Millions of records are compromised in online security breaches, making the internet less safe for business every year. Consumers are certainly aware of this risk. If your e-commerce site can’t provide the highest level of online payment security, buyers may look elsewhere.

But what does “online payment security” really mean? This term encompasses all the guidelines, tactics, and systems your business uses to protect its online financial transactions (and all the data associated with them) from cyberattacks and fraudsters. As the level of e-commerce crime continues to rise, so do the number of practices and tools involved in securing your payment processes.

The good news is that most security strategies are well established, frequently updated, and easy enough to implement. Here’s the key information you need to understand to keep online financial transactions secure — and to demonstrate that safety to your customers.

The key components of online payment security

Online payment security has three primary aspects: fraud protection, security, and compliance.

Fraud protection

One of the biggest problems for e-commerce businesses is financial fraud. Fraud occurs when bad actors try to conduct illegal or fake transactions as part of an attempt to acquire goods without personally paying for them. And it’s a massive problem — experts predict that merchant losses from online payment fraud will exceed $362 billion globally by 2028!

Some of the most common financial fraud tactics to watch out for include

- Account takeover fraud: A fraudster tries to gain access to existing customer accounts.

- “Friendly” fraud: Also known as chargeback fraud, friendly fraud occurs when a customer (or a fraudster pretending to be a customer) disputes a credit card transaction, claiming they didn’t receive a purchase or they didn’t authorize a charge.

- New account fraud: A fraudster takes on a false identity to open a new payment card account, which they then use to make purchases.

- Buy now, pay later fraud: A fraudster may take over a customer’s account and make a purchase using this payment option and then disappear without paying.

There are many other types of fraud to watch out for, and as an e-commerce seller, you can count on dedicating a fair amount of resources to combating fraud in all its various forms.

Security

Using resources to secure the safety of both your business and your customers is another important component of online payment security.

In addition to protecting against financial fraud, you also need to be concerned about malware (“malicious” software), phishing, and other similar types of attacks designed to infiltrate your computer system and steal customer data. Keep reading for more information about the types of security measures you can take to keep criminals at bay and boost customers’ trust in your business.

Compliance

Naturally, you want to make your business transactions secure, but there are also a number of regulations that compel you to do so. But the web of regulations surrounding online payments can be hard to untangle and even harder to implement.

There are regulations around data privacy, consumer security, the handling of credit card data, and even the security of your own IT department. Additionally, each card network has its own set of rules to follow, and, depending on where you do business, you may have to abide by certain geographical regulations. (For instance, if you have any UK customers, you must comply with the General Data Protection Regulation’s data protection rules.) And did we mention that nearly all of these rules are regularly updated?

The good news is that many payment platforms monitor these policies and make changes to stay updated, which is especially helpful for your compliance efforts.

Online payment security: Types of protection

There are a number of different resources available to help e-commerce merchants combat cybercrimes of all varieties. These include

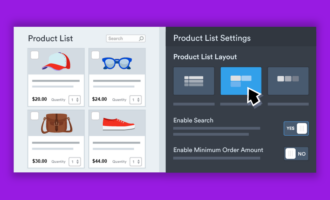

Payment gateways

A payment gateway is a software application that encrypts financial data and authorizes transactions, communicating with payment processors to enable the transfer of funds from buyer to seller.

Unless you plan to run payment data through your own servers — and make the significant investment it takes to do so safely — you’ll need a payment gateway, whether it’s built into your hosting platform or incorporated via a third-party plug-in.

Payment gateway providers handle financial identifiers on behalf of their customers, protecting site owners from the risks associated with storing data on their own servers. Established gateways like PayPal and Authorize.net invest heavily in security, charging membership and/or transaction fees to site operators.

Pro Tip

Safely accept online payments and protect customer data with Jotform’s advanced form security, PCI and GDPR compliance, and trusted payment gateway integrations.

SSL and TLS

Websites protect payment information by encrypting the data before transmitting it. Two major protocols accomplish this encryption — Secure Sockets Layer (or SSL) and Transport Layer Security (or TLS). TLS is the newer protocol, with stronger encryption algorithms. However, many industry insiders use the terms interchangeably, as SSL is more widely known among web users.

Most site owners don’t need to worry too much about the difference; the important thing is to obtain an SSL or TLS certificate from a trusted hosting service. This certificate shows that customer data is encrypted as it travels from the user’s computer to your e-commerce site during the first step in any payment transaction.

“For the moment, provided SSL security is up to date with modern encryption, secure information is well protected at this stage,” says Jason Agouris, CEO of digital systems provider iTristan Media Group.

An SSL or TLS certificate is vital in today’s online ecosystem. In most browsers, the presence of such a certificate is readily apparent to users, symbolized by a closed padlock in the URL bar. When a website doesn’t have an up-to-date certificate, browsers may warn users of the security risk, which can pose serious problems for any website that handles online transactions.

PCI compliance

The Payment Card Industry Security Standards Council (PCI SSC) is an international group dedicated to keeping payment data secure. It publishes and updates the PCI Data Security Standard (PCI DSS), which applies to “all entities that store, process, or transmit cardholder data and/or sensitive authentication data.”

