Do you sell goods or services online? If you do, knowing the difference between a payment gateway vs a payment processor is vital.

It’s easy to confuse the two terms, given the similarities between the two types of technology.

In this article, we’ll look at the role each of them plays in the online payment process, which service you need, and how Jotform can play a critical role in your online payment system.

An overview of the online sales process

Making an online payment is simple, but the underlying systems that facilitate digital transactions are not.

There are three major elements of an online payment system:

- Merchant accounts

- Payment gateways

- Payment processors

When a customer enters their payment details on your website to make a purchase, that information is secured by a payment gateway and sent to a payment processor. The payment processor checks if the customer has the available funds with the credit card provider and relays whether the transaction is approved or rejected back to the payment gateway. If it’s approved, the processor will issue the funds to the merchant’s bank account.

Payment gateways in detail

A payment gateway is a piece of software that captures and encrypts a customer’s payment information and then sends it to a payment processor. If you want to accept any form of digital payment on your website, you need to have a payment gateway, write Dana Miranda and Rob Watts at Forbes Advisor. “The technology circulates financial data around to the necessary entities to authorize payments and move money from a customer to a merchant.”

Payment gateways provide an encrypted two-way communication channel between your website, your payment processor, and the issuing bank. Once the encrypted data reaches the bank, the payment gateway decodes it into a usable format. The bank will authenticate the information, and the payment gateway will deliver the transaction details (approved or declined) back to the user.

Payment processors in detail

A payment processor is a company that acts as a middleman between your store and all the financial entities involved in the payment. It’s absolutely essential if you want to accept credit card payments of any kind.

“Payment processors act as a shuttle, delivering information from the credit card customer’s issuing bank to merchant accounts, where accepted payments ultimately land,” explain Kristen Hampshire and Lauren Swift in a U.S. News article. “The payment processor validates card security and facilitates the transfer of payment, moving money from the issuing bank to the merchant account.”

Payment gateways vs payment processors: The distinctions

There are quite a few differences and similarities when it comes to payment gateways vs payment processors — which is what makes the terms so confusing to begin with. Let’s clarify:

- A payment gateway captures payment details and transfers them to the payment processor. It communicates outcomes back to customers.

- A payment processor executes the transaction.

- Payment gateways can be standalone services, but many, like PayPal, are integrated with a payment processor.

- Payment gateways are commonly used in online transactions.

- Payment processors are necessary for all card-based transactions, including online and in-store sales.

Online payment collection with Jotform

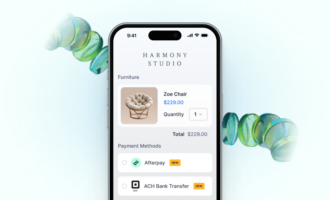

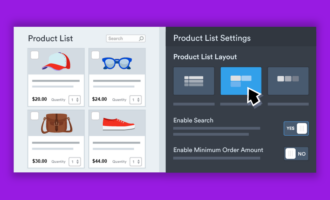

Payment gateways and payment processors make it easy to collect online payments, but Jotform makes the process even easier. Whether you need to accept payment for your products, collect donations for your charity, or set up recurring payments for your subscription business, Jotform lets you create a secure payment form at no cost.

Jotform offers over 100 free payment form templates you can use to get started. You don’t have to worry about security or integrations, either: All payments made through Jotform are secure, and Jotform integrates with more than 25 major payment processors. Additionally, Jotform is compliant with standards and regulations like the Payment Card Industry Data Security Standard (PCI DSS), the General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA).

Find the perfect online payment solution for your needs by browsing our payment gateway comparison chart — or start by creating a payment form using Jotform for free.

Send Comment: