Digital finance apps are making it easier than ever for consumers and businesses to transfer money almost instantly. And they’re catching on fast: According to a study by Cornerstone Advisors, more than 25 percent of Gen Z consumers and nearly 33 percent of millennials use a digital bank for their primary checking account, writes the banking consultancy’s chief research officer Ron Shevlin.

Cash App is one of the most popular mobile payment services in the United States, offering a seamless experience for online payments and peer-to-peer transfers. However, many people are unaware of the differences between Cash App for business and personal use. In this article, we’ll help you find the account that’s right for you.”

Cash App basics

Cash App is an online payment solution that allows users to transfer money and make other financial transactions seamlessly. That’s likely one reason why it’s become such a popular payment app. Data editor David Curry at Business of Apps reports that “Cash App had 44 million monthly active users in Q4 2021.”

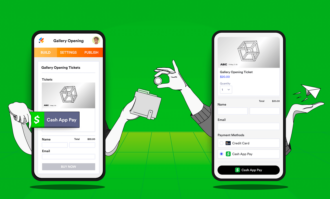

Cash App offers two types of accounts: a Cash App personal account or a Cash App business account.

Cash App personal accounts

A Cash App personal account allows users to send and receive money, set up direct deposits, purchase bitcoin, and use a linked debit card, says personal finance writer Kevin Payne. Users as young as 13 can have an account, but anyone 13 to 17 years old will need a parent’s permission to access certain features.

Cash App business accounts

A Cash App business account, also called Cash for Business, is simply a Cash App account tailored to business. There are no requirements to create a business account — making it the perfect choice for startups and small to medium-sized businesses. While there are no signup or monthly fees, Cash App charges you a fee for each transaction.

Your Cash App business account isn’t limited to receiving payments from other Cash App users. You can create payment links that anyone can use to send your business money.

You can even link your Cash App account to your existing business bank account and make standard deposits for free. If you want to speed up the process and transfer money instantly to your debit card, Cash App charges a 0.5–1.75 percent fee.

Cash App for business vs personal use

Cash App personal accounts are a great way for individuals to send money to their friends and family, purchase bitcoin, and spend money in stores using a linked debit card. Business accounts, on the other hand, come with additional features like tax reporting, making them more appropriate for organizations.

But the differences between the two go even deeper.

The fees Cash App charges depends on whether you have a business or personal account. Personal accounts incur no fees on transactions. Businesses will incur a small fee when they receive a transaction. That’s because Cash App generates most of its revenue through the fees associated with business accounts, explains Jakob Eckstein at Investopedia.

There are also differences in the transfer limits of both accounts. With Cash App personal accounts, you can send or receive up to $250 in a seven-day period and $1,000 in a 30-day period. You can increase the limit by verifying your identity on the platform. There are no limits on the amount of money business accounts can receive.

Steps to change a Cash App account from personal to business

Every Cash App account starts off as a personal account, but it’s easy to switch to a business account. Unfortunately, each account has to be associated with a different phone number. If you want to switch from a personal account to a business account, follow these steps:

- Open Cash App.

- Tap the profile button.

- Under Account & Settings, tap Personal or Edit Profile.

- Tap Switch to a Business Account at the bottom.

- Follow the prompts to finish the process.

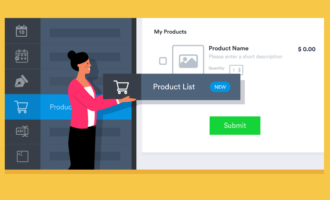

Connect Cash App and Jotform

Cash App is a great digital finance app whether you use it for personal or business purposes. In either case, it’s easy to accept Cash App payments through Jotform. Our Cash App integration makes it possible to collect payments through your forms without paying any additional fees.

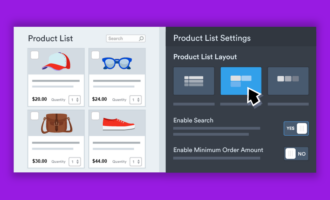

Get started today by customizing a payment form template and embedding it into your website.

With Jotform Mobile Forms, you can access and manage your payment forms on the go, ensuring you can collect Cash App payments anytime, anywhere — even when you’re offline.

Send Comment: