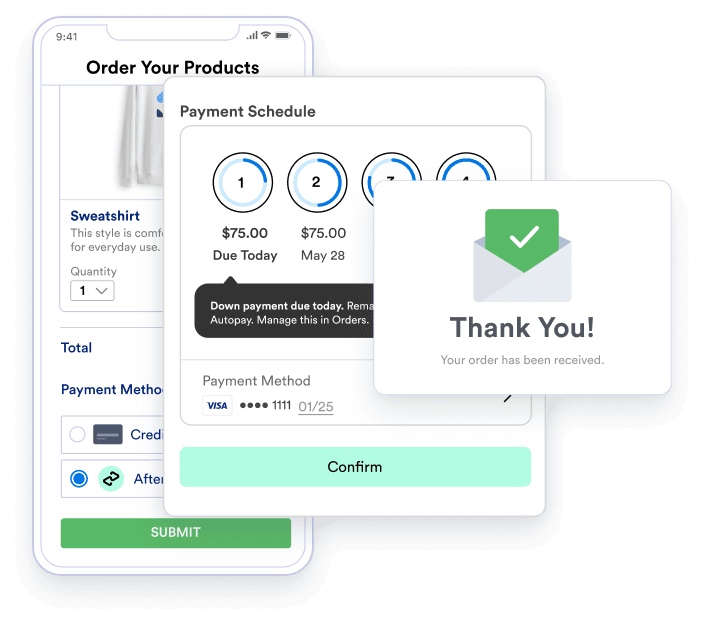

Afterpay via Square

Give your customers the flexibility to split up the cost of their purchases with Afterpay. Seamlessly integrate Afterpay into your form through your Square account. This interest-free payment option reduces financial pressure on shoppers by helping them budget their spending.

Increase Conversion Rates

Customers are more likely to complete their purchases when they have flexible payment options. Offering Buy Now, Pay Later options through Afterpay or PayPal can reduce cart abandonment, improve conversion rates, and increase your revenue.

Enhance the Customer Experience

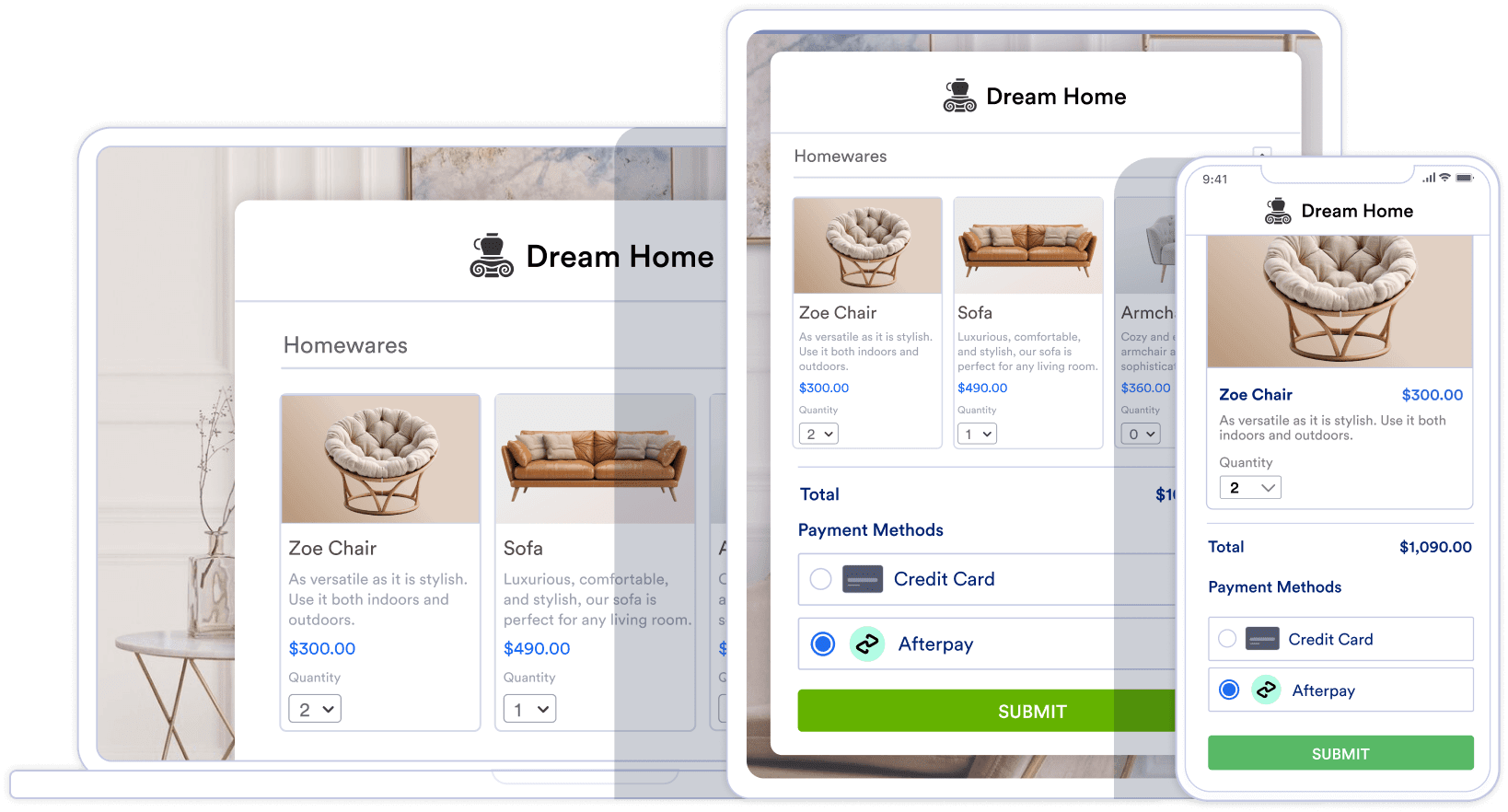

Jotform’s Afterpay and PayPal integrations ensure a smooth and user-friendly checkout process for your customers. Providing the flexibility to pay over time helps build trust with customers and improve the shopping experience, resulting in greater customer satisfaction and loyalty.

Customize to Fit Your Business

Jotform’s intuitive drag-and-drop Form Builder makes it easy to add Buy Now, Pay Later options to your forms. Customize your forms to match your brand and tailor the payment process to suit your specific business needs. Our extensive template library makes getting started quick and hassle-free.

Security You Can Trust

Jotform protects your form data with PCI certification, GDPR and CCPA compliance features, a 256-bit SSL connection, and the option to encrypt your forms. Healthcare professionals on Gold or Enterprise plans can even opt for HIPAA compliance features to keep sensitive patient details safe.

Frequently Asked Questions (FAQs)

-

What is Buy Now, Pay Later?

Buy Now, Pay Later is a type of short-term loan and payment plan that allows customers to split up the cost of a purchase into equal installments to be paid over time.

-

How does Buy Now, Pay Later work?

When customers select the Buy Now, Pay Later option at checkout, the total cost is broken up into equal amounts that will be billed over the course of a few weeks. Customers are typically required to make the first payment at the time of purchase, then complete the remaining payments periodically until the purchase is paid off.

-

How does Pay in 4 by PayPal work?

Pay in 4 by PayPal is an interest-free installment plan that lets you spread out the cost of a purchase into four equal payments. At checkout, customers must log in to or sign up for a PayPal account and provide an initial down payment of 25%. Merchants are paid for the full cost of the purchase up front, and PayPal manages the customer’s remaining payments.

-

How does Afterpay work?

Afterpay is an installment-based payment plan where purchases are split into four interest-free payments. Customers who are applying for Afterpay for the first time will provide their usual payment details at checkout to automatically create an Afterpay account, while returning Afterpay users will be prompted to log in to their existing account. Customers will provide a 25% down payment at checkout, and can manage the rest of their payments from the Afterpay website or app.

-

How do I integrate Afterpay with Jotform using my Square account?

In the Form Builder, click the Add Form Element button, then go to the Payments tab and select Afterpay. Log into your Square account in the Payment Settings window and choose Afterpay as the payment method. Click the Continue button to add the products you want to sell. For donations and user-defined amounts, click the Save button. Check out our user guide for more detailed, step-by-step instructions.

-

Can I offer both Pay in 4 by PayPal and Afterpay options on the same form?

Currently, Jotform only supports one payment gateway per form, however you can automatically funnel customers to separate order forms with different payment options based on their preferences. Take a look at our user guide to find out more about setting up multiple payment forms.

-

Are there any additional fees for using Jotform’s Buy Now, Pay Later options?

No, Jotform doesn’t charge any additional fees to collect payments. Buy Now, Pay Later options from PayPal and Afterpay are easy to integrate into your forms. Seamlessly make sales and process payments without any extra transaction fees.

-

How does the payment schedule work for Pay in 4 by PayPal?

The customer’s first payment is due at the time of the transaction. The three subsequent payments are billed every 15 days.

-

How does the payment schedule work for Afterpay?

Customers make their first payment at checkout. The remaining three payments are due every two weeks.

-

Are there any limitations on the types of products or services that can use Buy Now, Pay Later options?

There are no limitations on the types of products or services you can offer, however there are spending limits. Afterpay can be used for purchases up to $2000, and PayPal can be used for purchases up to $1500.

-

How secure are the Buy Now, Pay Later transactions through Jotform?

All transactions are protected by Jotform’s advanced form security and trusted payment gateway integrations. Protect both your data and your customers’ data with a 256-bit SSL connection, PCI DSS Service Provider Level 1 certification, and GDPR and CCPA compliance features.

-

Can I customize the payment options to fit my brand's look and feel?

Absolutely! You can select the payment option that best suits your needs, choose the types of payments you will accept, and update your product listings with your product names and photos. Use the drag-and-drop Form Builder to easily add your payment gateway, arrange the sections, and create a clear checkout flow that drives conversion.

-

What happens if a customer misses a payment on Pay in 4 by PayPal or Afterpay?

Merchants are paid the full purchase price upfront, so there’s no risk to you if a customer misses a payment. Pay in 4 by Paypal has no late fees, however missed payments may impact a customer’s future eligibility for Pay Later products. With Afterpay, customers may be charged a late fee up to a maximum of $8.00 if they do not make an installment payment by the specified due date and it remains unpaid past the grace period.

-

How can I track and manage Buy Now, Pay Later payments through Jotform?

Tracking Buy Now, Pay Later payments with Jotform is the same as tracking any other payments processed through your forms. You can view and manage payments by logging in to your account for the payment gateway you have chosen for that form. The other submission data you collected is available to review in Jotform Tables.

-

Are Buy Now, Pay Later options available for international customers?

No, Buy Now, Pay Later options are available only to U.S. residents who are 18 years of age and older.

-

How quickly will I receive payments when customers use Pay in 4 by PayPal?

Merchants are paid in full at the time of the transaction. For Pay in 4 by PayPal, merchants can expect to receive payment on a similar timeline to credit card transactions processed with PayPal — typically within one to three days.

-

How quickly will I receive payments when customers use Afterpay via Square?

Merchants are paid upfront at the time of purchase. With Square’s standard transfer schedule, you can expect to receive funds within 1-2 business days.