9 of the most popular NFC payment apps

You’ve probably heard about NFC payment apps like Apple Pay and Google Pay that let customers tap their phone or smartwatch to pay instantly at checkout. These contactless payment tools speed up in-store transactions and create a smoother, more secure shopping experience that keeps customers coming back.

But as a merchant, staying competitive means keeping up with every way your customers want to pay. Customers use a wide range of payment apps and wallets, and accommodating them as best as you can means fewer missed sales and happier customers. Beyond the well-known NFC payment apps, we’ve compiled a list of other options — from consumer-side wallets to merchant-facing systems — that make contactless payments easy to accept and manage.

How to choose the right NFC payment app

When it comes to payment, security is a top concern for both businesses and customers. Thankfully, NFC payment apps use encryption and tokenization technology to safeguard customer card information against fraud. On top of that, most NFC payment apps also require biometric authentication — fingerprint or face ID — to reduce the risk of theft or unauthorized payments. Together, these features make NFC payment systems one of the safest ways for customers to pay in person.

Still, as a business owner, you’ll want to look beyond just convenience. Here are a few key criteria to consider when choosing a contactless payment system that ensures a smooth experience for your customers.

1. Compatibility with devices and terminals: Some NFC payment apps only work on specific devices, for instance, Apple Pay on iPhones and Samsung Pay on Samsung phones. To serve a wider customer base, you need to choose a contactless system with cross-platform support. Also, consider whether the app integrates with your existing point of sale setup (POS) or can work with inexpensive NFC readers.

2. Security and compliance: NFC payments already use tokenization and encryption, but it’s still important to pick a provider with a proven track record in preventing, detecting, and mitigating fraud. Check for Payment Card Industry (PCI) Data Security Standard (DSS) compliance to ensure the provider you choose has transparent policies around data handling and breaches.

3. Customer experience: NFC payment flows are known for being simple and intuitive — ideally one tap, one confirmation. Some NFC payment apps also support offline transactions up to certain limits, making checkouts even quicker. Avoid solutions that complicate the process or slow down your customers.

4. Multi-currency support: If you serve tourists or international customers, look for payment providers that support multi-currency transactions and major global card networks. This flexibility helps you accommodate customers from anywhere.

5. Supported payment methods: Look for an app that works with a wide range of card networks and digital wallets to minimize friction at checkout. The more options you can accept, the smoother the experience for your customers.

10 best NFC payment apps

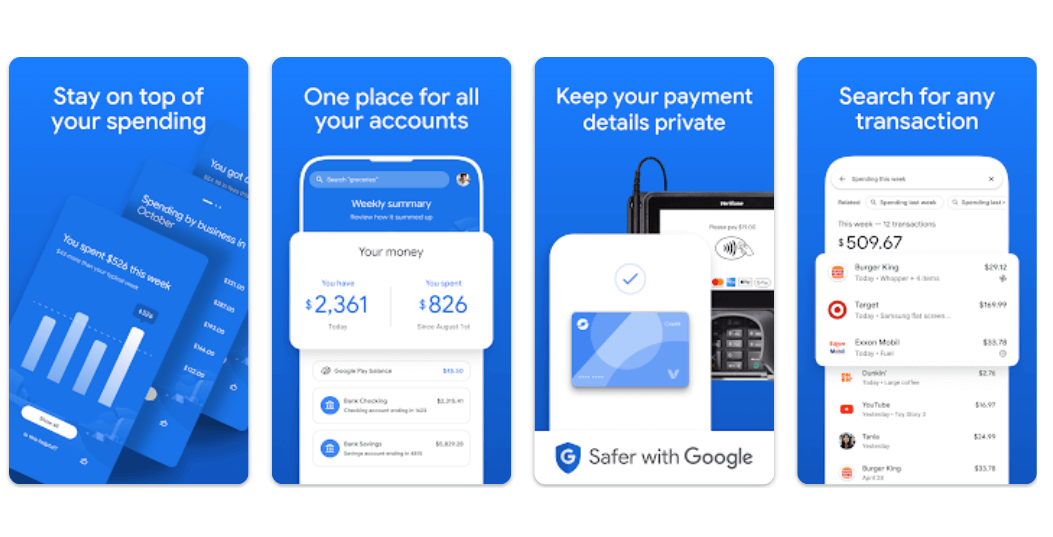

1. Google Pay: Best for Android users or cross-platform acceptance

Google’s reach goes far beyond search — it extends to phones, online ads, and apps like Google Pay, which facilitates online, in-store, and person-to-person payments.

Google Pay works on Android and iOS devices as well as the web. “It uses a token system that adds an extra layer of security,” says Brian Crane, founder of Spread Great Ideas. “The system substitutes actual card data with encrypted, virtual data. In addition, Google Pay offers gift cards and loyalty programs.”

Key features: Integration with other Google services, stores loyalty/transport cards, cashbacks, rewards, and exciting offers

Pros: Free to use, strong security system, supports Android and iOS

Cons: Bank support may vary, transactions might take days to reflect

App store rating: 4.0 on Google Play Store, 4.6 on the Apple App Store

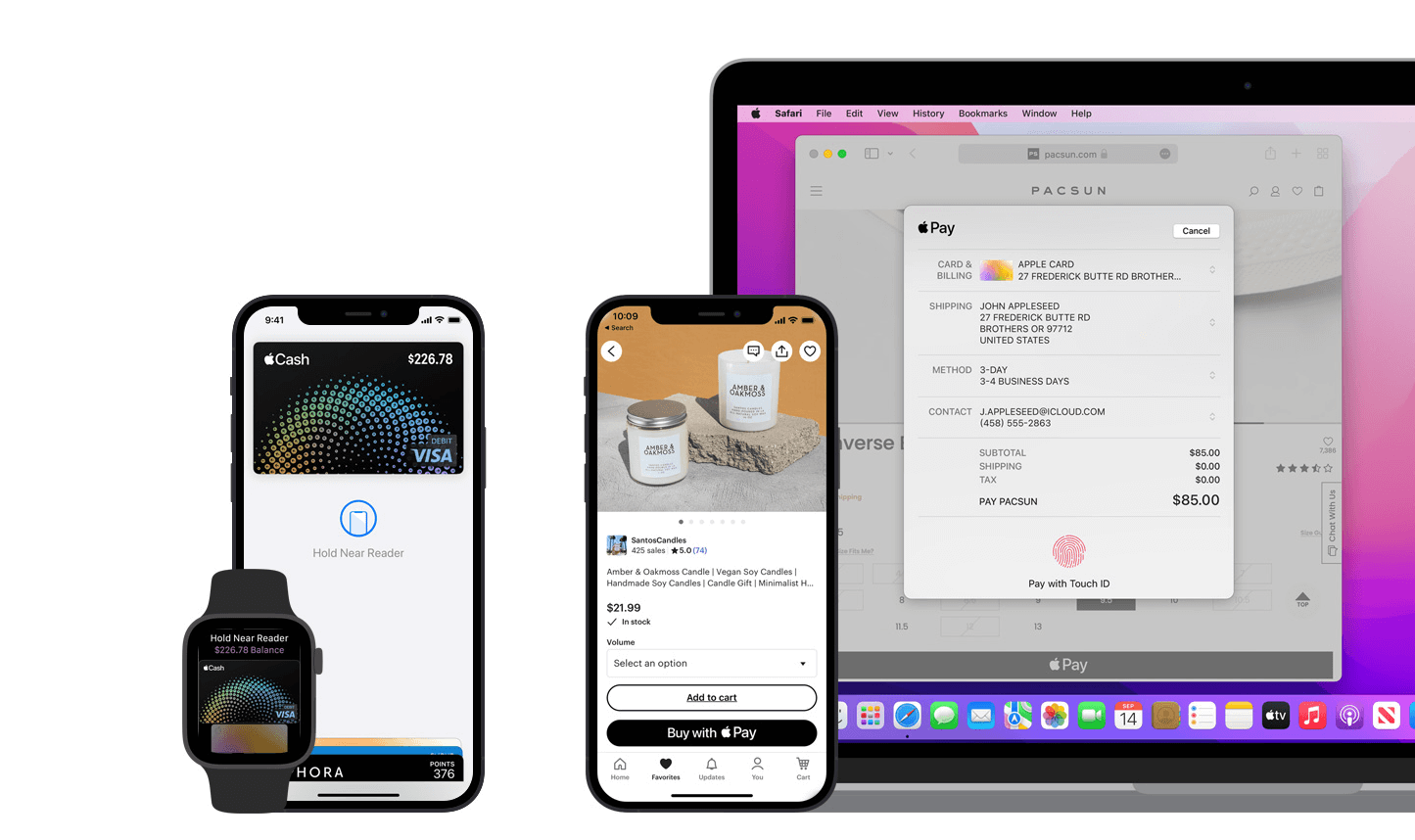

2. Apple Pay: Best for iPhone/Apple users

“Apply Pay may be limited to iPhone users only, but the host of features it provides makes it a great choice in NFC payment apps,” says Crane. Like Google Pay, it uses a tokenization system that keeps credit card details private and encrypted. “The app also offers customers high-reward credit card options, and it can be used to get discounts on movie tickets and other third-party purchases.”

Given its widespread adoption, offering Apple Pay in-store is one of the easiest ways to create a more convenient checkout experience for your customers.

Key features: Built into Apple Wallet, syncs with Apple ecosystem, supports offline transactions

Pros: Very convenient and secure, widespread support by most banks and card networks

Cons: Only works on Apple devices

App store rating: 4.8 on the App Store

3. Samsung Pay: Best for Samsung users

Samsung Pay, now part of Samsung Wallet, lets users make secure contactless payments using their Samsung smartphones. Like Apple Pay and Google Pay, Samsung Pay uses tokenization and a biometric authentication system. Customers can store their debit and credit cards, loyalty cards, and digital keys in one place that’s compatible with a wide range of payment terminals. Many Samsung phone owners use Samsung Pay, especially because it offers benefits like cash back when shopping with certain merchants.

Key features: Integrates with the Samsung ecosystem and other e-wallets, peer-to-peer payment, robust security

Pros: Convenient for Samsung users, supports MST in some regions

Cons: Exclusive to Samsung devices alone

App store rating: 4.4 on Google Play Store

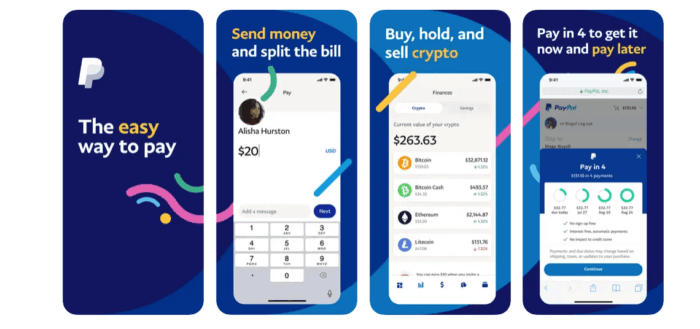

4. PayPal Pay: Best for paying with PayPal balance

Along with being convenient and easy to use, PayPal is a big player in international money transfers. “Its robust and efficient security protocols for these transfers — in addition to its core competencies in peer-to-peer payments and online purchases — also make it a safe choice as a payment app.”

PayPal now offers a digital wallet that supports contactless payments anywhere Mastercard Tap to Pay is accepted. The wallet is available on Android and iOS devices and doesn’t require integrations with Google Pay or Apple Pay. PayPal Pay also allows businesses to accept contactless payments on their smartphones without additional hardware. Customers simply hover their cards or digital wallets over your phone to complete transactions. This feature helps prevent missed sales when customers forget their wallets or expect contactless options. It also builds loyalty by giving shoppers more ways to pay.

Key features: Supports international payments, includes rewards and offers, robust security

Pros: Wide adoption, doesn’t require a separate card reader for accepting payment, quick access to funds

Cons: Only supports Apple Pay, Google Pay, and Samsung Pay digital wallets

App store rating: 4.2 on Google Play Store

5. Venmo: Best for shopping in the US

Crane says Venmo is another popular and effective platform for making payments, especially mobile-centric payments. “The ease of use is appealing when sending and receiving money. Plus, it has low transaction costs.”

Venmo offers digital cards, which customers can add to their Google Wallets for Tap to Pay at checkout. Alternatively, they can make use of a QR code that you’ve set up and placed near the payment terminal. If you have a Venmo business profile, you can even accept contactless payments from digital wallets and NFC-enabled cards on your phones thanks to Venmo’s integration with Tap to Pay on Android.

Key features: Integrates with Google Wallet, offers other payment methods like QR code

Pros: Widespread adoption in the United States, super easy to use

Cons: Limited to customers in the US, collecting payment only works on Android, instant transfers attract additional fees

App store rating: 4.6 on the Google Play Store, 4.9 on the App Store

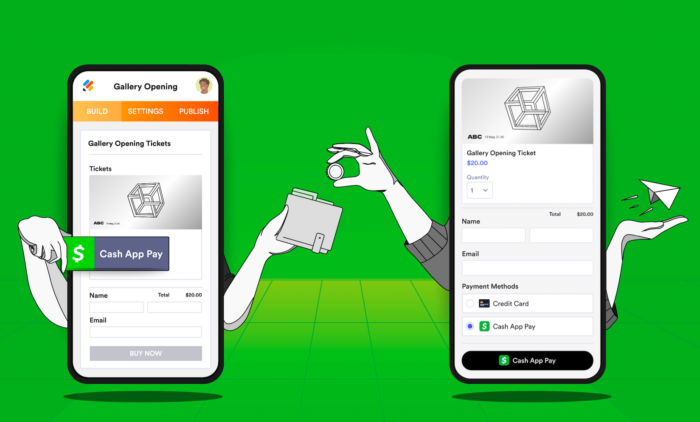

6. Cash App: Best for sellers already using Cash App

If you already use Cash App Business, you can now accept contactless payments using your iPhone and the Cash App iOS application — no extra hardware needed. Cash App recently launched a Tap to Pay feature that lets mobile vendors, independent sellers, and small businesses collect digital payments using Apple’s built-in NFC technology. It works like any other contactless payment system: at checkout, you simply prompt customers to tap their contactless payment device to your iPhone, and the payment processes instantly and securely. One major advantage is that the feature isn’t limited to Cash App users alone. You can accept payments from all major debit and credit cards as well as mobile wallets like Google Pay, making it easier to complete every sale without turning customers away.

Key features: Allows bitcoin transactions

Pros: Not restricted to Cash App accounts alone

Cons: Only works in the US, doesn’t allow for international payments

App store rating: 4.8 on App Store, 4.7 on Google Play Store

7. Square: Best all-in-one payment solution for small businesses

When it comes to merchant-oriented NFC payment apps, Square provides one of the top solutions in the United States. It allows you to take contactless payments in person using just your iPhone or Android device and the free Square Tap-to-Pay app. Customers simply tap their NFC-enabled cards or phones on your device to complete the payment securely. Square supports all kinds of digital wallets, credit, and debit cards, so your customers can pay however they want.

With Square, all you need to accept payments is your phone and an internet connection. Whether you’re running a retail shop, cafe, or mobile business, you can sell on the go and give customers a frictionless checkout experience. Square also provides POS systems, NFC card readers, invoicing, and inventory management solutions, making it a complete payment system for in-person sales.

Key features: Mobile POS system, integrated business tools

Pros: Easy to use and set up, predictable transaction costs, reliable brand with widespread usage

Cons: Occasional app glitches, requires reliable network access, potential vendor lock-in

App store rating: 4.6 on Google Play Store

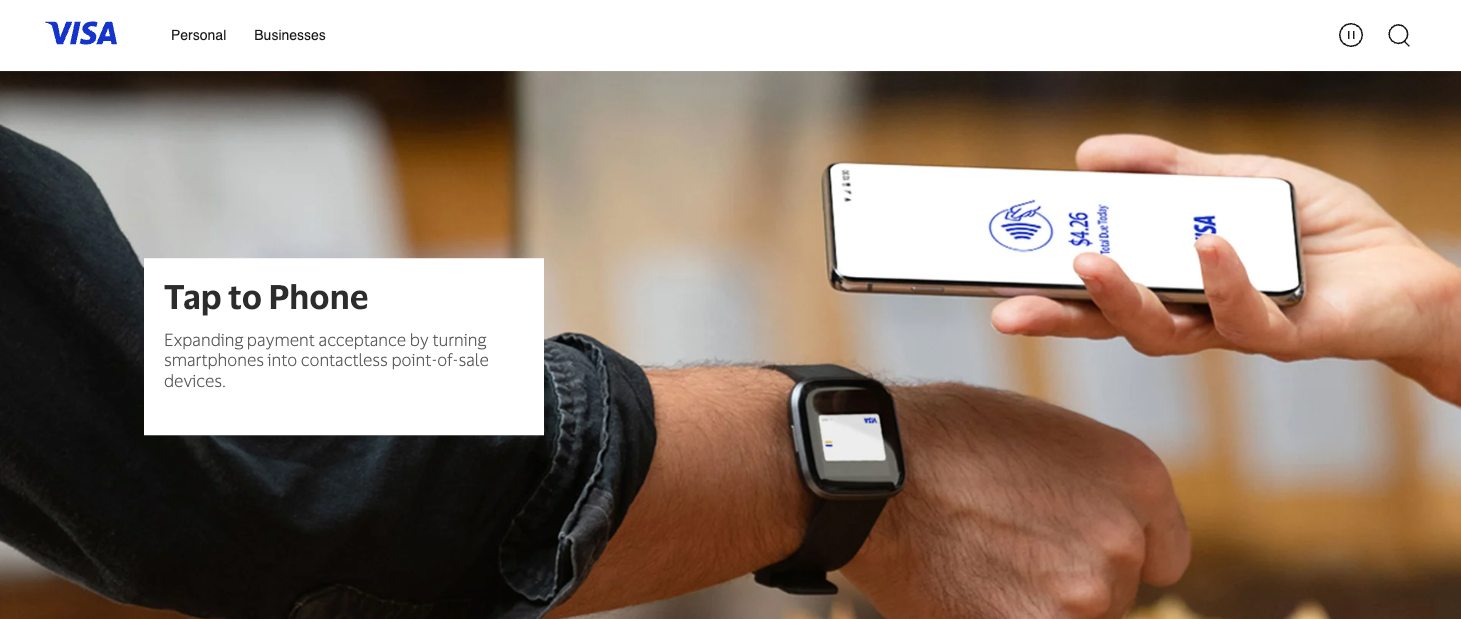

8. Visa tap to phone: Best for turning your Android phone into a payment terminal

Visa’s Tap to Phone is designed for small businesses and microsellers that want a simple, affordable way to accept payments. It turns the NFC-enabled smartphones and tablets you and your staff members already own into a point-of-sale (POS).

Instead of investing in card readers or POS systems, you can simply download the app and start accepting payments right from your phone. Customers can tap their smart watches, phones, or physical cards — no swiping, signing, or PIN required. The Visa Tap to Phone works with major digital payment solutions, including Apple Pay, Samsung Pay, and Google Pay, making it easy to accept payments from virtually any customer.

Key features: Doesn’t require separate payment hardware

Pros: Easy to set up in minutes, works for customers and merchants anywhere in the world

Cons: Low transaction limits

App store rating: 4.2 on Google Play Store

9: Curve Pay: Best for international transactions

Curve Pay is a secure digital wallet that lets users consolidate multiple cards into one tap-to-pay app. Ideal for frequent travelers, it enables in-store contactless payments by integrating with Apple Pay and Google Pay. Users can link personal and business cards from all major banks in the UK and EEA, then make payments through their smartphones, smartwatches, and other wearables like rings, bracelets, and keychains. Curve also provides a physical card for added flexibility.

Beyond convenience, Curve offers cashback rewards, fee-free foreign exchanges, and better exchange rates than most banks when shopping abroad — all while working seamlessly with any NFC-enabled payment terminal.

Key features: Universal card support, free foreign exchanges, post-transaction card switching

Pros: Flexibility and control after purchase, cost savings on foreign transactions

Cons: Limited to the UK/EEA markets

App store rating: 3.0 on Google Play Store, 4.8 on App Store

What’s happening when your customers use NFC payment apps?

Near field communication (NFC) is short-range wireless technology found in devices such as speakers, tablets, gaming consoles, and smartphones that enables quick data transmission between compatible devices.

“NFC is based on radio frequency identification, or RFID, a technology that’s been around for decades,” says Matt Hudson, a longtime programmer and founder of the mobile app development platform BILDIT. “Except NFC requires that you be really close and only be transmitting a small amount of information between devices.”

Given these limitations, it’s no surprise that NFC is commonly used in smartphones to make mobile payments. As Crane adds, “In a mobile payments context, NFC enables a phone and a payments terminal to communicate with one another when in physical proximity.” This allows people to send or receive payments in real time.

Hudson notes that while NFC technology has made good progress with its expansion into payment applications, the hardware we use for NFC in the U.S. still has some room for improvement. “If we compare the typical payment terminal in the U.S. to some other countries, its counterparts tend to transmit a clearer signal and work faster. Still, the terminals we do employ offer consumers and businesses a ton of convenience.”

Give customers an enhanced payment experience with Jotform

With Jotform, you can give your customers a seamless checkout experience when they shop online. Join thousands of merchants who use our powerful online form builder to collect information and payments from customers. Start with one of our 800+ customizable order form templates to set up a smooth checkout experience, then integrate the form with Google Pay, Apple Pay, Venmo, PayPal, or a number of other payment processing options.

This guide is for small business owners and microsellers, brick-and-mortar retailers, retail shop and café managers, mobile vendors and independent sellers, POS teams, and online merchants who want to accept secure contactless payments, support more wallets and cards, and streamline checkout across phones, watches, and NFC terminals.

Send Comment:

1 Comments:

More than a year ago

I want to hook up Google pay