Different types of businesses need varying levels of PCI compliance, ranging from a few simple requirements for online sellers using gateways to full validation for gateway providers themselves. Major payment card brands like Visa and Mastercard operate independent programs that define validation levels and compliance, so the notion of “compliance” itself is complex.

Most e-commerce merchants who use payment gateways can gauge their level of PCI compliance with that organization’s Self-Assessment Questionnaire A. This document includes only the PCI DSS requirements that apply to sellers who outsource payment card handling to validated third-party services — i.e., reliable payment gateways.

Be sure to ask any third-party vendors that handle financial transactions whether they carry validation for all PCI DSS requirements. If they don’t, keep looking.

Tokenization for secure online payments

Encryption isn’t the only way to conceal financial identifiers as they move between customers, your site, and the payment processor. Tokenization is a powerful strategy that replaces a credit card number with a unique code, or “token.” Client computers transmit the token rather than the information itself, rendering the data useless if it’s stolen.

Agouris recommends choosing a payment gateway that provides tokenized transactions for the greatest security benefits.

“For most businesses now, the best option is to fully tokenize their payment gateway relationship with their e-commerce platform, such that the business’s own e-commerce system never actually sees the full payment information,” Agouris says.

“All the system knows is that the payment gateway did or did not approve the payment and why. The immediate security is now shifted to leverage the payment gateway’s systems, whose day job is all about security on your behalf.”

Multifactor authentication

To grant access to protected information, a system needs to verify the user’s identity. A simple way to do that is to prompt the user for a password — but a malicious user could acquire that password, so a single factor isn’t enough to guarantee security.

The second factor is typically a code sent to the user’s phone or email address upon request for access; this tactic verifies that the user also possesses an item (the phone or email account) that proves their identity. This is a simple but effective type of multifactor authorization that dramatically improves security.

As with all efforts to ensure online payment security, the use of multifactor authentication doesn’t just make e-commerce safer; it also makes customers more likely to click “buy” in the first place.

Firewalls and network security

Aside from using various methods to protect payment information specifically, you can secure your entire network with the use of firewalls. Think of a firewall like a fence — it monitors incoming traffic and keeps intruders out of your network and systems but allows customers and trusted parties in. Firewalls have been around for decades and are still considered an essential tool in the cybersecurity toolbox.

There are several different types of firewalls. A web application firewall is a good choice for e-commerce businesses because it’s designed to protect web applications specifically, and it helps protect against the most frequent types of attacks. Some businesses choose to work with a managed service provider who can install and maintain the firewall, but if you have knowledgeable pros on staff, you may be able to implement and manage it in-house.

Firewalls are important for any business network, but for e-commerce sites, where customers are continuously inputting sensitive data, they’re crucial. You should consider a firewall as an addition to the above security measures.

Security updates and patches

Software and operating system vendors are keenly aware of security threats and are constantly working to find and address vulnerabilities in their products. They occasionally issue security updates or “patches” to customers. Some of these are automatically applied, but others may require you to install them manually.

Don’t neglect patch notifications! It’s important to act on them because some hackers target systems that are unpatched. Keep your systems up to date to ensure your site remains secure for online transactions.

Patching isn’t difficult; however, the more vendors you have, the more security patches you may receive. Prioritize your efforts based on the purpose of the patch, the impact it will have on your security efforts, and the urgency of each patch.

Ways to communicate payment security to buyers

Online payment security strategies serve two critical purposes: They protect customer data and help visitors feel secure when making a purchase. To reassure customers, site operators must openly advertise their investments in data protection.

For example, if you’re using advanced fraud-detection plug-ins, list them on your shopping cart page. Your payment gateway should also be fully PCI compliant; let your customers know that it is. When visitors see that payments on your site are secured by a familiar name, your chances of making more sales increase exponentially.

Online payment security tips and best practices

Security works best when all parties involved follow some basic practices. Below are some of the things sellers and buyers can do to stay safe.

For sellers

In addition to implementing the types of protection above, sellers can take these steps:

- Evaluate the security practices of your vendors. Many businesses have relationships with multiple vendors, some of whom use or store their data. Regularly vet these providers to ensure their data management practices are up to par.

- Control access to sensitive data. Internally, limit employees’ access to customer and banking data to reduce its exposure.

- Train employees on cybersecurity. Developing your employees’ knowledge around cybersecurity threats helps create a strong first line of defense. Train them to recognize and report suspicious activities as soon as they arise.

- Install 3D Secure 2. This protocol offers merchants a seamless way to authenticate cardholders at the time of purchase. It’s simply another layer of security you can add to your process to prevent fraud.

For buyers

- Avoid using debit cards for online purchases. Debit cards are linked to your bank account; this puts your entire account at risk if a data breach were to occur. Instead, choose a credit card or payment platform (like PayPal), most of which have processes in place to protect consumers when fraud occurs.

- Purchase only from secure sites. A good indicator is if the URL switches from “http” to “https” on the purchasing page — that means it’s encrypted. A lock icon should also indicate that the site has installed SSL encryption.

- Beware of sites that appear to be infected with malware. If you experience suspicious popups, unexpected redirects, or a search engine warning about a site, avoid purchasing from them.

- Minimize purchases made on public WiFi networks. Public WiFi networks aren’t always as well-protected as they should be. If you do need to make a purchase on public WiFi, make sure the padlock icon is present or simply use your mobile data for the few minutes it takes to buy.

The most secure online payment methods

With online payments, there’s always a chance that bad actors could intercept data. However, some payment methods make this harder than others.

As noted previously, debit cards are generally considered a risky payment method; however, it’s still a fairly popular one among consumers. As a merchant, you’ll need to carefully consider your payment method options and try to balance security concerns with customer preferences. You’ll also likely need help from a payment provider or other vendor to handle online transactions of any type as securely as possible.

Let’s look at some of the most secure online payment methods:

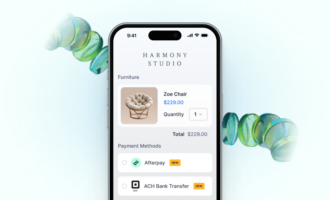

Digital wallets

By now, most people are aware of the safety measures that are built into digital wallets like Apple Pay and Google Pay. Depending on the specific wallet, it may offer facial or fingerprint recognition, a PIN number, or other security feature. Digital wallets also encrypt your data and use tokenization to avoid sharing actual credit card numbers with merchants at the time of purchase (and that data isn’t stored on the phone itself).

Credit cards

Credit cards are popular among consumers, and they’re relatively safe to use as well. Most reputable payment gateways also offer secure tokenization as part of their services.

ACH payments

An ACH payment is a bank-to-bank transfer facilitated by the Automated Clearing House (ACH) Network. ACH payments are highly secure because banking information is verified and authorized before a transaction can be processed. While this payment method isn’t appropriate for e-commerce businesses that sell low-cost items, it is a good payment choice for those that sell high-value items (like many B2B sellers, for instance).

The risks of not having an online payment security strategy

For a number of reasons, it’s well worth the effort to do everything you can to secure customer transactions. Neglecting this aspect of your business could have some serious consequences.

You could experience a cyberattack

First and foremost, conducting financial transactions online without an online payment security strategy puts your business at risk of falling victim to one of the myriad cyberattacks that happen each year.

Unfortunately, the chances of being the target of a cyberattack aren’t the same as winning the lottery — in fact, in 2022, a shocking 83 percent of organizations suffered more than one data breach. Businesses of all sizes are vulnerable, but hackers realize that small businesses are less likely to have security measures in place, and they’ll take advantage of this fact.

Cyberattacks are costly in multiple ways. You could incur ransom payments, business downtime, legal fees, and more. Many businesses are forced to pass these costs on to their customers, making it difficult for them to stay competitive. Ultimately, a cyberattack could put your organization’s financial health in jeopardy.

You could lose customers

While online payments are now commonplace, most customers still look for indicators of security measures before sharing personal or payment information. Research has shown that 18 percent of shoppers have halted a purchase due to concerns about whether they could trust the site with their credit card information.

If you don’t have an online payment security strategy in place, you have nothing to alleviate their fears. In other words, your inaction could be scaring a fair amount of customers away for good.

You could be fined

All entities that store, process, and transmit cardholder data must comply with PCI DSS. This set of standards represents common-sense practices around everything from building a secure network to protecting cardholder data and more.

PCI DSS is not a law; however, it’s usually mandated as part of your relationships with card brands and banks. And while there’s no formal method of enforcing the standards, your failure to comply with them would likely be uncovered after a breach — and you could incur penalties as a result.

The stakeholders in online payment security processes

Many parties have a stake in keeping online payment transactions secure — it certainly isn’t the work of one business owner alone. Some of the key players in this area include

- Customers: As discussed above, customers can and should take measures on an individual level to keep their data safe.

- E-commerce merchants: Business owners are responsible for making sure their transaction systems are secure and should remain vigilant with regard to potential fraud.

- Payment processors: Companies that facilitate electronic payments are responsible for protecting customer information and analyzing transactions to detect and prevent fraudulent payments.

- Regulatory agencies and watchdog groups: Government bodies like the Federal Trade Commission and agencies like the PCI Security Standards Council work to identify new threats and put guidelines in place to help reduce the risks of making online payments.

- Banks: Financial institutions must actively work to ensure they can safely authorize transactions, manage merchant and customer accounts, transfer funds, and more.

The best way to boost your security: Work with trusted partners

Maintaining online payment security might seem like a daunting task, but choosing the right partners and vendors to work with can go a long way toward making your ecosystem safer. Before signing up with any vendor, investigate their security practices and make sure they’re prioritizing security as much as you are. Remember — investing in security is investing in the future of your business!

This article was originally published in March 2020. The most recent update was in April 2025 by Meredith DeSouza.

Send Comment: