These days, we handle just about everything on our smartphones, but when it comes to banking, choosing the right companies to handle our money can be tricky.

Forbes reported that in 2022 78 percent of adults in the United States preferred to do their banking digitally rather than in person, which is a staggering number considering that online-only banks are still a relatively new concept.

Digital banks need the help of companies like Plaid to connect users’ financial accounts with other apps quickly and securely. In this article, we’ll explain how Plaid works, evaluate its safety, discuss its benefits, and talk about some helpful Plaid integrations.

What is Plaid?

The fintech industry is booming. If you’re unfamiliar with the term, it’s shorthand for the financial technology industry, which includes online banks, money transfer apps, investment platforms, and other digital products related to money and banking. If you’ve used an app or platform to pay for a product or monitor your finances on your computer or phone, you’ve used a fintech product.

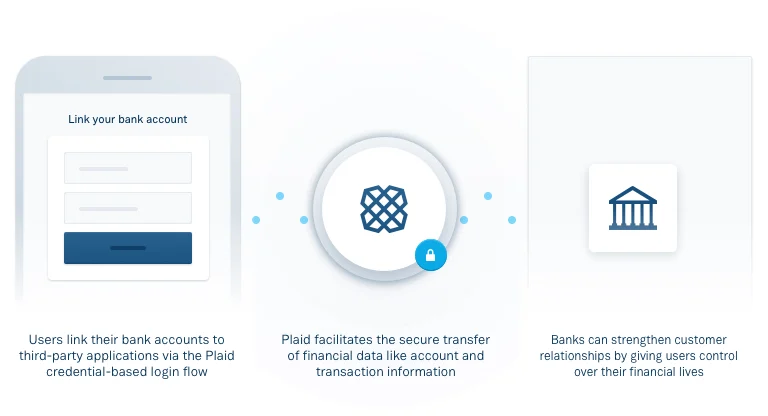

Plaid is a fintech company that connects third-party applications with the financial institutions that hold your money. The platform enables users to safely and securely link their bank accounts to other apps and services outside of their primary bank.

Once Plaid is connected to your accounts, third-party apps can — with your permission — access your financial data to successfully carry out transactions, like sending money to a friend for a coffee, paying a bill, or budgeting and tracking the money in your accounts.

How does Plaid work?

To understand how Plaid works, you first need to understand APIs, or application programming interfaces. An API is essentially a playbook that allows software applications to speak to each other.

For example, if you have a weather website and you want to incorporate live updates of the current weather all around the country, you can use an API to connect your website to an application that holds the weather data. Then the data collected in the app will be seamlessly added to your website via the API.

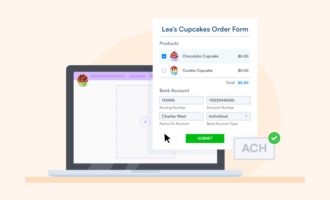

To facilitate an ACH (Automated Clearing House) payment, Plaid uses a network of APIs to verify a user’s identity, request access to their financial data, and link their bank accounts to Plaid’s platform. Once Plaid has access to your data, it can facilitate transactions by securely transferring information between your bank and the Plaid app.

Which companies and banks use Plaid?

Plaid is a popular platform that many well-known companies and banks use to facilitate their financial relationships. Since Plaid integrates with more than 12,000 financial institutions in the United States, Canada, and Europe, there’s a high chance your financial institution connects to it.

The many companies and banks that use Plaid include

- Acorns

- American Express

- Copilot

- Merrill Lynch

- Prudential Retirement

- SoFi

- Square

- U.S. Bank

- Venmo

- Wells Fargo

Is Plaid safe?

While Plaid works with thousands of banks and has built its business on the notion that your financial information belongs to you, it’s important to dig into the details. Here are some of the ways that Plaid protects your data and privacy:

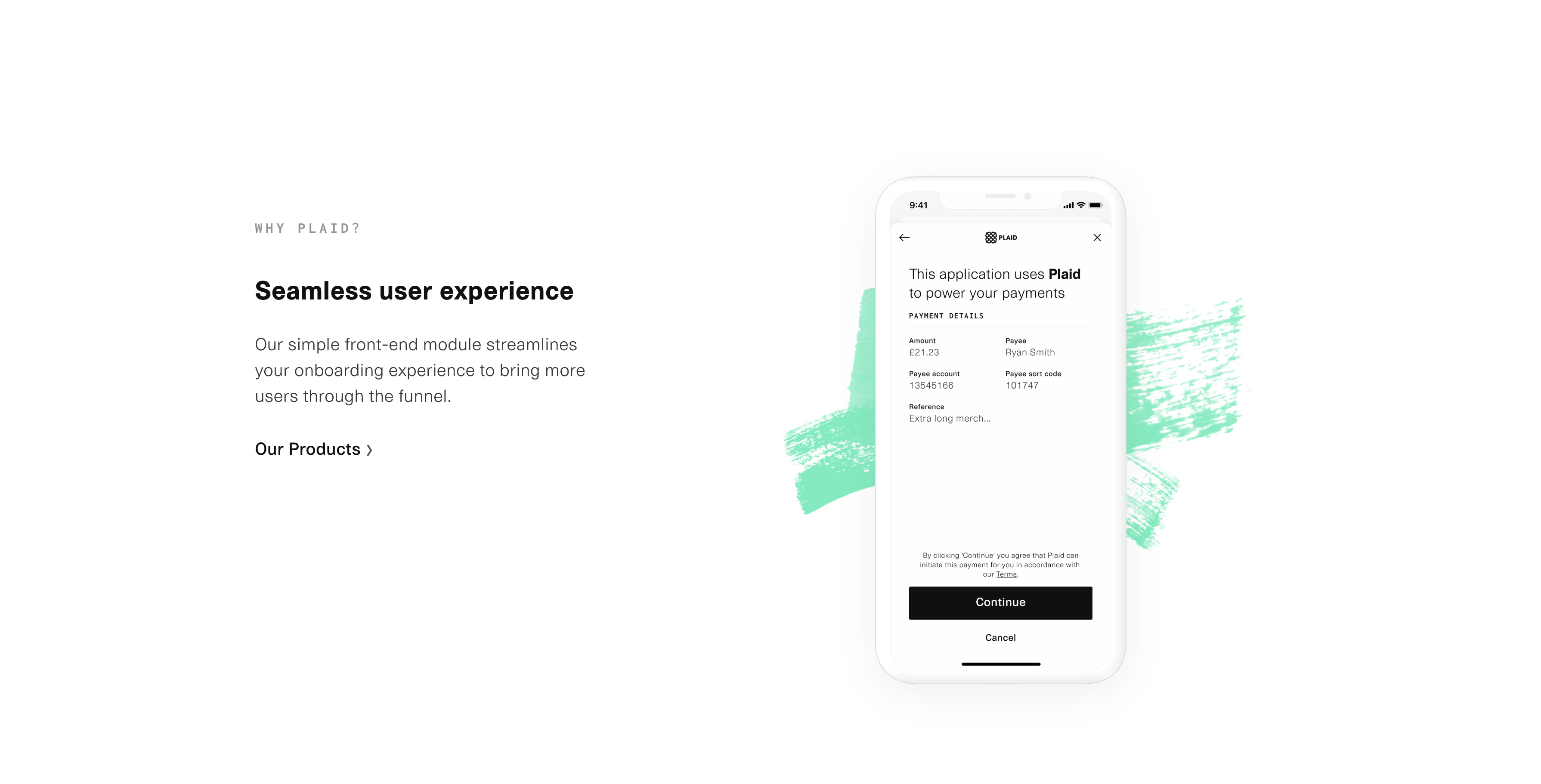

- Full disclosure: Plaid is transparent about how it works with your finances. Plaid’s logo and an explanation of its role will be displayed every time an app uses its services.

- Control over your data: When you allow Plaid access to your financial information, you can select which accounts it pulls data from. If you don’t want to share everything, you don’t have to.

- Plaid Portal: Plaid’s control center lets you view all of the connections you’ve made using its platform in one location, making it easy to disconnect accounts whenever you need to.

- Permissions Manager: Apps can use Plaid’s permission management API to create their own privacy permissions for their Plaid connections, contributing to trust and safety.

Just so you know

Receive form payments in your bank account quickly and securely with Jotform’s Stripe and Square ACH integration.

What are the benefits of using Plaid?

Reduced processing time

Plaid reduces payment processing time through its efficient data aggregation and verification processes.

By securely connecting to users’ bank accounts and retrieving transaction data in real time, Plaid streamlines the payment verification process. When a payment is initiated, Plaid can quickly confirm account details and available funds, expediting the transaction authorization process.

Improved security features

Plaid continuously enhances its security measures to safeguard users’ financial data. Its improved security features include multifactor authentication, encryption, and monitoring and alerts for suspicious activities. Plaid has also collaborated with leading cybersecurity firms to stay on top of vulnerabilities in its system.

Enhanced user experience

Plaid makes things easier for both businesses and consumers.

Users connect their financial accounts with little hassle, while businesses get quick access to data, making the process of accepting ACH payments smoother. Plus, with Plaid’s insights, businesses can give users personalized tips while keeping their financial info safe.

How do you integrate Plaid?

If you want to integrate Plaid ACH into your business system, first sign up for a Plaid account. You’ll receive API keys, including a public key and a secret key, which are essential for authenticating your API requests.

Next, select the integration method that best suits your use case and application requirements. For user-facing applications, use HTML, JavaScript, or mobile SDKs to add Plaid Link to your app’s interface.

Your Plaid API keys will then be used to authenticate any requests that come through Plaid’s servers; your keys should be used in the headers of your HTTP requests. Once a user links their bank account, you’ll be able to access their financial data through Plaid’s API endpoints.

What are Jotform’s ACH integration options?

If you’re looking for an easy way to set up ACH payments in Jotform, you can use Jotform’s integrations with Square and Stripe. You can add more payment methods through direct banking and start bringing in customer payments in just a few easy steps.

Both Square and Stripe can connect to your bank account via Plaid, so the benefits and safety considerations already mentioned will apply to your forms.

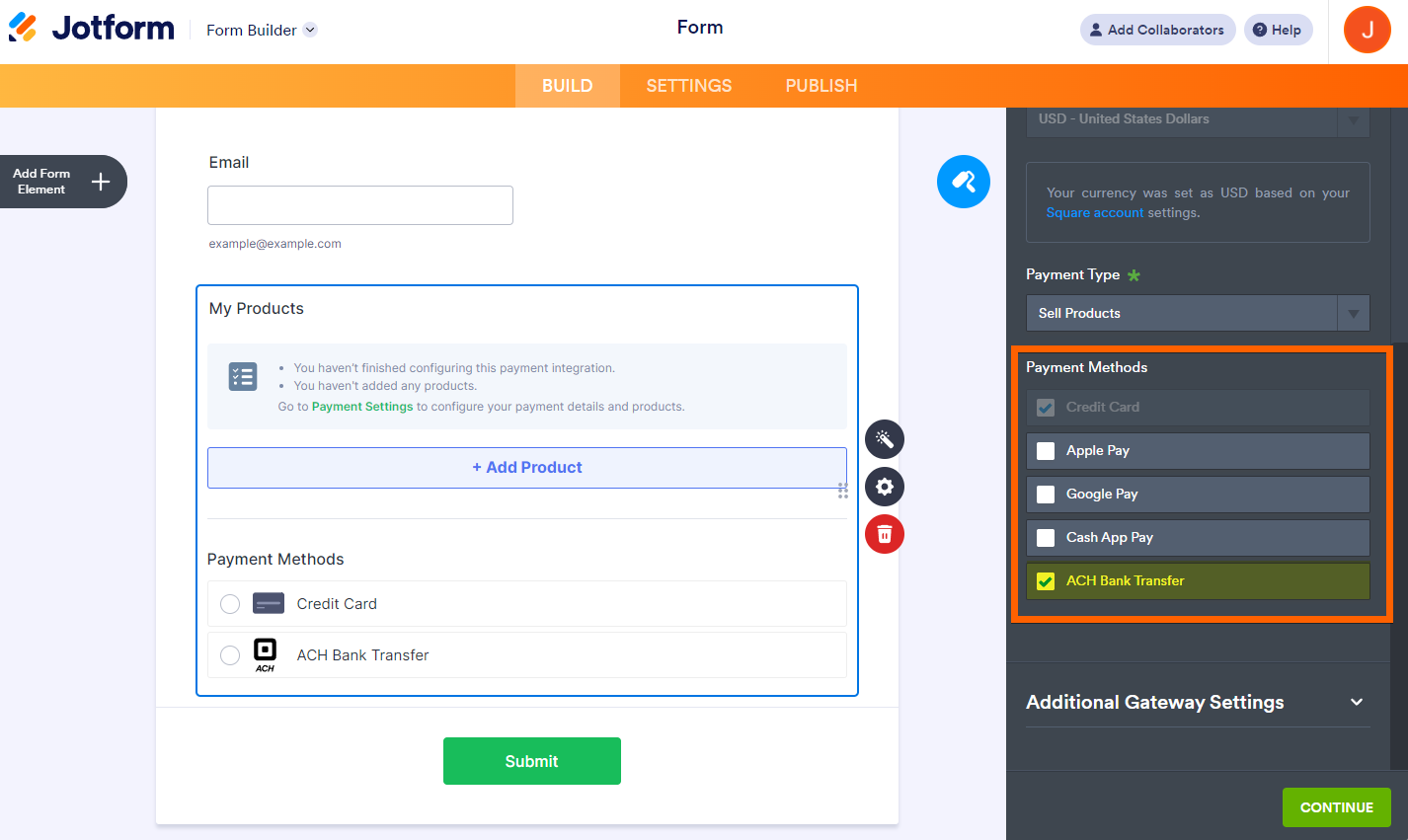

Jotform’s integration with Square

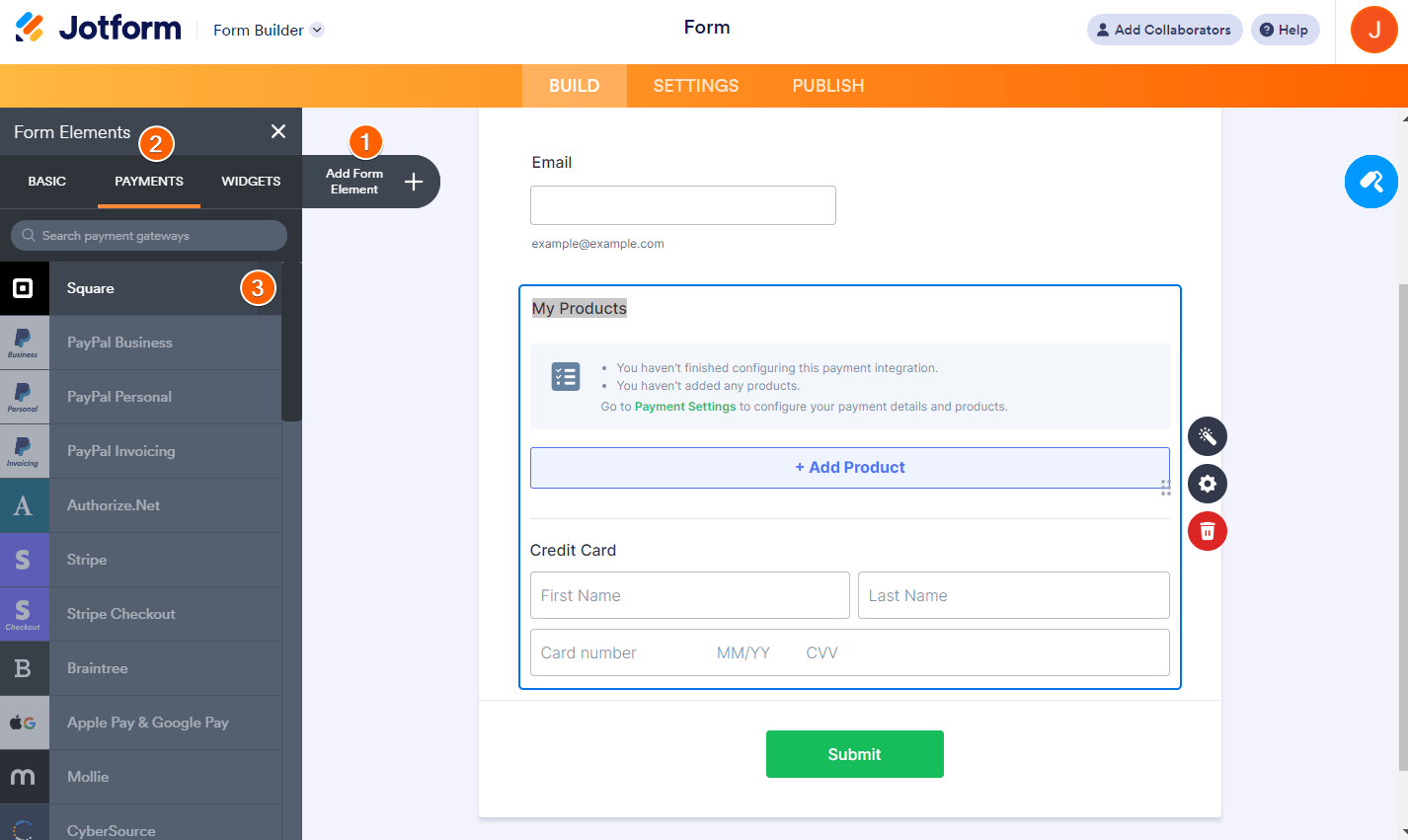

To connect to the Square integration, head to the Jotform Form Builder and follow these steps:

- Click the Add Form Element button.

- Select the Payments tab.

- Search for Square in the dropdown list and click it, or simply drag and drop it onto your form.

- Once you’ve selected the Square integration, a Payment Settings menu will appear. (You can also open the menu by hovering over the integration form field and clicking the wand icon.) Link your Square account by clicking Connect in the menu. When the button changes from Connect to Connected, you’ve successfully linked your account.

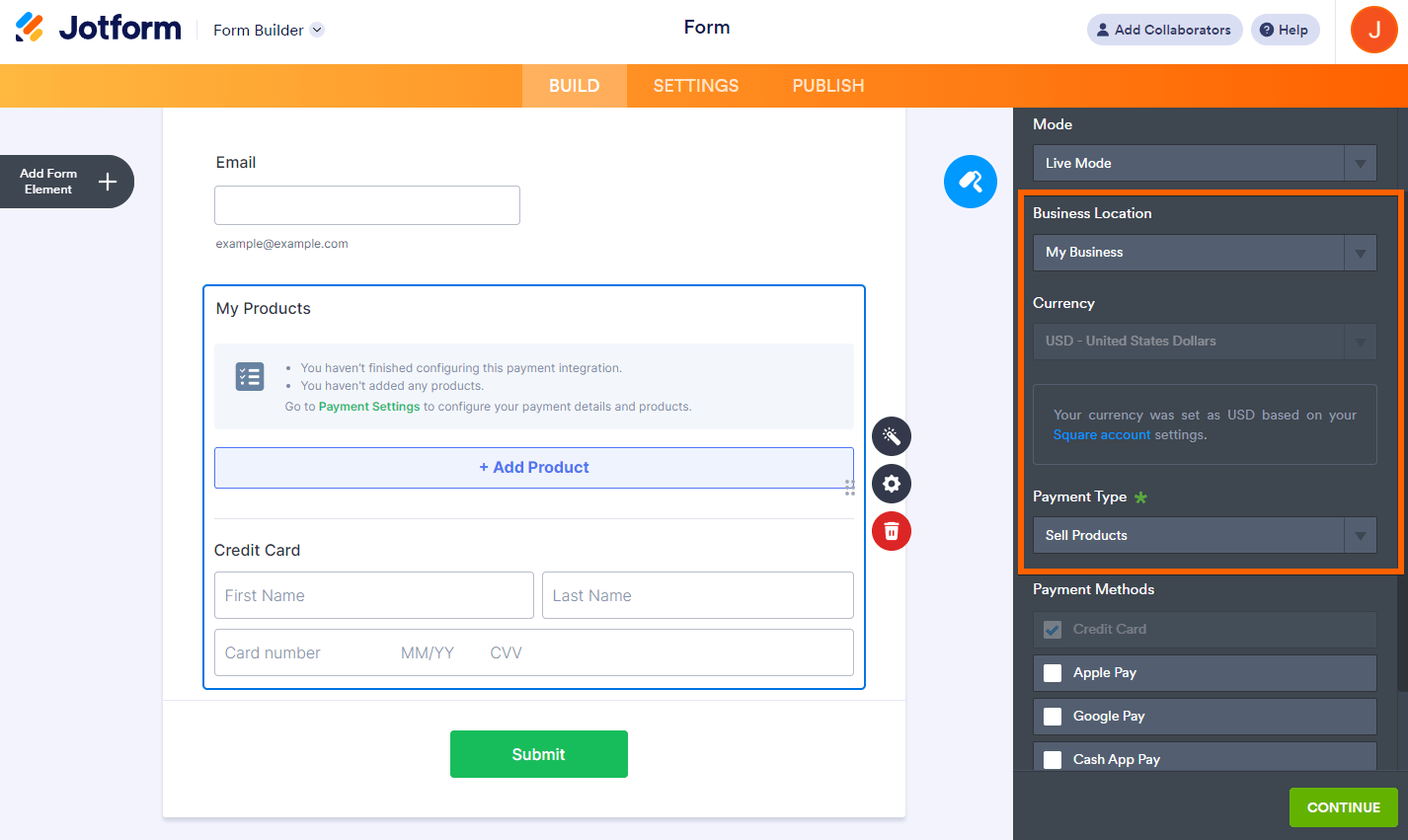

- Complete the following fields:

- Business Location: This field will match the location you’ve registered with your Square account.

- Currency: This field will match your Square account’s settings and will be locked.

- Payment Type: Choose from the options in the dropdown menu. You can sell products or subscriptions or accept donations or user-defined amounts.

- Under Payment Methods, select ACH Bank Transfer.

- Under the Additional Gateway Settings, you’ll see the following options:

- Customer Email: If your form contains multiple email fields, select the email address where the form will be sent through Square.

- Authorization Only: You can set up Square to authorize payments now and charge customers at a later date.

- Order Fulfillment Type: Select whether payments from your form are for Pickup (the default method) or Shipment.

- Send Payment Receipt: Toggle this option to send a receipt to your customers.

- If you chose products or subscriptions in the Payment Type field earlier, click the Continue button to add your items. If you chose user-defined amounts or donations, click the Save button to complete the integration.

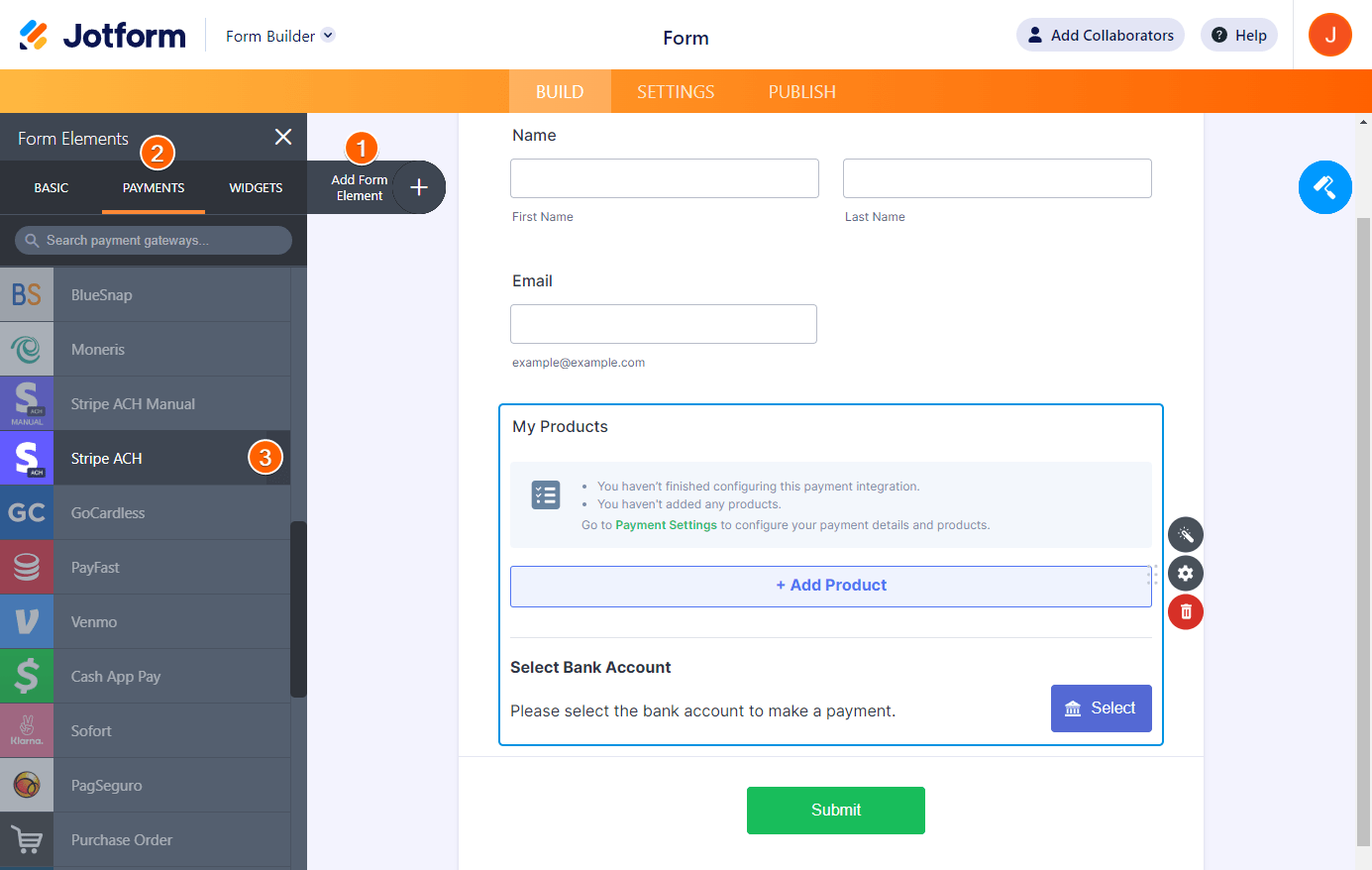

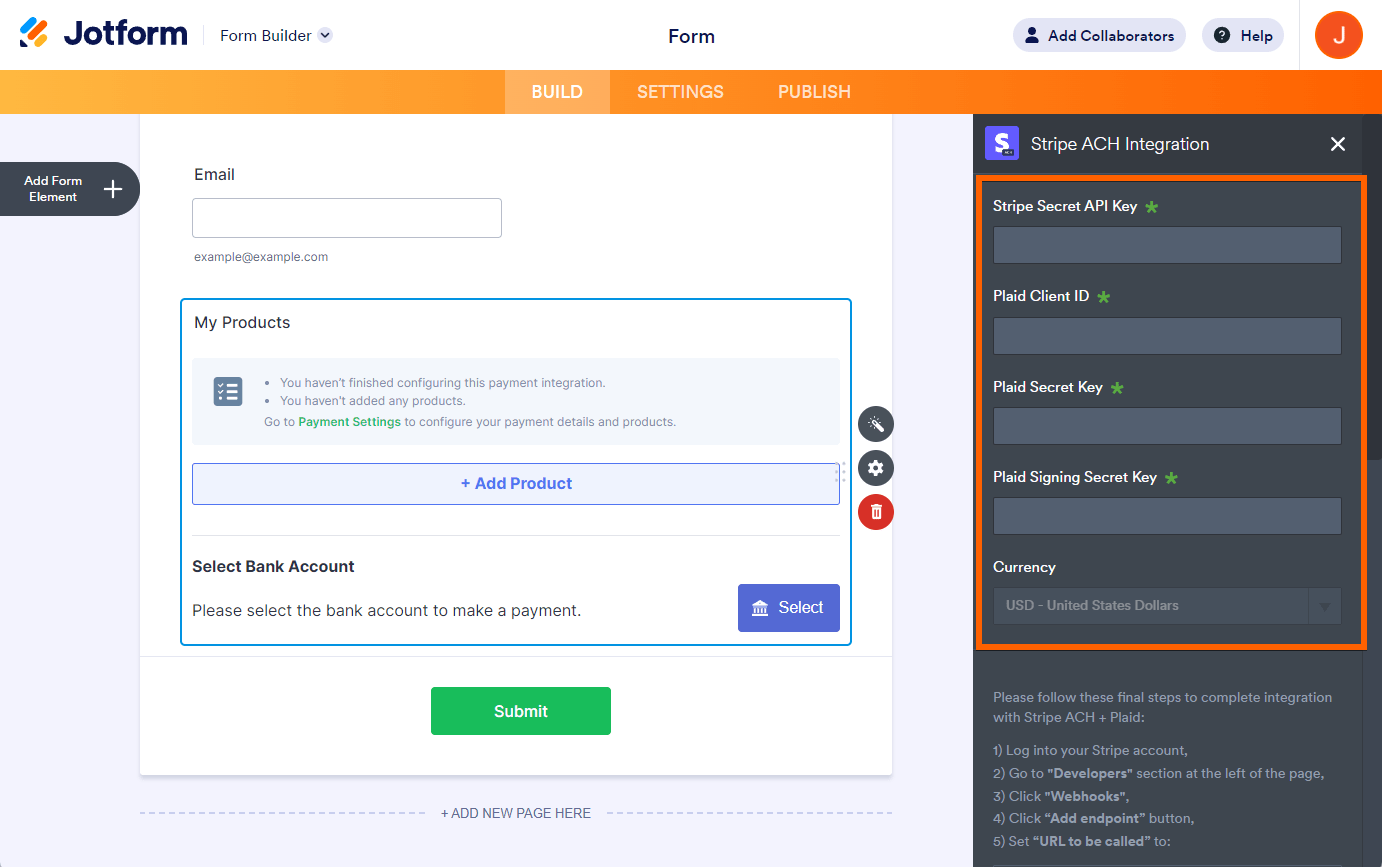

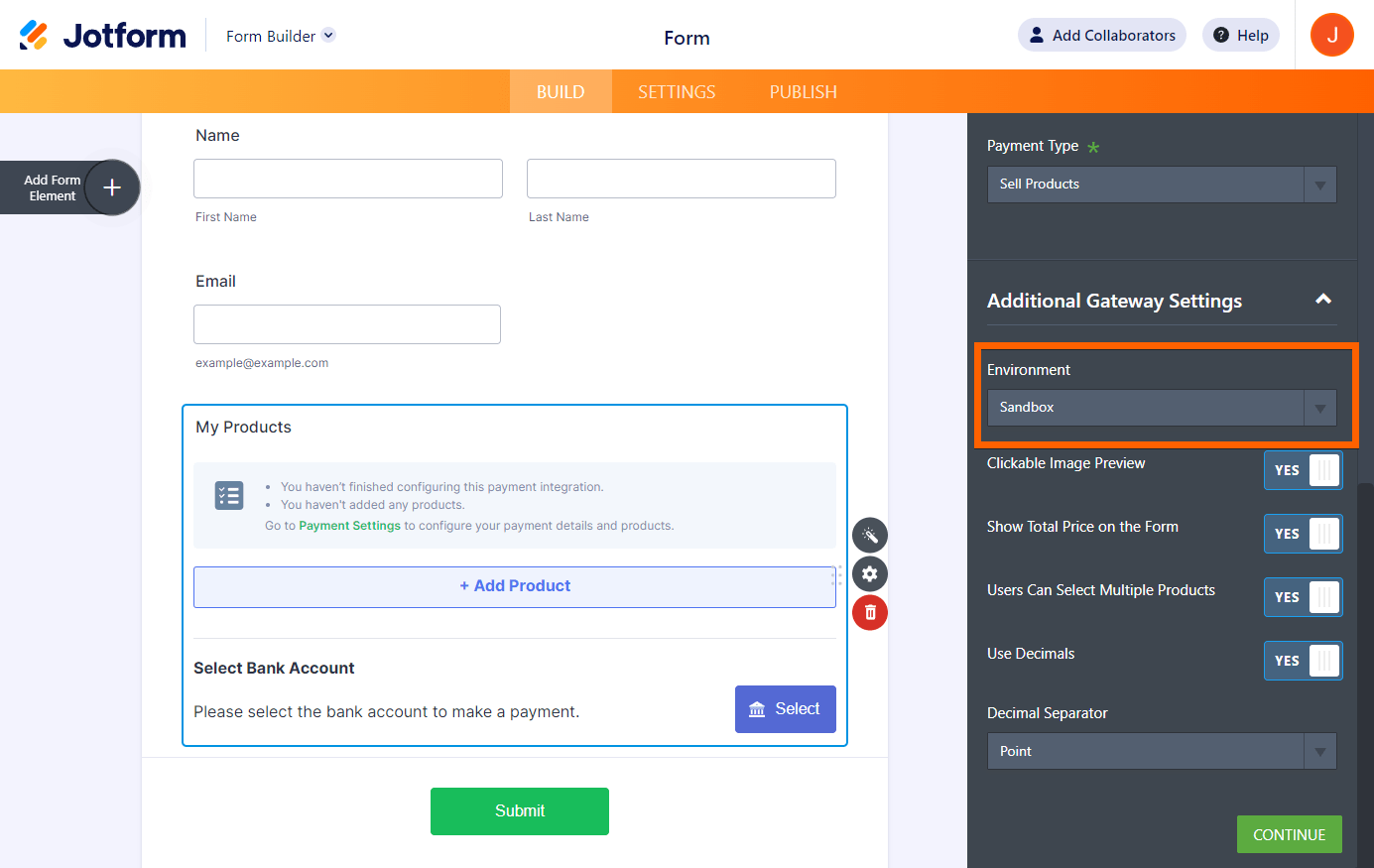

Jotform’s integration with Stripe

To add the Stripe integration to your form, follow these steps:

- Click the Add Form Element button.

- Select the Payments tab.

- Search for Stripe ACH in the dropdown list and click it, or simply drag and drop it onto your form.

- Once you’ve selected the Stripe ACH integration, a Payment Settings menu will appear. (You can also open the menu by hovering over the integration form field and clicking the wand icon.) In the menu, fill out the following fields:

- Choose a Payment Type from the dropdown. You can sell products, accept donations, or collect user-defined amounts.

- Under Additional Gateway Settings, choose the appropriate Environment:

- Sandbox

- Development

- Production

If you chose products in the Payment Type field earlier, click the Continue button to add your items. If you chose user-defined amounts or donations, click the Save button to complete the integration.

Photo by Ono Kosuki

Send Comment: