If you collect payments through your forms, there’s one method your organization may be overlooking: It’s called ACH.

As a consumer and/or business owner, you’re likely already familiar with ACH payments, though you might not recognize the acronym, which stands for Automated Clearing House, a U.S. financial network used for electronic payments and money transfers.

If you pay your bills electronically from your bank account (instead of using a credit card or writing a check) or receive direct deposit from your employer, the ACH network is probably involved.

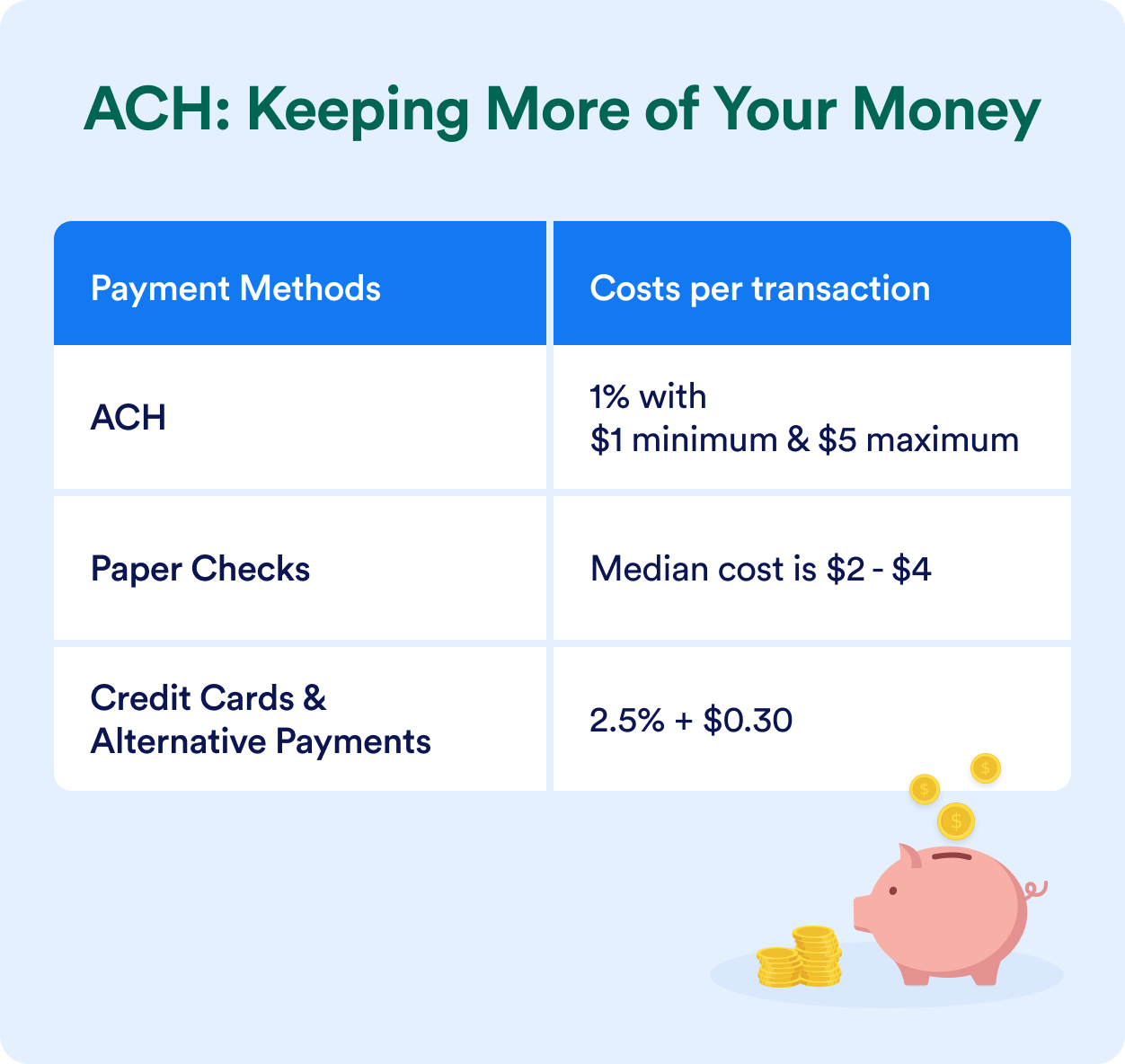

For businesses, ACH payments are a popular alternative method. Because they’re electronic, ACH payments are more reliable and less of a hassle than checks. Generally, it also costs less to process an ACH transfer than a credit card payment. So if you’re a high volume business, or are looking to scale growth, ACH payments may be very beneficial.

For those reasons, we’re happy to let you know that ACH is now available as an alternative payment method in your forms through our Square integration.

In this article, you’ll learn what the ACH payment method is, what benefits ACH offers businesses/organizations — and their customers — and how to integrate Square ACH with Jotform. By the end, you’ll be ready to take payments via ACH on your forms. 🥳

Start using ACH with Square in your forms today.

What is the ACH payment method?

Known simply as “direct payments or direct debit,” ACH payments transfer money from one bank account to another without the use of checks, credit card networks, wire transfers, or cash.

Since the payment passes through a clearing house, which has its own set of regulations, ACH payments are widely viewed as one of the most secure types of transactions.

It appears businesses have caught on, as ACH payment volume is steadily growing. The ACH network processed more than 31.5 billion electronic payments in 2023, valued at $80 trillion. It’s the 11th year in a row when the total value of ACH payments increased by at least $1 trillion.

ACH payment collection benefits

While a main benefit of the ACH with Square payment method is clearly cost savings, that (and a few other benefits) deserves to be explored a little further. And yes, ACH offers benefits for your customers as well.

Benefits of ACH for your organization

- Higher conversion potential (leading to higher sales)

- No hidden fees for failed ACH transactions

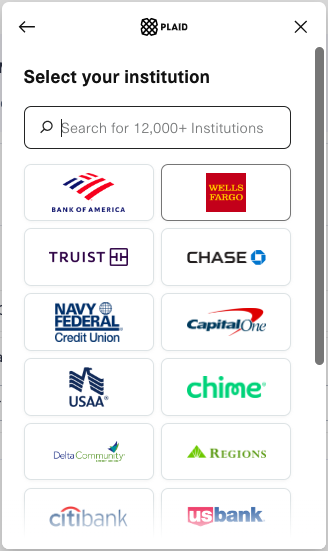

- Square ACH connects to over 12,000 financial institutions

- Electronic transfers automate your payment workflow and backend reconciliation

- More security with less fraud risk

- Convenience: no paper invoices, no paper checks, no trips to the bank

Benefits of ACH for your customers

- Reliability: The last thing customers want is for a payment to fail. Using their bank account (which doesn’t change), instead of a credit card, means the payment method won’t expire.

- Speed: ACH payments are usually processed faster than checks.

- Convenience: Small businesses/customers often elect to make bank payments instead of managing credit cards, digital wallets, and checks.

- Security: ACH is simply a safer payment option.

- Cost: Since ACH costs you less, ACH costs your customers less (especially as it relates to product pricing or when extra costs are passed on to the customer)

How to integrate Square ACH with Jotform

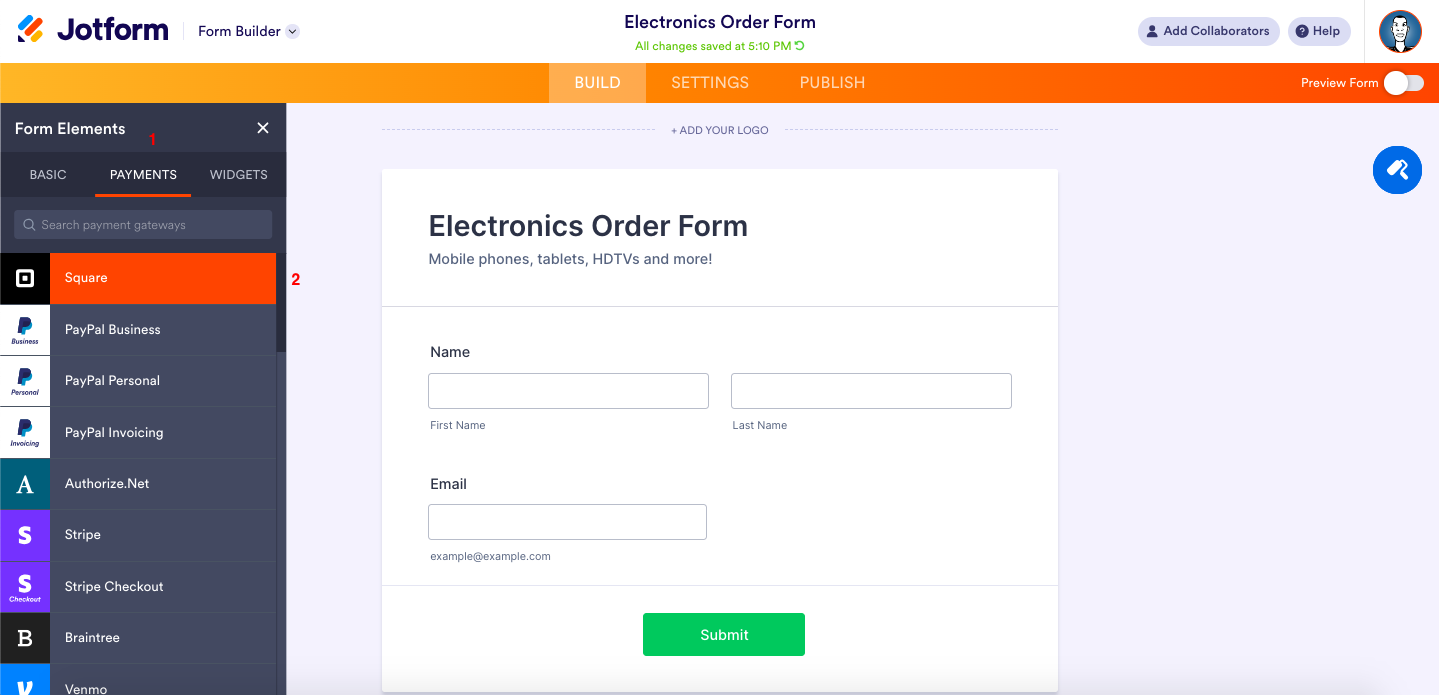

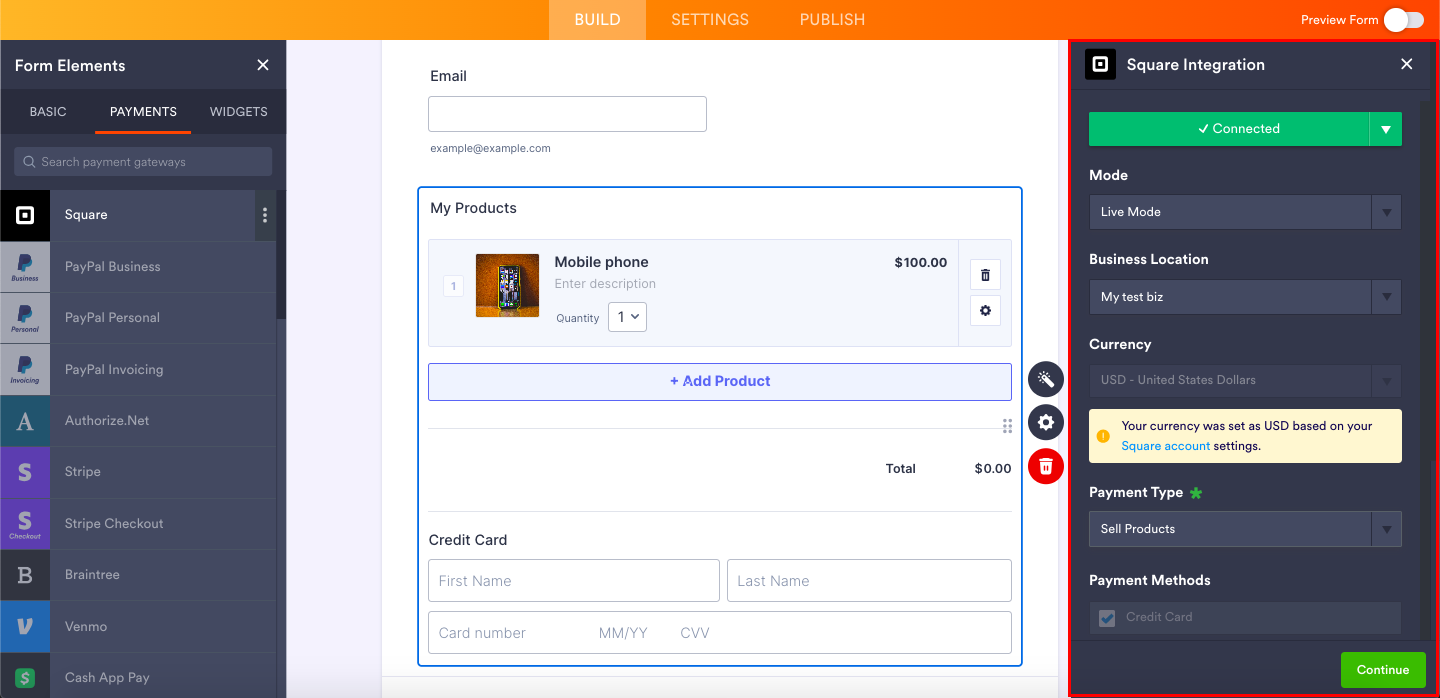

Adding the ACH payment method to your form is a snap. In the Form Builder, click the Add Form Element button on the left of the screen and go to the Payments tab.

Search for Square, and then drag and drop the Square payment element into your form or simply click on the icon.

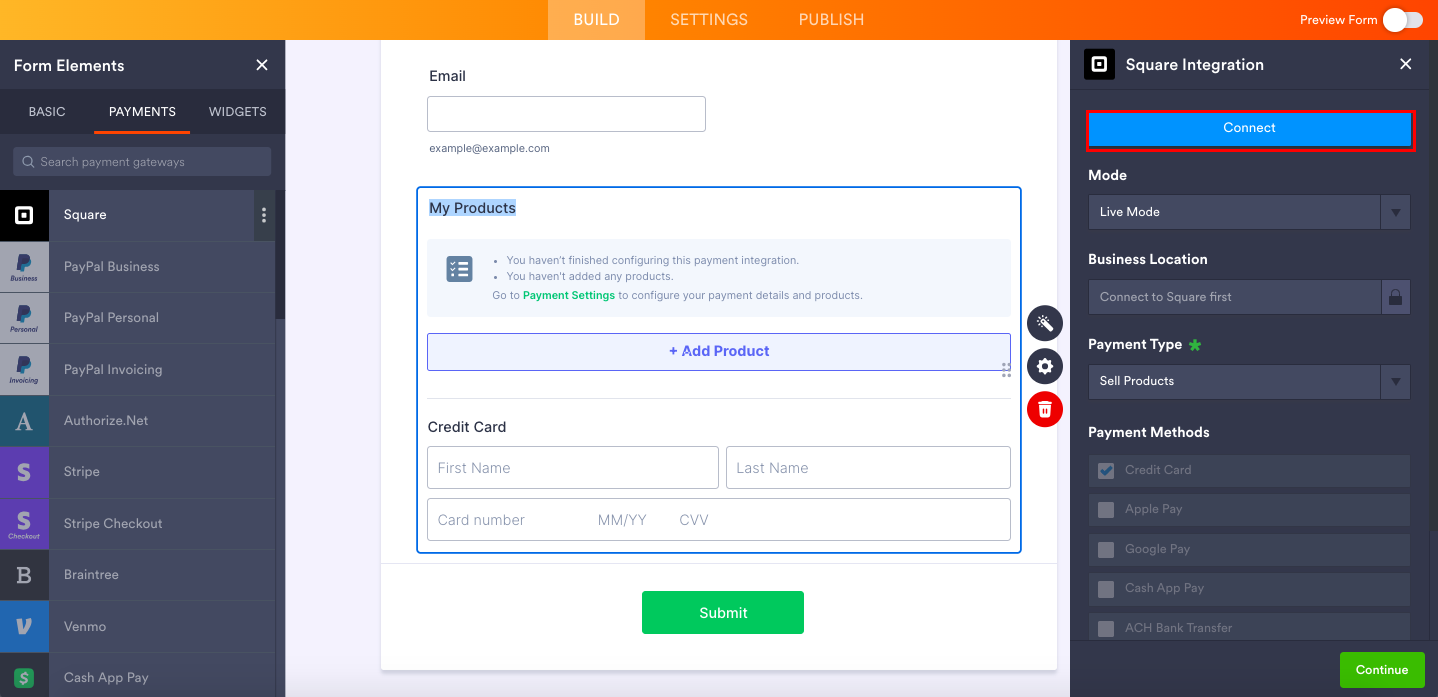

Next you’ll need to authenticate your Square account in the Payment Settings by clicking the blue Connect button. The settings open by default when you add the Square element to your form; however, you can always open them by clicking the wand icon to the right of the element.

*Note that the credit card payment method will be selected by default, but you can update this once you’ve authenticated your account.

The button will turn green once you’re connected. You can then customize your payment settings.

In the settings, your business location should be the one you’ve registered with Square. Also, your currency should be set to USD, as the ACH payment system is available only in the U.S.

For payment type, you can select Sell Products, Collect Donations, or allow users to pay a User Defined Amount. The ACH payment method does not support subscriptions.

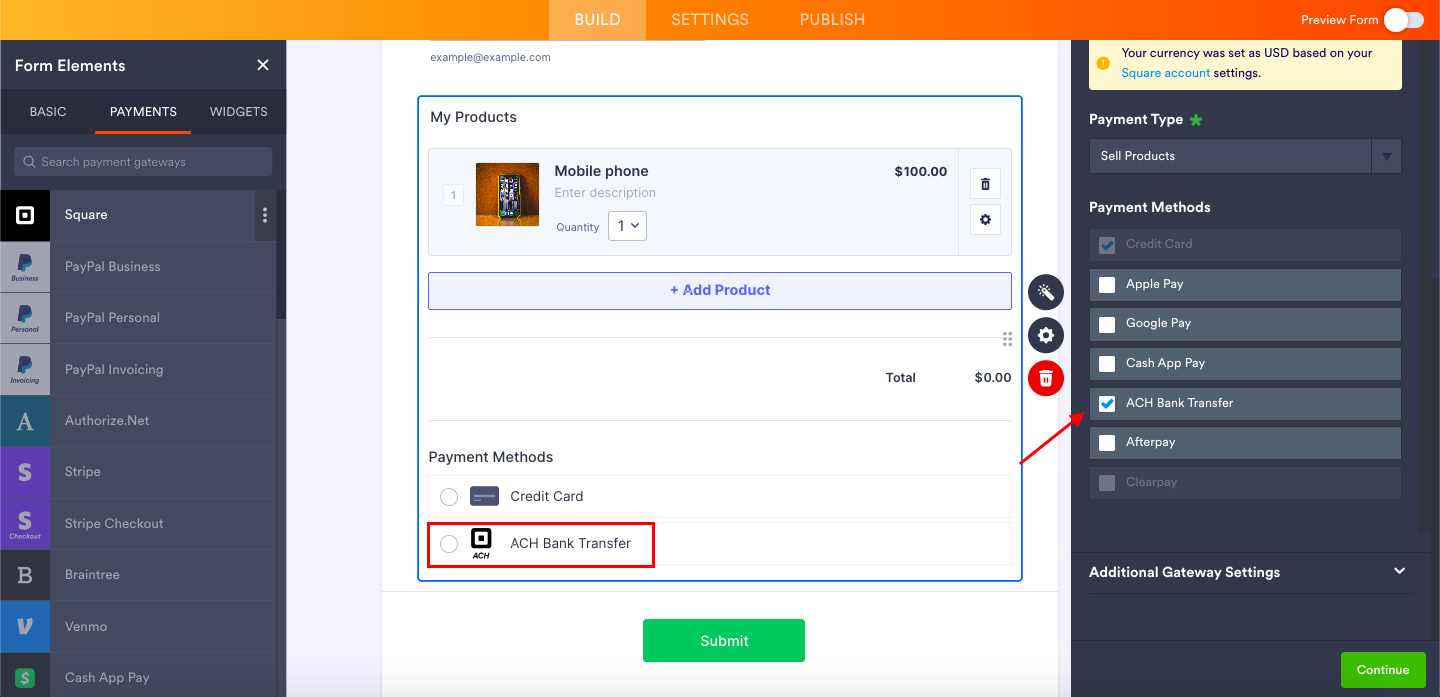

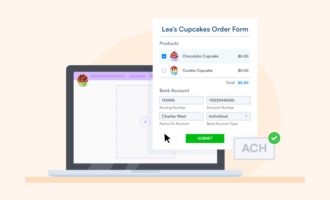

For the payment method, select ACH Bank Transfer. You’ll then see the option appear on your form, along with the credit card option.

If you’re selling products, click the green Continue button to add your product. If you’ve selected user-defined amounts or donations, click the Save button to complete your integration.

If you’d like to learn more about collecting payments with Jotform, register for our webinar on June 25!

Customer view

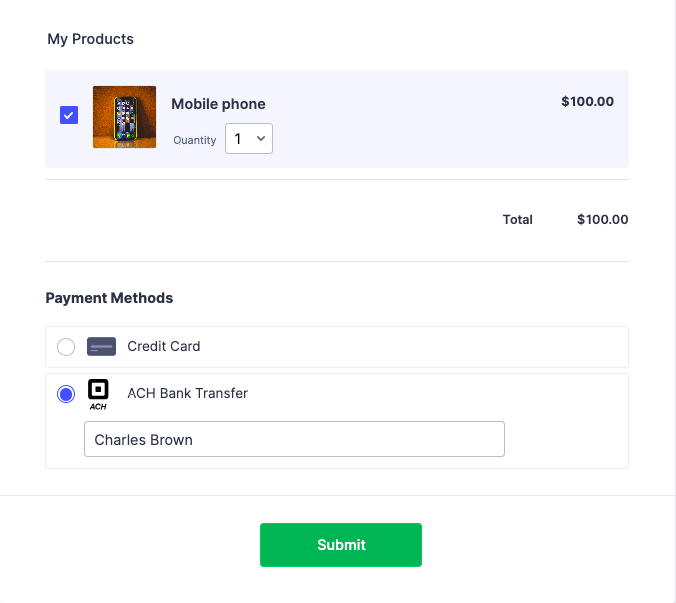

Once your form is live, your customers can select ACH as a payment method.

When your customer chooses the ACH Bank Transfer option, they’ll be prompted to enter their bank account holder name.

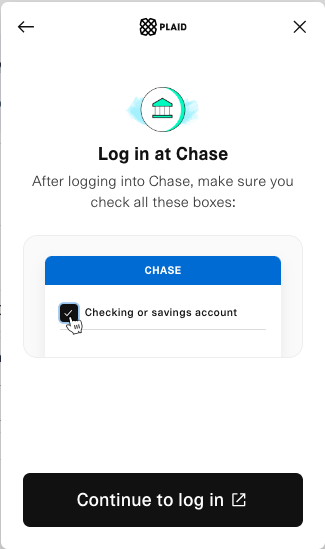

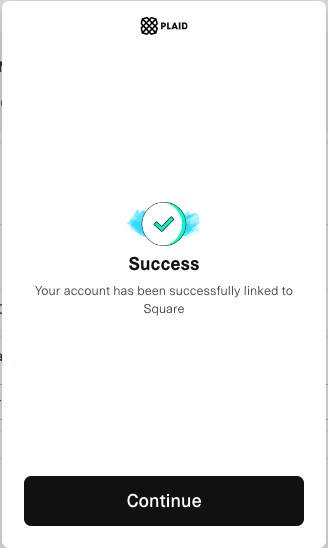

After a user submits your form, they will go through a series of quick steps to select and authenticate their bank account and then choose the account type to fund their payment.

Pro Tip

The current transaction cap per ACH transaction is $50K with Square.

Check out our user guide to learn more about integrating the Square ACH payment method, including details about the additional payment gateway settings available through Square.

Did you know?

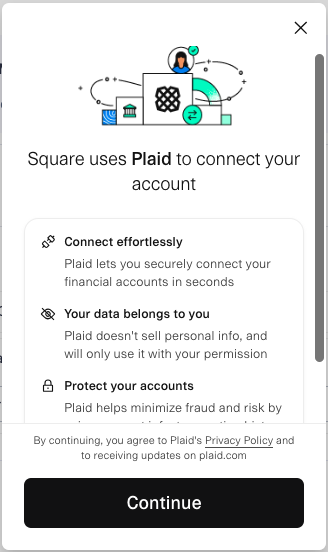

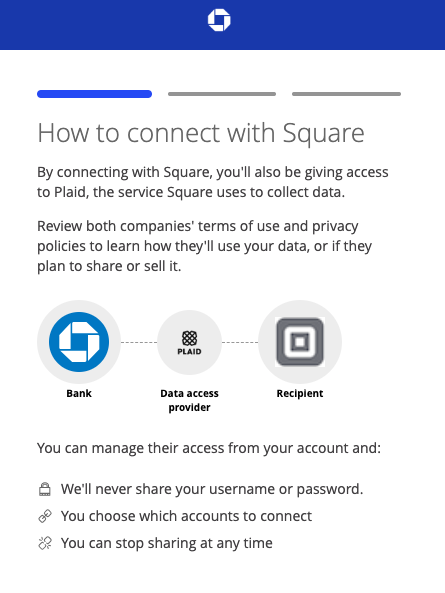

Square’s tokenized check system uses a connection with Plaid to present customers with their bank login interface at checkout. Customers can enter their bank login credentials instead of providing their account and routing numbers to you.

The less expensive, more secure payment method you can’t afford to overlook

Jotform’s integration with Square ACH offers an additional payment method, providing your forms the kind of payment flexibility unavailable with some of the market alternatives.

ACH is a favorite among small businesses and organizations because it saves them costly credit card processing and checking fees, and eliminates manual busywork like taking paper checks to the bank or mailing invoices.

But there’s no reason this same logic shouldn’t apply to all organizations that process B2B transactions and/or sell consumer products/services.

On top of that, because your customers are making payments directly from their bank accounts, the risk of credit card fraud and/or cybercrime greatly decreases. Square ACH uses Plaid to safeguard transactions via a highly secure network.

And the chance of missed sales and failed payments — when the customer’s card you have on file expires — decreases because bank accounts rarely change. Finally, you’ll get access to your funds in your Square account in three to five business days.

Stop🛑 making runs to the bank and paying costly transaction fees, and start 🏁 using ACH with Square in your forms today.

Send Comment:

3 Comments:

More than a year ago

can dental office sign up for afterpay

More than a year ago

Am i able to turn off the square credit option and only use ACH?

More than a year ago

If a bank is not yet available through PLAID, is it still possible for the customer to provide their routing and checking account number?