Many business owners choose to offer Google Pay as a payment method for their customers. It’s easy to use, has no transaction fees for business owners or consumers, and has 25 million users in the United States alone. However, Google Pay is only one of many digital wallets available.

In this article, we’ll look at several Google Pay alternatives your business may want to consider in addition to or instead of using Google Pay for business.

Just so you know.

Choose the right payment method for your business with these six alternatives to Google Pay.

Google Pay alternatives

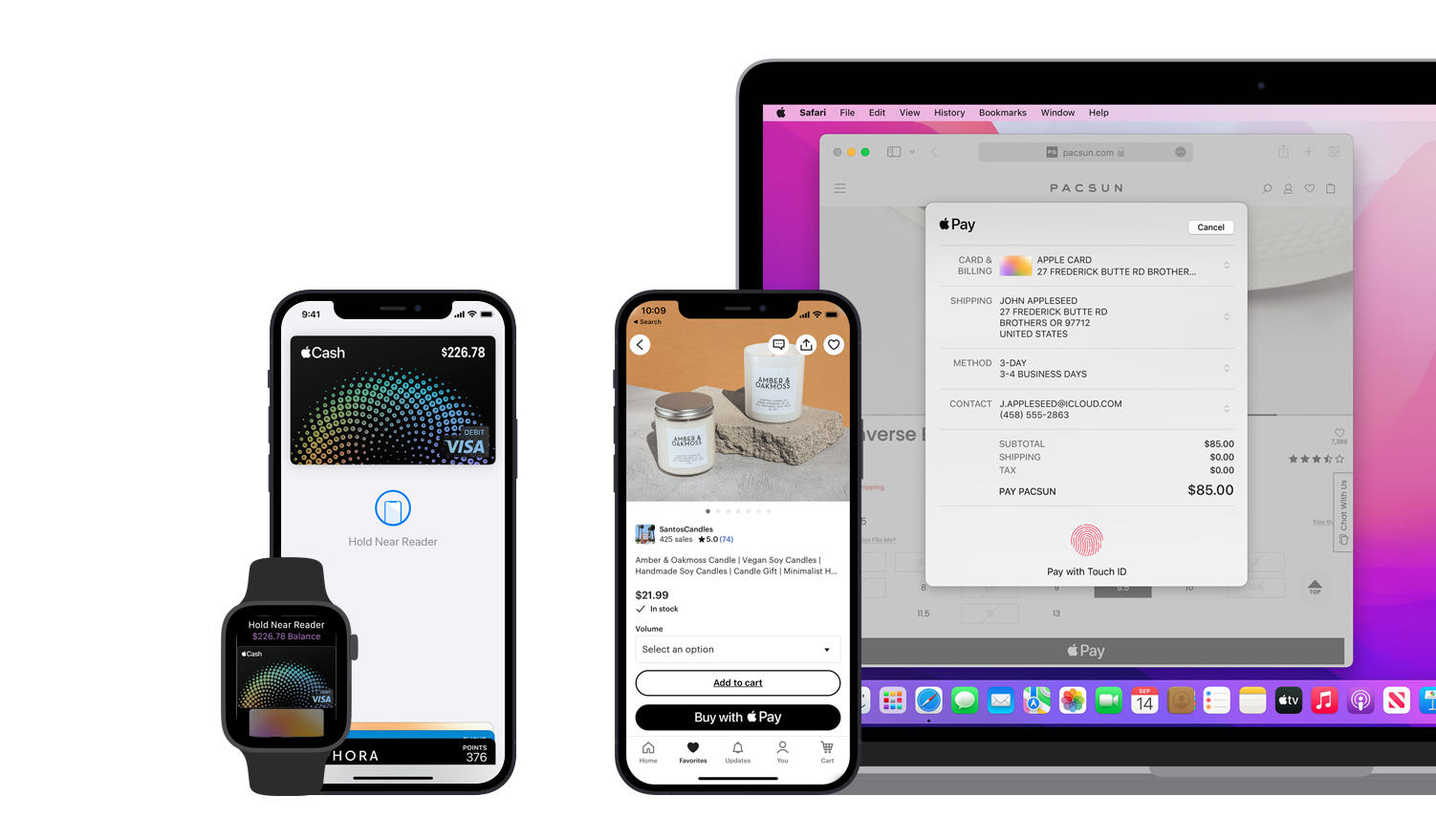

1. Apple Pay

Apple Pay and Google Pay are very similar in terms of features and functions. Consumers can use both of these digital wallets to pay for goods and services as well as to send money to friends and family.

The key differentiator is that Apple Pay is built into Apple devices and doesn’t require users to download it separately. Since many consumers have iPhones, business owners may want to consider offering Apple Pay as a payment method. Another notable feature: Apple Pay comes with Apple Cash, which is similar to a digital debit card and gives customers more flexibility in how they pay.

Like Google Pay, Apple Pay is free to use for businesses and consumers.

If you’d like to gain a deeper insight into the comparison of the two solutions, make sure to explore our article Apple Pay vs Google Pay.

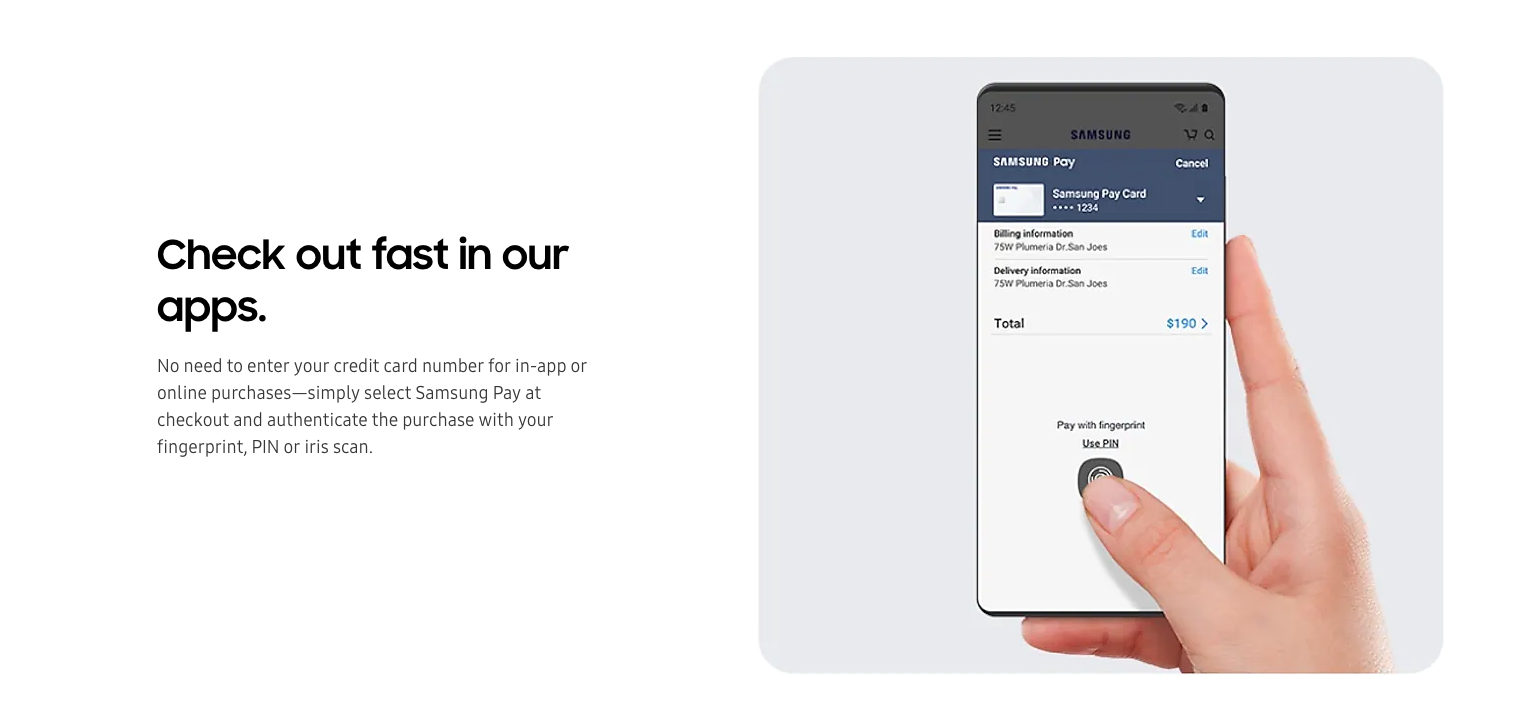

2. Samsung Pay

Samsung Pay is similar to Google Pay and Apple Pay, with the notable difference that consumers can only use Samsung Pay on Samsung devices.

In terms of security, Samsung Pay, like its competitors, takes security seriously, and each transaction requires authentication by fingerprint, PIN, or iris scan. There are no fees for consumers or merchants with Samsung Pay.

3. Skrill

Skrill enables users to conduct many different types of online financial transactions, such as sending and receiving money peer to peer, making online purchases from businesses, and selling and buying cryptocurrency.

Skrill has a dashboard that allows users to manage transactions and view updates. It also has roughly as many users as Google Pay, and it can be used in over 120 countries.

When it comes to fees, Skrill doesn’t charge when users send or receive money online or pay for purchases. There is a charge, however, for withdrawing funds from a Skrill account.

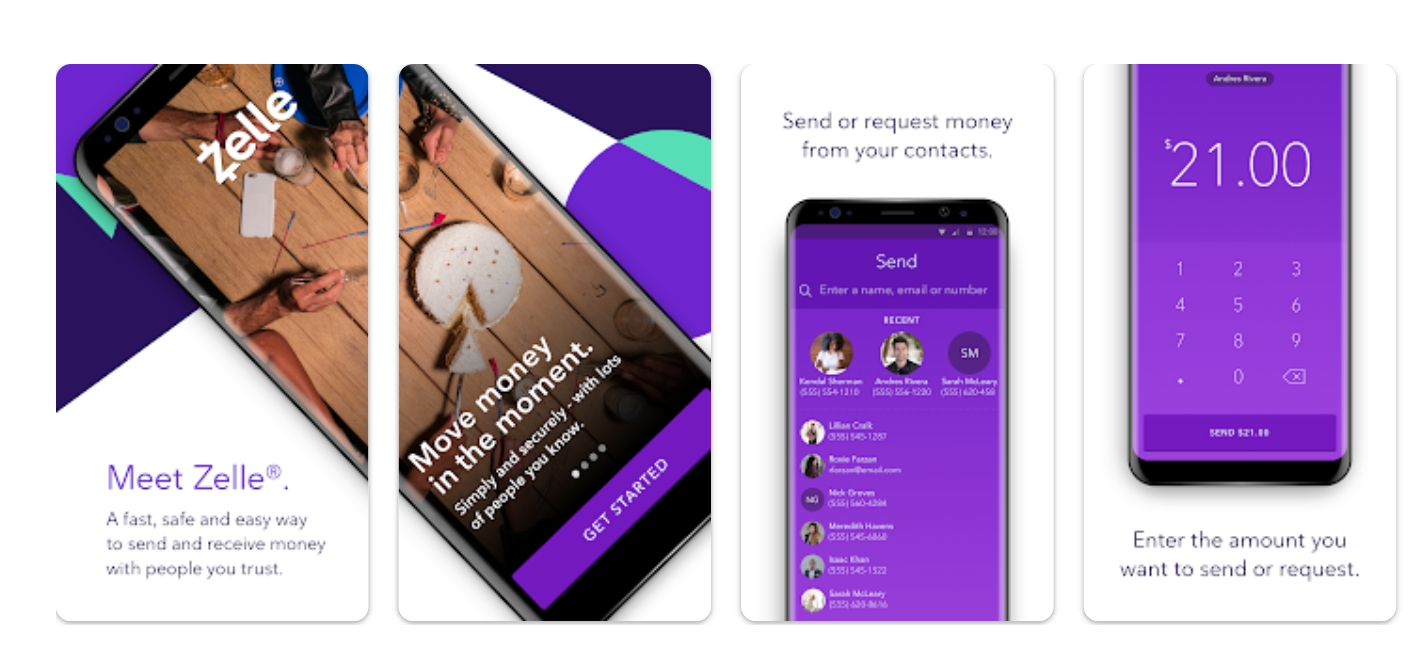

4. Zelle

Zelle is a payments network that allows for the transfer of money between individuals or between individuals and small businesses. A business can use Zelle as a payment method if their bank accepts it.

A key benefit of using Zelle is that money transfers quickly; it takes just minutes, while some other payment methods can take days. In terms of fees, Zelle is free to use for consumers. For businesses, their financial institution determines the fees.

5. Payoneer

Small and large businesses as well as freelancers and consumers use mobile payment platform Payoneer. It enables businesses to request payment by sending invoices to their clients. Customers can also send direct transfers to businesses even if they haven’t received an invoice.

Unlike Google Pay, this payment method has an affiliate program; businesses can earn commissions by promoting Payoneer successfully to others. Payoneer charges fees depending on the type of transaction as well as the location of the business.

6. PayPal

PayPal is a pioneer in digital payments for both individuals and businesses, and it has over 400 million active users. It offers robust security measures for both businesses and consumers. Plus, businesses can send invoices as well as estimates to customers and request payment for specific goods and services using PayPal, so it makes bookkeeping easier.

PayPal doesn’t charge fees for transferring money, but it does charge for other services, such as currency conversions and certain commercial transactions.

You can also get a more thorough analysis of the two solutions compared by reading our Google Pay vs PayPal article.

As payment methods continue to evolve, it can be challenging for merchants to keep up with — and adapt to — the latest offerings. In choosing which ones to accept — whether it’s Google Pay or one of the alternatives listed here — keeping customer preferences in mind is key. But don’t forget to consider the implications for your business in other areas, too, including security, fees, and customer support.

Send Comment:

3 Comments:

More than a year ago

This isn't particularly helpful as these options are not equivalent to each other - Apple and Samsung's options are locked to their hardware platforms and the other two can't be used to pay for goods in a brick and mortar store. What is missing is an actual alternative to a Google-based payment system that can be used on any Android flavour phone.

More than a year ago

Google pay is fine

More than a year ago

I am reading your amazing and helpful content How To Make Money Online By Commenting On Blog Posts. thanks for sharing best online money making sites. i will help everybody. thank you again