So you want to find out more about surveys, what they entail, how they compare to similar data-collection methods, and how to get started creating one? Then this is the perfect guide for you.

What is a survey?

Here’s the simplest and briefest definition: A survey is a structured way to collect information or feedback. Surveys can be used to gain insights on just about anything, from all kinds of audiences. You can get a more in-depth answer to the What is a survey? question here, along with a few other FAQs.

For the most part, surveys are fairly simple to create and carry out, but there are a few things you need to be aware of to get high-quality results. We’ll cover all that and more in the following chapters.

Step-by-step guide on how to create a survey

- Set a clear goal for your survey. You need to be clear about not only what information you’re trying to get but why you want it.

- Define your target audience. Whether it’s distinguishing between customers and employees or narrowing down participants by demographics, it’s critical that you clearly define who you’ll be surveying.

- Think critically about your questions. Your questions should support your goal, so think through them carefully and get input from others before finalizing your survey.

- Ask one question at a time. There should be a one-to-one relationship between what’s being asked and how survey participants can respond.

- Be objective and unambiguous. Try to make your questions as objective as possible and use unambiguous language to ensure your meaning is clear.

- Keep question just as long as they should be. Try to be brief unless the participant needs more information to answer the question accurately.

- Find the survey tool that best aligns with your purposes. Online survey tools can make your job a lot easier

Remember to bookmark this guide for later reference. When you get stuck on methodology or question generation, you’ll want a handy link to the insights presented below.

How to create a great survey: Tips and tools

Creating a well-rounded survey takes more than just picking a random tool, typing a few questions, and hitting send. It takes critical thinking, planning, and patience. While we can’t necessarily help you with the patience part, we can help you think critically and plan your survey with the tips and instructions below.

Review these tips before creating your survey

Set a clear goal for your survey

Define your target audience

Think critically about your questions

- Ask only one thing. There should be a one-to-one relationship between what’s being asked and how survey participants can respond.

- Be objective and unambiguous. Try to make your questions as objective as possible, even if you want a subjective response, such as how a person feels about something. Use unambiguous language to ensure your meaning is clear. For example, use the words daily or weekly instead of frequently, as frequently can be interpreted differently by each participant.

- Be only as long as needed to elicit an accurate response. Don’t give a lot of details if a simple description will do. Try to be brief unless the participant needs more information to answer the question accurately.

- Align with your goal. If a question won’t produce an answer that helps you achieve your goal, leave it out. More information is not always better.

Do you want to determine why your latest product isn’t selling as well as you projected? Or are you interested in how employees feel about moving to a new office building? Think about the key question you want to answer.

You need to be clear about not only what information you’re trying to get but why you want it. Consider the product release example — are you trying to find ways to improve product sales, or are you looking for insights for the next product release? And for the employee example, do you want to see what building features matter to employees, or are you trying to determine whether you should stay put or move?

The why of your survey goal is important because it will help you formulate the right questions for your audience.

Whether it’s distinguishing between customers and employees or narrowing down participants by demographics, it’s critical that you clearly define who you’ll be surveying. Again, thinking about your goal will help you define the relevant group.

Recalling the product release example, you should survey customers who purchased the product to determine what they liked and didn’t like about it and what inspired them to buy. You could also reach out to customers who didn’t purchase your product to get feedback on why they chose not to buy. Of course, the questions you ask these two types of customers would be different, which is why it’s important to define your audience (or, in this case, audiences).

Your questions should support your goal, so think through them carefully and get input from others before finalizing your survey. Keep in mind that each question should

There are many more tips where these came from. In fact, we wrote a separate guide to discuss them all:

How to create a survey using the best survey tools

- Google Forms. Part of the popular Google set of office tools, Google Forms pairs organically with its sister products. Form creation is easy, as is keeping track of survey responses. However, Google Forms has a traditional survey design that doesn’t allow for much customization. Check out our guide on how to create a Google Survey.

- Facebook. Facebook’s poll feature is incredibly simple to use but limits you to two questions. See how to create a survey on Facebook.

- Word. While not the most modern survey tool, Word still has its uses. Most people already have this word processing program installed on their computer, making it readily accessible. If you want a simple tool to create a quick survey for printing and distributing in person, this could work. Check out our blog for step-by-step instructions about creating a survey in Word.

- Jotform. Jotform is just as easy to use as all the above tools, without any of the drawbacks. You can customize every element of your surveys to your heart’s content, including the visuals, question display style, and branding. Jotform also integrates with all the applications you use every day. Get a head start by using one of Jotform’s numerous survey templates, or begin with a blank canvas and paint your own survey picture by following these steps.

Now that you have a good idea about survey creation, let’s take a look at the various types of surveys.

Types of surveys

Surveys come in all shapes and sizes and can be delivered in a multitude of ways. To give you a broad sense of the different approaches you can take with yours, we cover the major survey types below — categorized by purpose and distribution method.

Survey types by purpose

Customer satisfaction

Employee engagement

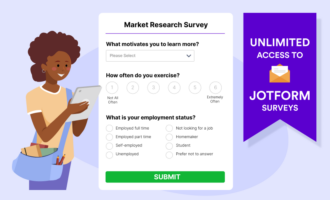

Market research

When your target audience is customers, there are a number of options you can use. If you have a service-based company, you may want to gauge your customers’ satisfaction with your service offerings. You could also determine their satisfaction with the employees they interact with or their overall satisfaction with your company.

Alternatively, if you have a product-based company, you could ask for feedback from a select group of customers about different products they’ve bought — what they like, what they don’t like, and what aspects of the product could be improved. Such feedback could lead you to either modify the product or create an entirely new one.

Tangentially, you could ask a wider selection of customers whether they would be interested in a new product that encompassed the feedback you received from other customers.

Much as with customers, employees also offer many opinions on internal matters — whether it concerns their work environment, peers, or company happenings.

Employee engagement is an important aspect many companies focus on. Engagement in this context can mean different things, but it generally refers to employees’ happiness, connectedness, and feeling of being valued in the workplace.

This is an important factor since organizations with high engagement have lower absenteeism and turnover, fewer safety incidents, and fewer quality incidents when compared to organizations with low engagement. Thus, regularly assessing employee engagement through surveys can help you keep a pulse on engagement levels and address potential issues before they become big problems.

It doesn’t stop at engagement, though. You can survey employees to help make company decisions, such as moving locations or adding new perks to your employee benefits package.

Sometimes you need opinions from people your company hasn’t interacted with before. Because your customers and employees have engaged with your business, they may not be able to provide the unbiased feedback you’re looking for. Alternatively, you could be looking to feel out the market for a new line of business. Or you may want to get input from a general sampling of people for any number of other reasons.

Market research allows you to do just that — whether you want to launch a new product, gauge brand awareness, or see how you stack up against competitors. With a market research survey, you choose who you want to target based on criteria like demographics, lifestyle, product usage, and geography. Surveying the segmented group you identify will provide you with data to help inform your business decisions, so you don’t have to rely on assumptions and guesswork.

Survey distribution methods

Face to face

Online

Telephone

Ranking by far the highest in participant cooperation, surveys conducted via face-to-face interviews generally produce very detailed responses. That’s because the interviewer can ask follow-up questions and dig deep into the reasoning behind responses, unearthing greater insights for decision-making. However, this method can be costly, time-consuming, and difficult to arrange due to geographic restrictions or limited availability.

Unlike face-to-face or telephone surveys, online surveys provide the greatest opportunity to reach the most people without being limited by location or time zone. Online survey participants can generally complete surveys from anywhere as long as they have an internet connection and an appropriate device, and can complete the survey within your set time limit. Additionally, it’s generally cheaper and faster than the other options, and there are many survey tools available that make distribution and response collection simple.

Surveys conducted via phone offer a compromise between face-to-face interviews and surveys distributed online. While these surveys face similar issues to face-to-face ones (lengthy to conduct, language barriers, limited availability, etc.), they are less costly and aren’t restricted by geography.

Phone-based surveys also allow for an active and personable conversation between the interviewer and participant. George Kuhn, president of Drive Research, adds that “much like face-to-face surveys, phone surveys allow interviewers to ask additional questions and give respondents the opportunity to explain their answers in greater detail. This results in higher-quality responses, especially from respondents who would otherwise answer differently due to the lack of anonymity of a face-to-face interview.”

So you’re clued in on the wide array of survey types, but what differentiates surveys from other data-collection methods? We answer this question in the next chapter.

What differentiates survey from other data collection methods?

When designed correctly and distributed to a carefully researched demographic, surveys can provide a wide variety of data points that are ripe for insightful analysis and corresponding action.

For example, ProjectManager.com conducted a paid time-off (PTO) survey of full-time employees across several industries. Responses provided information about how certain age groups felt about PTO and how well their feelings about their company’s PTO plan aligned with the company’s intentions.

“The insights from the 400+ responses were enlightening. Plus, the corresponding white paper we created was well received and shared across social media, driving attention to our software products,” says Kris Hughes, the company’s senior content marketing manager.

But are there other ways to collect data? And how do they compare to surveys? Keep reading to find out.

How surveys compare to other data-collection methods

Survey vs questionnaire

The best way to think about the distinction between a survey and a questionnaire is to consider a questionnaire as one part of a survey. A questionnaire is simply a set of questions, while a survey is the entire lifecycle of research — questions, the delivery or distribution of those questions, and the analysis of responses to those questions.

Other than using a questionnaire for pure input purposes, such as asking people for their email address, it will always be part of a survey.

Survey vs poll

The biggest difference between a survey and a poll is length. Unlike surveys, polls are extremely short — typically only one multiple-choice question. When you use a poll, you’re trying to quickly and simply gather information about one specific thing. “Surveys provide more actionable data points than polls since polls have no wiggle room,” says Hughes.

Robyn Bolton, founder of MileZero, says polls are useful for clarifying details. For example, if you’ve created a new product, you may want to determine which features to include as standard versus optional. Or you may be trying to choose a color. “For simple questions like these,” Bolton says, “a poll can be useful to understand an absolute preference, while surveys can be useful to understand relative preferences.”

Survey vs census

The main difference between a census and a survey is the sample size. While a survey queries a segment of a given population, a census attempts to capture information for the entire population. In other words, a survey is meant to only represent the population, but a census is the population.

Understandably, a census is a much larger and longer undertaking than even the most complex or sizeable surveys, though its results are more reliable and accurate than a survey. It’s no wonder the U.S. Census is only conducted every 10 years.

Survey vs focus group

A focus group is a qualitative research method that involves questioning a small group of participants simultaneously, usually together in the same room or via video conference. A moderator presides over the group.

“The moderator’s job is to guide the discussion and gauge participants’ honest thoughts and reactions to the subject at hand, such as your product, service, or brand,” explains Larissa Murillo, marketing manager at MarketGoo.

Surveys differ from focus groups in that surveys take a more quantitative approach. They mostly deal with numbers or easy-to-quantify responses that can be analyzed on a spreadsheet. “While the numbers may give you clues, they don’t tell the whole story,” says Jim Jacobs, president of Focus Insite.

Jacobs notes that the error rate on a quantitative survey tends to be much higher than a qualitative method like a focus group or even an in-depth interview. “An experienced moderator or interviewer can quickly get to the root of a response and dig up additional details — something that won’t be revealed by simply checking a box on a standard survey,” he adds.

Is a survey the right tool for your purposes? With comparisons out of the way, let’s take a deeper look into surveys, including the methodology behind them and the pros and cons.

Survey methodology: A deeper look

Recall that a survey queries a sample of a given population, such as a subset of your customer base or employees within a certain department. Identifying and selecting that population sample is part of your survey methodology. Other aspects of survey methodology include evaluating and testing questions, determining the method for posing questions and collecting responses, and adjusting survey estimates to correct for errors.

But how do you know if your processes and methods will produce the insights you’re seeking? Consider the advice below to help ensure you’ve done the due diligence needed to set you up for success.

Survey methodology: How to draw meaningful conclusions

First, ensure you’re following best practices for survey data collection. In that section, we cover several tips to prepare you for collecting survey data and maximize your chances of getting high-quality results.

Second, get your population sample right. “Your population sample must represent your target audience, and it should be large enough to have statistical significance,” says Claire Shaner, content marketing specialist at BestCompany.

Here’s the example she gives: If you want to survey your employees on their feelings about the human resources function, but you only get 10 responses from interns, that’s not sufficient to generalize the feelings of your entire workforce. If you’re curious about what sample size is appropriate, check out this handy sample size table.

Last, when you get the results, be methodical as you review the data. Pay close attention to the questions you identified as being most important to achieving the goal of your survey. Cross-tabulate, filter, and graph responses to those questions among any subgroups and analyze your findings.

Assuming your sample size is large enough and representative of your target audience, you should observe fairly accurate trends as you manipulate the raw data. Formulate your own conclusions and test them by systematically bringing in and comparing the responses to your other questions.

Pros and cons of survey research

Surveying is generally considered a reliable and useful approach to information gathering, but there are some challenges to overcome as well.

Pros

- You can collect a broad range of data. You can use surveys to gauge attitudes, beliefs, values, opinions, motivations, and a host of other feedback. With these different data points, you can draw a more holistic picture of your survey topic.

- Results tend to be statistically significant. Recall that statistical significance is essential to drawing meaningful conclusions. Since surveys are often cheap and easy to administer, you can reach more people and improve the population representativeness of your results.

- Anonymity can elicit more honest answers. Respondents to surveys delivered online remain anonymous, which can encourage people to be more transparent in their answers. “Using a third-party firm that collects and aggregates responses before passing them on to you provides further anonymity and separation between you and participants,” notes David Chaudron, managing partner at Organized Change.

Cons

- Survey creators may be unsure about how to measure certain sentiments. Chaudron provides an interesting example about museum staff members who were unsure how to gauge the popularity of a children’s exhibit. Giving kids smiley face surveys didn’t provide enough information, so they observed how many kids pressed their noses against the glass of the exhibit instead.

- It can be hard to find a balance in data collection. Stacy Caprio, founder of Accelerated Growth Marketing, gives her take on walking the tightrope of data collection: “Collect too little data, and it’s statistically insignificant. Collect too much data, and it could take too much time to complete collection and assess the results before you’re forced to make a decision.”

- The target audience may not know what they want. In the case of asking customers about new products, they may not know that what you’re creating is something they would want or need in the future. “Customers don’t always know what may best serve their needs, so you may hamper your innovation by relying too much on their feedback,” explains Caprio.

Now that you’ve learned more about surveys, it’s time to put that knowledge into action by creating your own survey. Start with one of the survey templates below.

Examples of Jotform's surveys

Once you’ve identified your survey goal, read up on best practices for survey data collection, and determined how to draw meaningful conclusions from your surveys, what’s next? Creating your survey, of course.

To create your survey, you’ll need to develop the right questions, identify the most appropriate responses, and choose the right tool to distribute and collect the surveys. But why start from scratch when you can follow in the footsteps of the countless researchers, marketers, and consultants who came before you?

These survey creators have already done most of the hard work for you by building survey templates on Jotform. They come in two formats:

- Classic, where questions are shown all at once

- Card, where questions are displayed one at a time

Just so you know

Get a head start building your online survey with Jotform’s free, customizable ready-to-use survey templates.

Your survey template options

Event satisfaction survey

Restaurant evaluation survey

Market research survey

Patient satisfaction survey

Product survey

Training evaluation survey

Whether you’re looking to conduct market research, gauge patient satisfaction, or anything else, Jotform has a vast library of survey templates ready to suit your needs. Check out some of our most popular survey templates to see if one fits the bill.

This is our most popular survey template. It’s been cloned over 17,000 times and includes a few quick questions about an attendee’s experience at an event. You can send this to attendees after the festivities are over to get their take, and then use their feedback to improve your next event.

Questions in the template cover previous attendance and attendees’ satisfaction levels with different aspects of the event, like location and content. Also included is space for attendees to detail ways they feel the event could be improved.

Check out this survey template in its classic and card formats.

This multi-question survey is for gauging your customers’ feelings about the food and service provided at your restaurant. You can use it to ensure there are no issues with food preparation and quality or staff performance.

As expected of a restaurant survey, questions deal with order accuracy, cleanliness, speed of service, and overall experience. There’s also an open-ended question for general comments and suggestions.

Check out this survey template in its classic and card formats.

If you’re looking to get opinions from a specific group of people for market research, such as for a new product line, you’ll need to filter out those who don’t fit your criteria. This form gives you a great start with demographic questions like gender, age, household income, and more that you can easily modify. Then just add your specific questions and distribute accordingly.

Check out this survey template in its classic and card formats.

Similar to the event satisfaction survey, the patient satisfaction survey is brief and gauges how patients felt about their doctor’s visit. You can use this for any healthcare setting, whether it be a hospital, clinic, or other facility.

Survey questions ask for a patient’s gender and birthdate, as well as their sentiments about the doctor, nurse, and general visit experience. The survey ends with a free space for patients to share their thoughts on how the facility could improve its service.

Check out this survey template in its classic and card formats.

The product survey is more in-depth than the previous ones. A big distinction is that it asks for respondents to identify themselves and provide contact information. If you’re looking for deep insights into how and why customers use your products, this is the right survey template. You can use the contact info to follow up with customers via phone.

The survey queries respondents about how long they’ve used the product, how it compares to competing products, and more.

Check out this survey template in its classic and card formats.

Are you looking for feedback on the training you’re delivering to customers or employees? This form offers the perfect starting point for creating an insightful survey. If you want to keep things simple, use the template’s basic questions concerning participants’ overall satisfaction, sentiments about various training aspects, and whether they’d recommend the training to others.

Check out this survey template in its classic and card formats.

Any one of the above survey templates (or hundreds of others) should give you a great head start in building a survey that will help you get the information you need. Good luck!

Send Comment:

4 Comments:

More than a year ago

I like it

More than a year ago

Nice 👍

More than a year ago

I really loved this article about tutorial program philippines! It gave me some new insights that I never really thought of before.

More than a year ago

I always loved baking, and my specialty was my blueberry cupcakes. But for 12 years my only customers were my husband and my two sons, and they tend to leave without paying any money after they eat the cupcakes :)

Being a stay home mom takes its toll after a while, being home all alone most of the time challenged my sanity levels. Last year I've decided to bake my cupcakes and sell them! I have been the proud owner of Amanda's Cuppys for a year now.

When I was baking for my family, I used to go experimental very often, out of politeness, they didn't complain that much :) But when it comes to selling your product to a lot of strangers, customer satisfaction carries a huge load. The best way to understand what your customer is feeling about your product is to use surveys. After I started conducting a brief survey, that helped me to keep on coming up with new cupcake ideas without making people vomit :)

This guide does a very well job to explain the different types of surveys and why surveys are important.

If I know myself, I am going to keep experimenting, the good thing is that I'll also keep surveying my customers so that I can leave a smile on their faces.