Top FreshBooks alternatives

FreshBooks has a reputation for providing user-friendly accounting services for small business owners. Its range of features include time-tracking and automated invoicing tools, combined with seamless integrations.

However, it has many competitors in the market for cloud-based accounting software, each with their strengths and weaknesses. In this guide, we’ll discuss 10 alternatives to FreshBooks and delve into what sets each one apart.

What FreshBooks does

FreshBooks is a cloud-based accounting software that’s designed to serve all types of organizations, from small businesses and freelancers to larger organizations with multiple employees. Its user-friendly interface simplifies tasks such as invoice creation, payment automation, expense tracking, and report generation.

The platform’s key features include a customizable report generator and integrations that support collaboration and synchronization. FreshBooks stands out for its invoicing and time-tracking capabilities, making it a preferred option for people who bill for their services based on the amount of time they’ve spent on the work.

Pro Tip

With Jotform’s Freshbooks integration, accessible via Zapier, you can effortlessly generate professional invoices for your customers as they fill out your Jotform forms.

What FreshBooks offers in features

Here’s a quick look at Freshbooks’ main features:

Billing: Freshbooks offers features that let you automate the process of sending invoices for recurring charges and reminders for overdue payments. With FreshBooks, you can also easily accept online payments.

It also provides time-tracking tools to help you track the time dedicated to specific projects. You can use those time records to generate invoices with a click.

Accounting: FreshBooks is well known for its accounting and bookkeeping features. It allows users to create detailed financial reports and collaborate with their accountants. The robust report generator in FreshBooks allows users to customize reports according to their needs. The data visualization and analysis tools can help you make more informed decisions.

Project management: With the project management features in FreshBooks, you can seamlessly collaborate with employees, contractors, and business partners. It also offers third-party integrations with over 100 popular apps.

Who should use FreshBooks

FreshBooks was designed with small business owners in mind. It’s intended to meet the needs of freelancers, businesses that work with contractors, small companies with employees, and those who are self-employed. Its flexible options and pricing plans make it a comprehensive platform for many different types of businesses.

What it costs

FreshBooks uses a subscription-based pricing model. There’s no free option, but it does give users a 30-day trial to explore its features. There are three subscription tiers designed for different business sizes:

- The Lite plan at $19 per month

- The Plus plan at $33 per month

- The Premium plan at $60 per month

This structure lets users select a subscription that fits their needs and budget.

What FreshBooks alternatives can do

While FreshBooks has many strengths, there are certain drawbacks to the software. You may find an alternative with features that are even better suited to your company’s needs.

The following 10 FreshBooks alternatives provide different tools, features, and pricing models. Consider whether any of these FreshBooks alternatives will work better for your business.

1. Jotform

Jotform is an online form builder and automation tool that can serve as a FreshBooks alternative. With an extensive collection of templates for invoices, expense-tracking forms, and more, Jotform is a versatile solution for businesses looking to create, customize, and share forms for financial management tasks. All form data is automatically recorded in Jotform Tables for easy management and analysis.

The platform’s strength lies in its customization options and extensive template library. The intuitive drag-and-drop form builder lets you easily add, remove, or edit form fields to meet your exact needs. You can tailor templates to match your expense categories, reporting structures, and more. You can also use Jotform to create forms for other business functions as well.

Jotform’s flexibility extends to its Jotform Approvals tool. You can use Approvals to automate bookkeeping workflows, including finance-related approval flows.

With Jotform, you can also create custom, no-code apps for managing tasks like filing expense reports. You can drag and drop to create an app from scratch or choose from a variety of ready-made app templates to get started. Users can access your app on any device.

Pro Tip

Automate your document creation process with Jotform’s AI Document Generator for fast and efficient results!

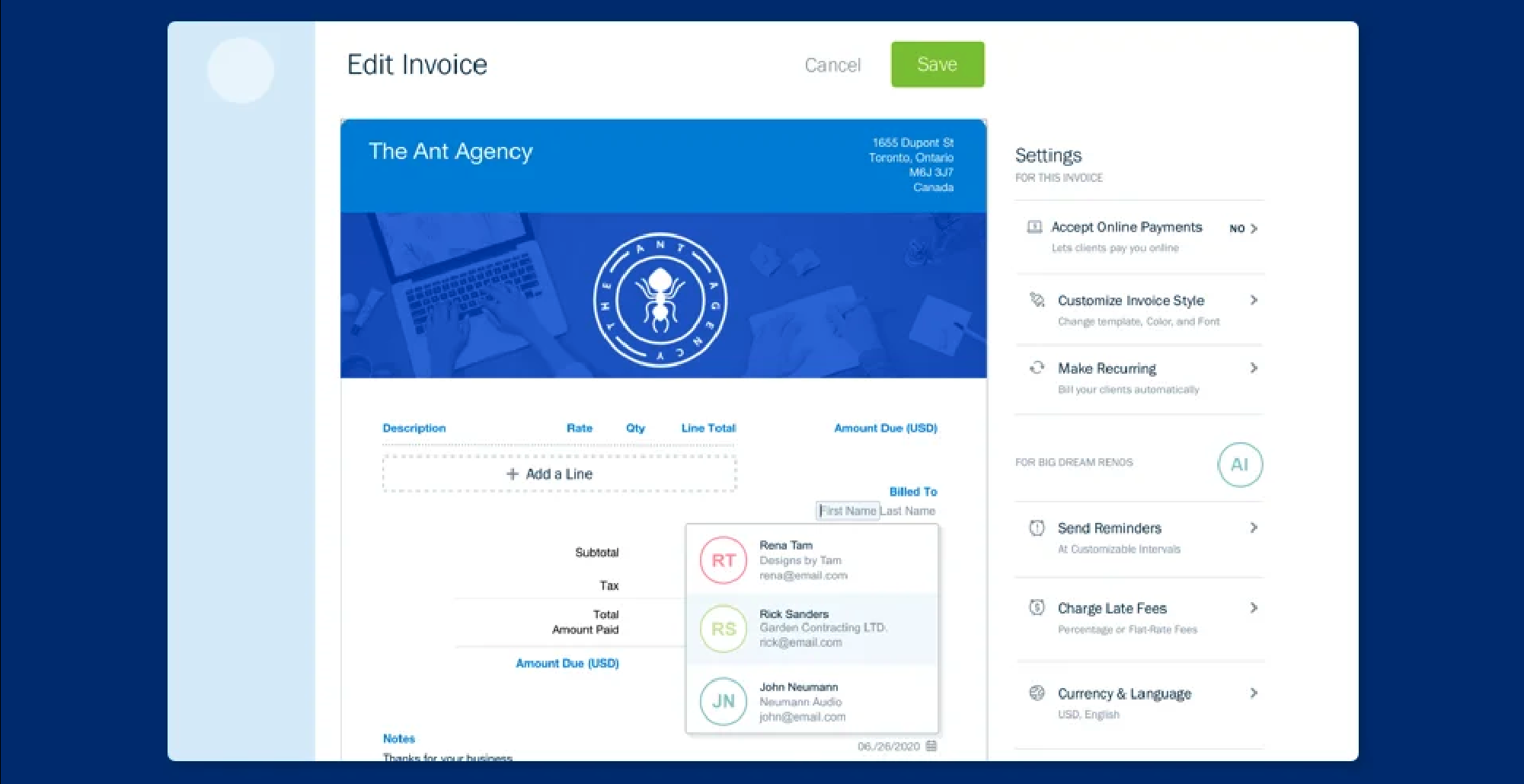

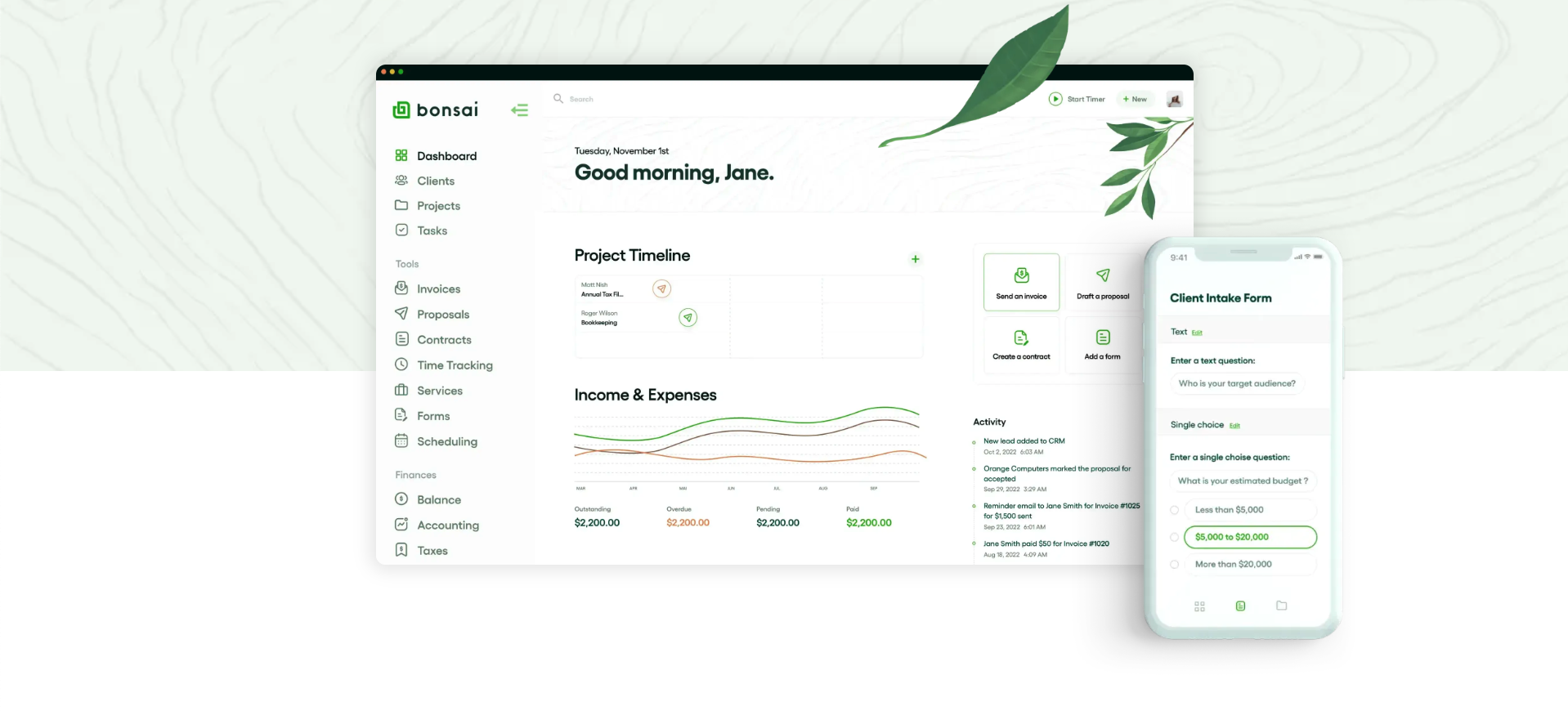

2. Bonsai

Bonsai is a business management platform with many of the same features as FreshBooks, plus more. In addition to time tracking, invoicing, bookkeeping, and accounting, Bonsai also provides customer relationship management (CRM), scheduling, and tax services. Its user-friendly interface and automation capabilities make it appealing to business owners who want extensive features.

Like FreshBooks, Bonsai allows users to automate tasks like sending invoice reminders and following up on payments. It also allows multiple team members to work together on projects and invoices.

However, some users may find Bonsai’s extensive feature options complex. And while Bonsai covers the basics, it may lack some advanced accounting functions found in dedicated accounting software.

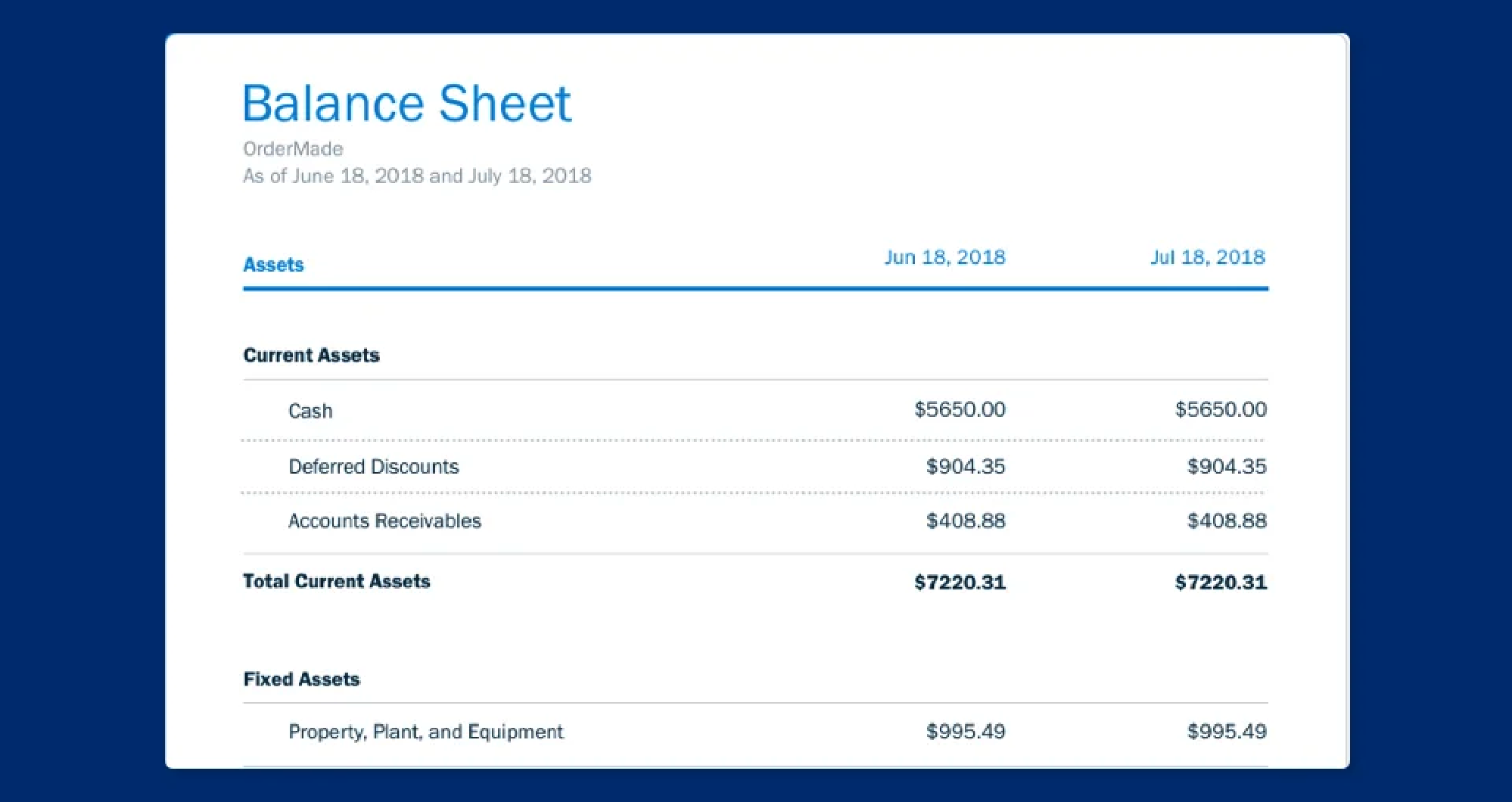

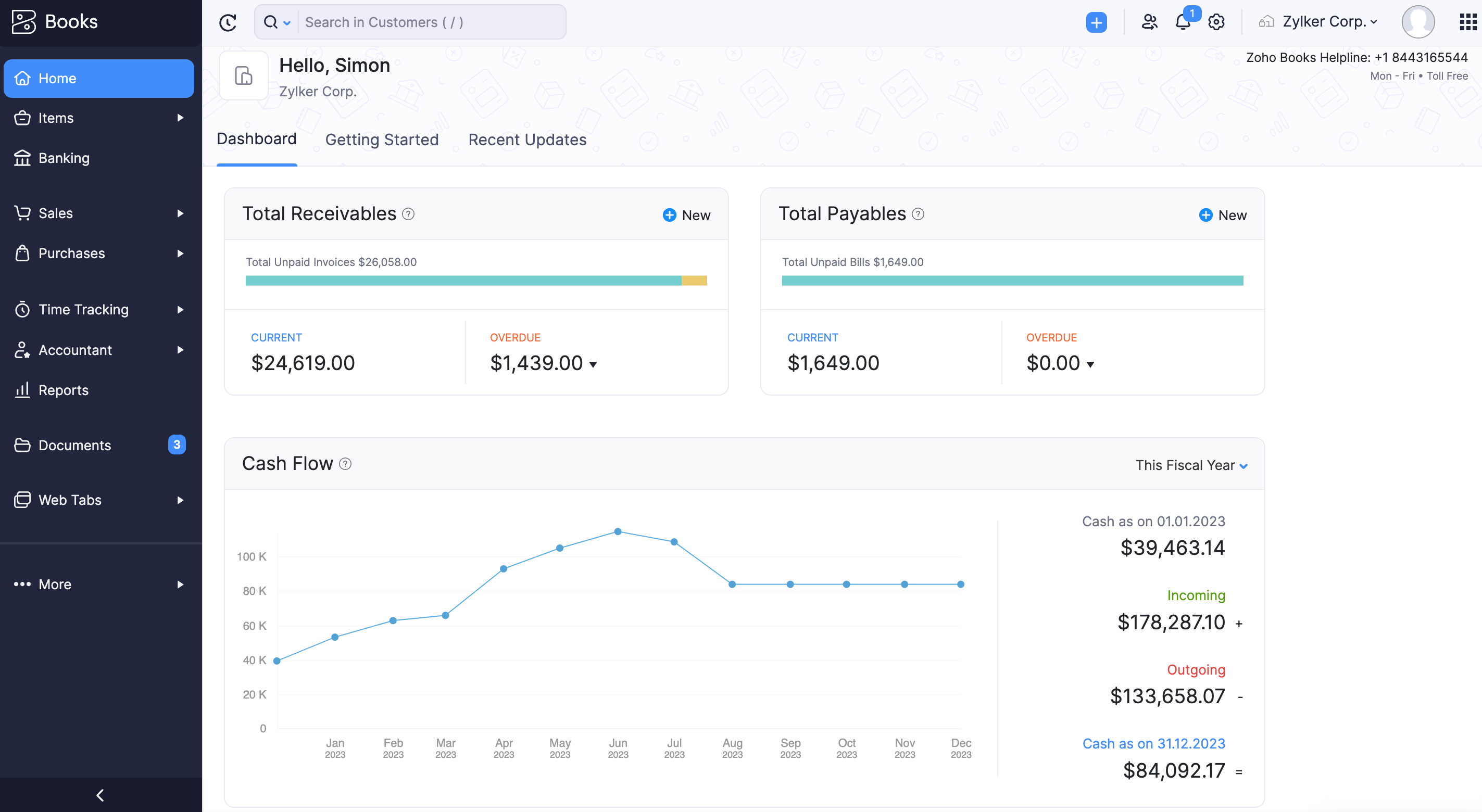

3. Zoho

Zoho and Bonsai offer a similar suite of tools, such as accounting, CRM, and project management. Zoho is known for being flexible and scalable. Many of its users say it’s useful for streamlining day-to-day operations.

Zoho Books is Zoho’s accounting tool. It provides accounting capabilities like bank reconciliation, collaboration tools, and project monitoring. Because of its extensive range of features, Zoho is a suitable option for both small businesses and large corporations. However, it may not be the best option for freelancers or self-employed people because of its cost and complexity.

Zoho offers a lot of flexibility, allowing users to customize the system to meet specific business needs. On the flip side, because of the wide range of options it provides, Zoho might be challenging for new users to get the hang of. Additionally, some find the pricing model a bit complex, especially if they only want to use certain features.

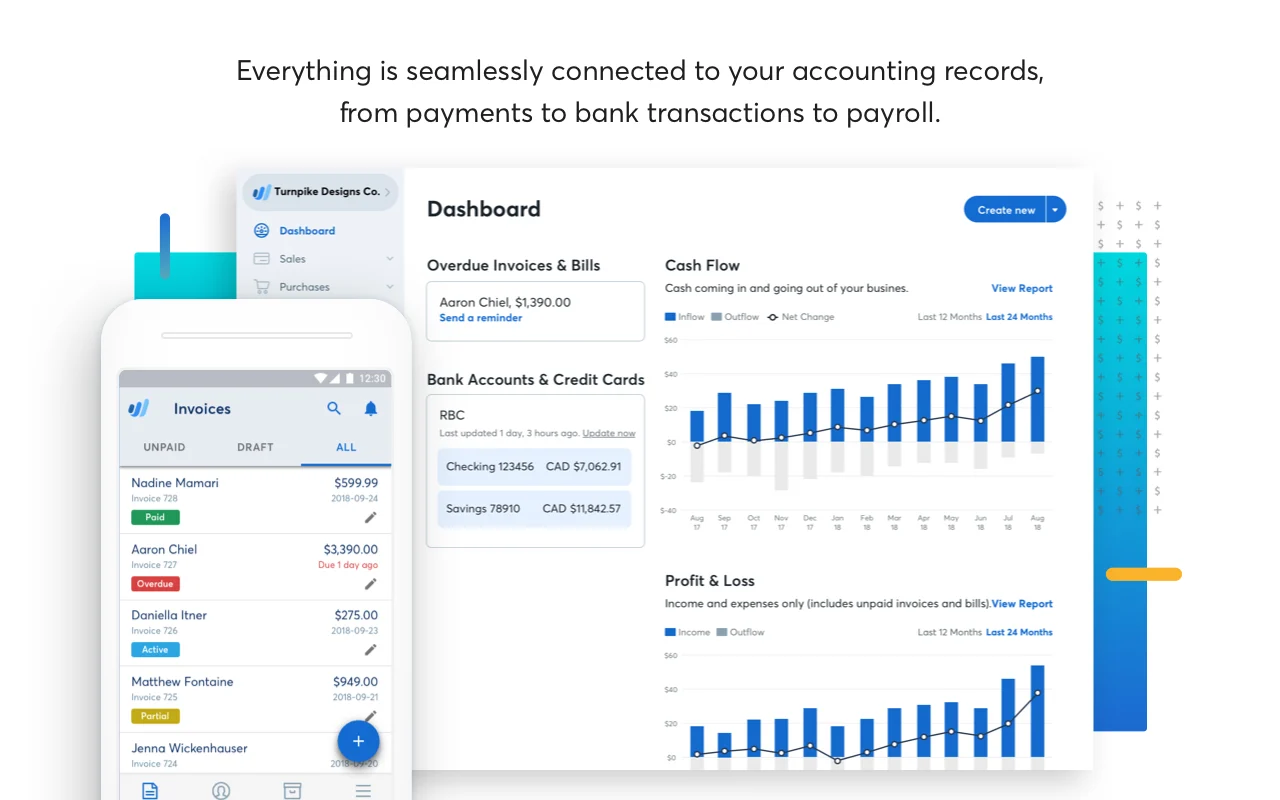

4. Wave

Like FreshBooks, Wave offers basic bookkeeping, invoicing, and billing tools. What sets Wave apart is that its basic offerings are free. For this reason, it’s a popular choice for startups and freelancers working on a budget.

Its ease of use is an advantage for users who don’t need advanced features. However, if you do wind up needing additional features — like receipt scanning or payroll and payment processing — you’ll need a paid plan.

Like FreshBooks, Wave is generally user-friendly, with a clean, straightforward interface. Both Wave and FreshBooks target small businesses, freelancers, and entrepreneurs. Their key differences lie in their pricing models and feature sets.

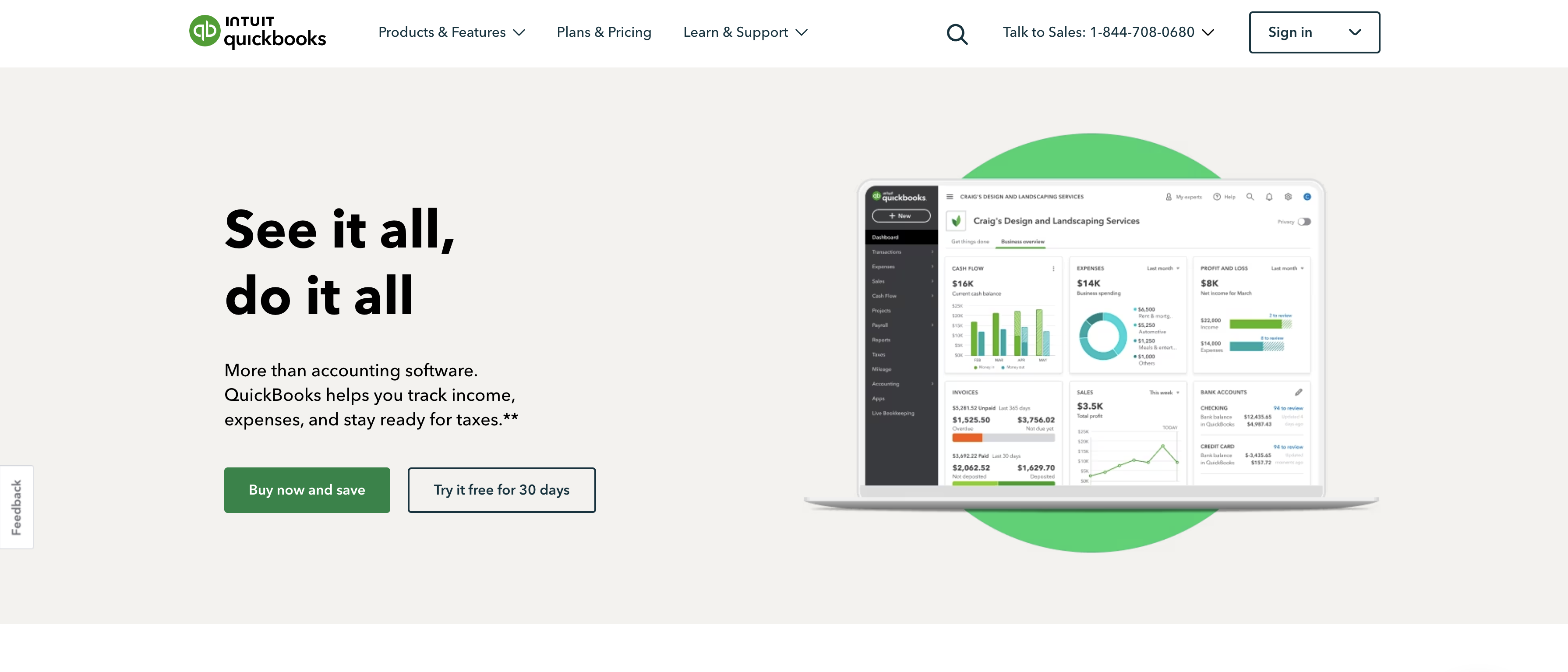

5. QuickBooks

QuickBooks is the go-to option for businesses with complex financial operations. Unlike FreshBooks, which caters to small businesses, contractors, and freelancers, QuickBooks is the choice for many larger companies because of its large buffet of features and tools.

QuickBooks provides several pricing plans to accommodate different business sizes and needs. Each plan offers different capabilities, with features such as the ability to track income and expenses, manage bills, and facilitate collaboration among team members. The pricing is generally higher compared to FreshBooks, reflecting the broader range of features and scalability offered.

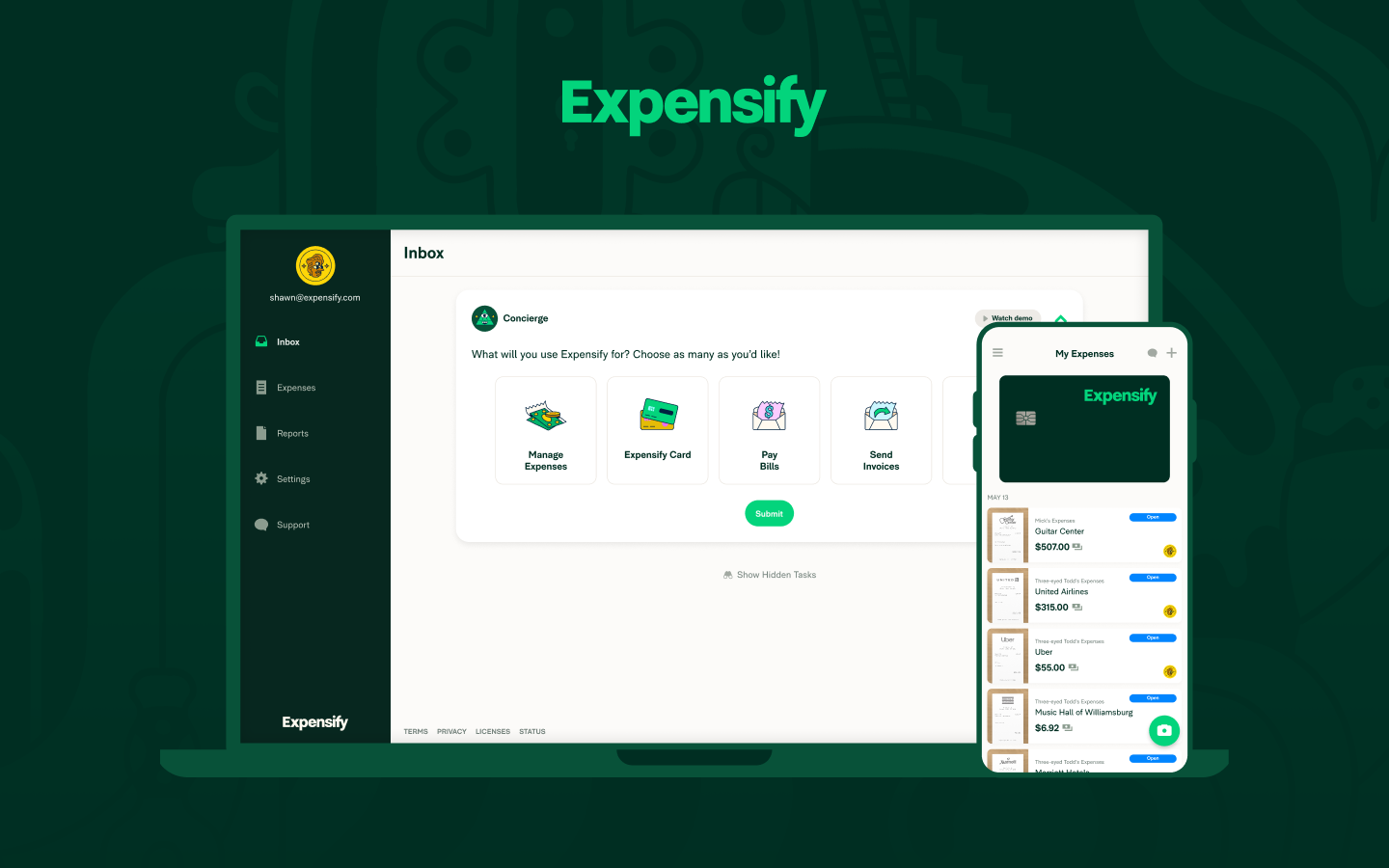

6. Expensify

Expensify focuses on expense management, offering features like receipt scanning, reimbursement automation, and corporate card reconciliation. Expensify’s SmartScan technology feature automates the extraction of data from receipts using optical character recognition (OCR) technology. This feature simplifies the expense reporting process and reduces manual data entry.

If expense management is what you’re after, Expensify might be an ideal choice for your business. However, it may not have as much functionality as other more exhaustive accounting solutions. FreshBooks also supports expense tracking, but its automation features may not be as specialized as Expensify’s, especially when it comes to OCR technology.

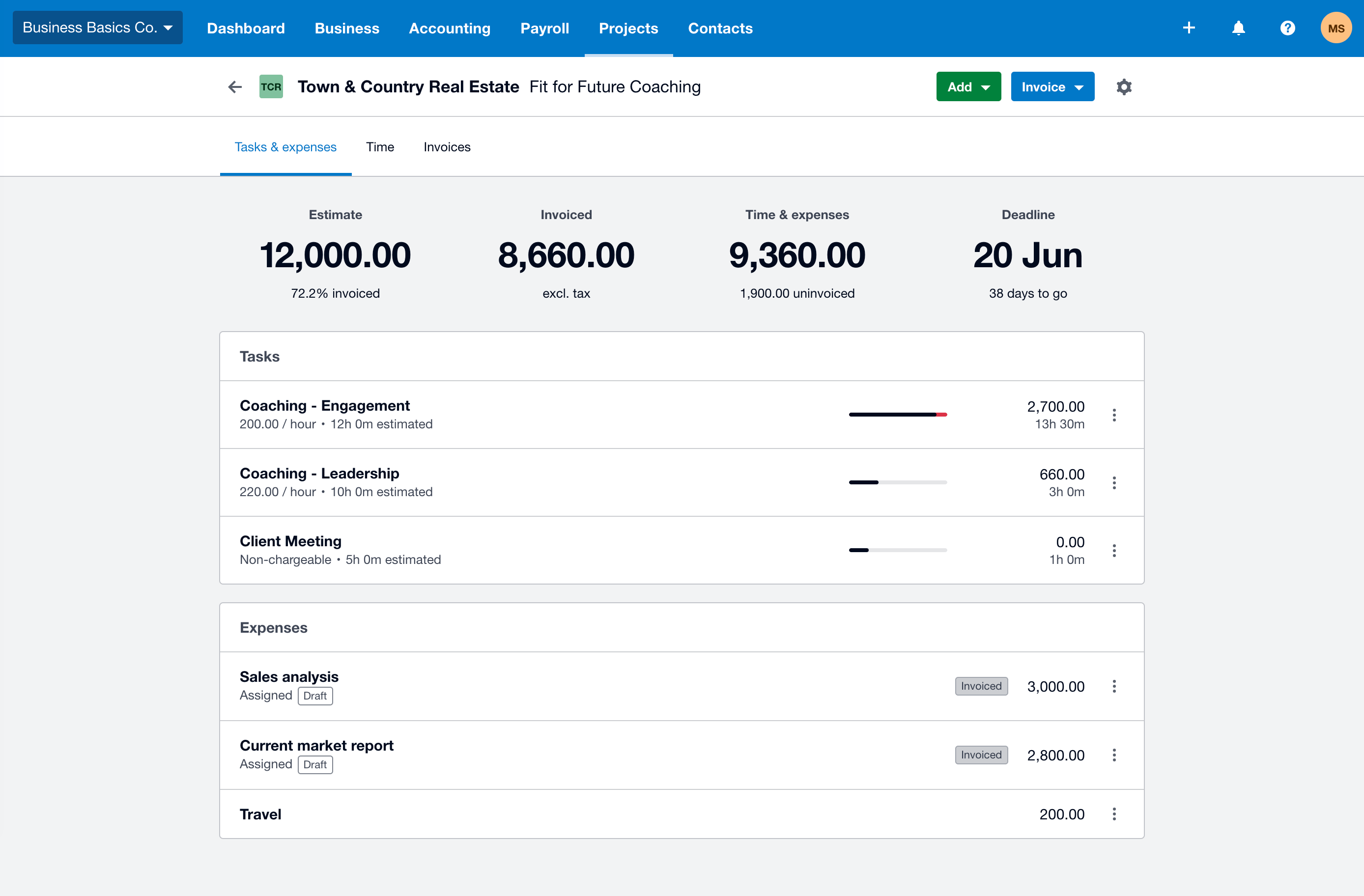

7. Xero

This cloud-based accounting software is well known for its easy-to-use interface and powerful capabilities. Xero provides a range of financial management tools such as invoicing, bank reconciliation, and payroll services. It’s ideal for businesses seeking an accounting solution with advanced features.

While Xero and FreshBooks both provide accounting functionality, Xero is tailored for businesses that need comprehensive financial management tools, so it offers a more extensive solution. FreshBooks, on the other hand, is recognized more for its user interface and focus on invoicing and time tracking, making it ideal for smaller businesses and freelancers with simpler financial needs.

8. Invoice2go

Invoice2go is a user-friendly invoicing and billing software designed for small businesses and freelancers. It aims to provide users with tools to efficiently create professional-looking invoices. As the name suggests, the platform also provides mobile apps, allowing users to manage their invoicing and business tasks on the go on their smartphones or tablets.

With its focus on being a user-friendly tool, it’s a less extensive accounting and invoicing platform than FreshBooks.

9. Sage Intacct

Sage Intacct Cloud Accounting targets small and medium-sized businesses that need features beyond basic invoicing and expense tracking. It does provide many of the same features as FreshBooks, but it goes a step further by providing bank reconciliation, financial reporting, and multi-currency support.

Sage’s cloud-based platform allows users to access their financial data from anywhere, making it a good choice for businesses with remote teams. The platform also provides collaboration features, allowing users to work with their accountants or team members in real time.

Sage Business Cloud Accounting is designed for businesses with more complex financial needs. FreshBooks, on the other hand, is geared toward users who prioritize simplicity and efficiency, making it a popular choice for users with straightforward financial workflows.

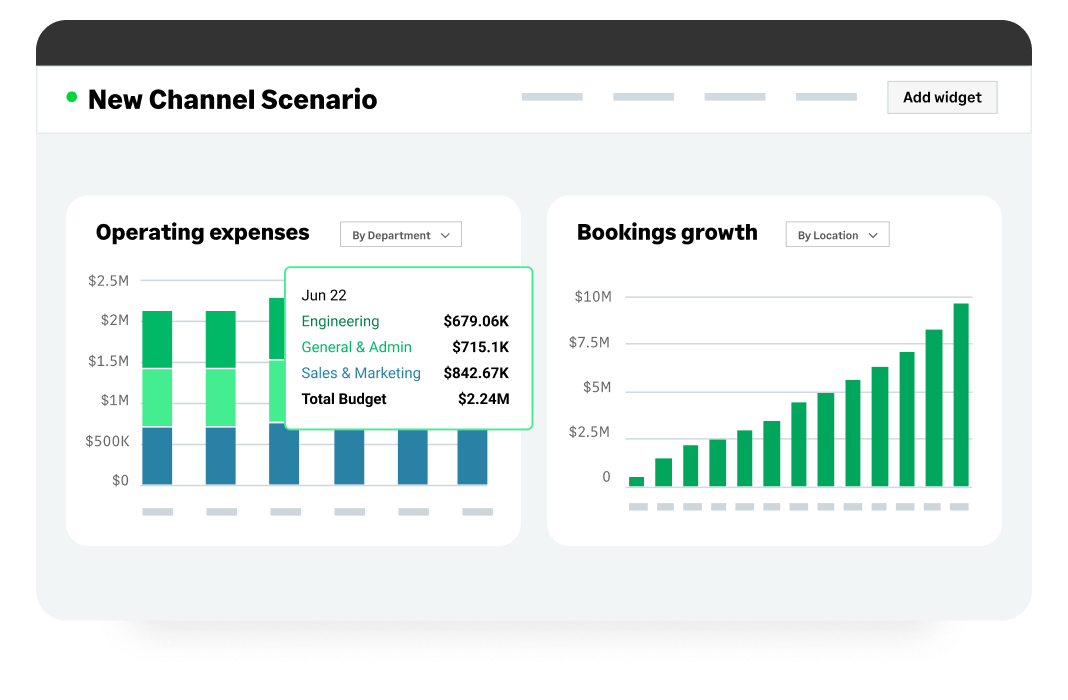

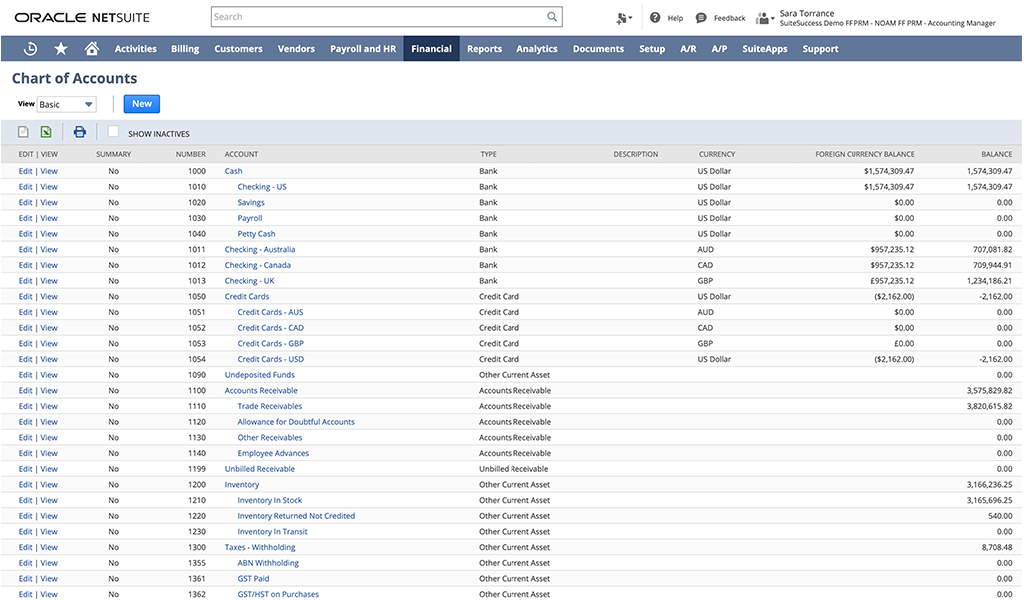

10. NetSuite

NetSuite, owned by Oracle, is a comprehensive cloud-based suite that prides itself on its enterprise resource planning (ERP) and financial management features. It’s a comprehensive platform that’s popular with large businesses. In addition to ERP tools, it also provides accounting software, global business management, CRM, professional services automation, HR tools, omnichannel commerce, and analytics and reporting.

With its vast array of cloud-based services, it’s a popular choice with tech companies and other large, cloud-based businesses. Its customization, integration, and automation options are key features of the product.

Because of its complexity, though, you may need to invest significant time and energy to learn how to make NetSuite’s tools work for your business. It’s also one of the most expensive options on the market, and it tends to work best for large businesses with many employees.

While FreshBooks remains a solid choice for many freelancers, entrepreneurs, and small business owners, exploring alternatives might open your eyes to a broader range of possibilities. Whether you prioritize all-in-one solutions like Bonsai or seek the simplicity of Jotform’s no-code approach, these alternatives can empower your business to thrive.

Finding the right tool for your specific needs is crucial, so take the time to consider which platform aligns with your workflow needs. When you find the right match, you can take the next step toward efficiency and success.

Photo by Karolina Grabowska

Send Comment: