Buying now and paying later isn’t new, from lines of credit in the Bronze Age to credit cards today. But since credit cards appeared in the 1950s, the buy now, pay later business model has remained relatively unchanged.

For many, that formula no longer makes sense, especially as credit card interest rate margins climb to all-time highs. Not coincidentally, modern buy now, pay later (BNPL) options have removed interest from the equation and enjoyed an increase in popularity.

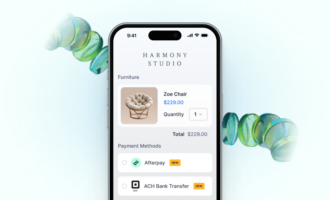

So it’s the perfect time for Jotform to make an exciting announcement. Afterpay, a leader in the BNPL landscape, is now available for use with Jotform via our Square integration.

Why offer BNPL with Afterpay? Afterpay users shop 50 percent more and spend 40 percent more than other shoppers. Additionally, nearly one in four Gen Z shoppers won’t buy at all if BNPL isn’t available, according to PYMNTS.

In fact, 53 percent of BNPL shoppers are Gen Z or millennials, according to NBC News. This article also states that Gen Z shoppers use BNPL services for everyday items like groceries as well as luxury purchases like airfare.

At a glance, here’s how BNPL with Afterpay works:

- Shoppers use your form to purchase with Afterpay.

- Shoppers agree to an interest-free payment plan with Afterpay.

- Shoppers pay the first installment at checkout.

- The seller receives the full purchase amount at the time of sale.

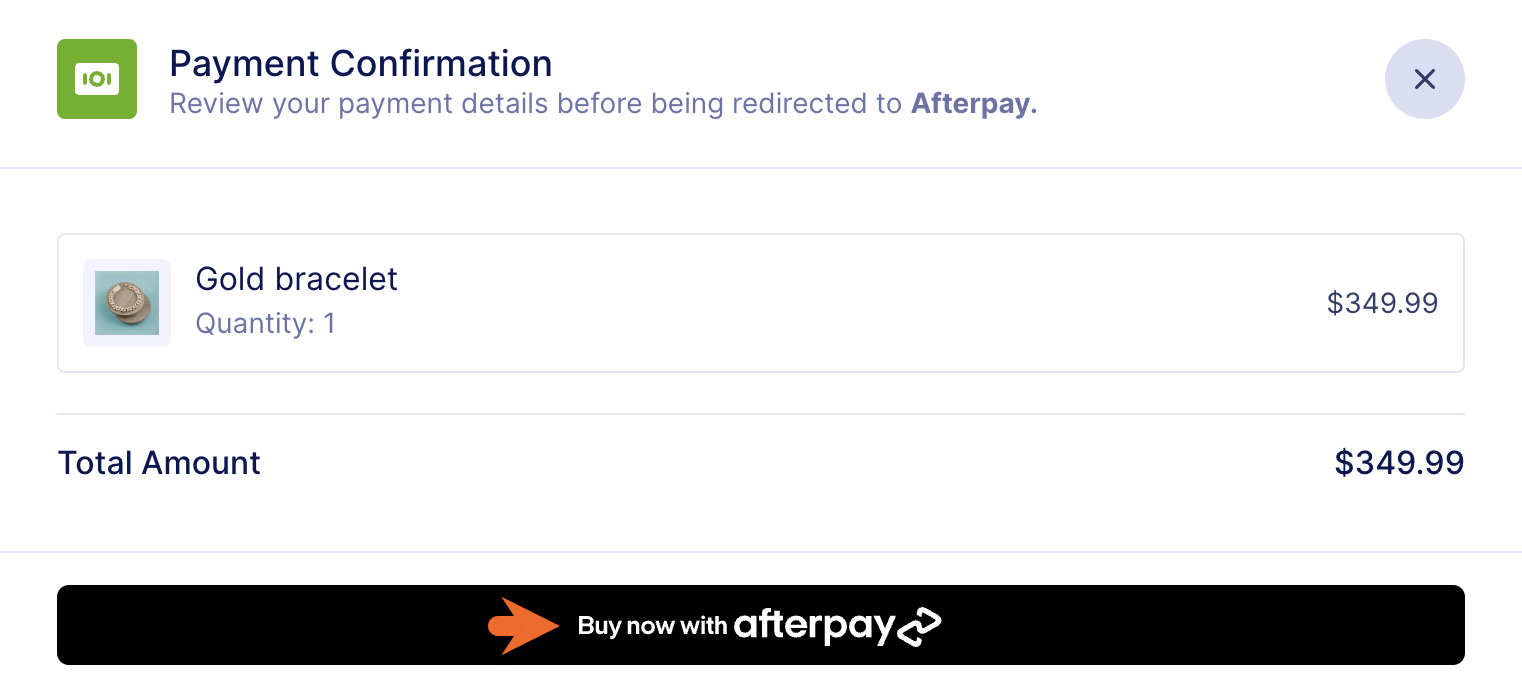

Upon checking out with Afterpay, shoppers are enrolled in an interest-free six-week payment plan and make their first payment. The remaining installments are spaced evenly apart and are automatically deducted from the shopper’s debit or credit card.

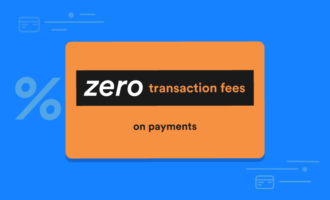

Sellers receive the full purchase amount at the time of the sale. There are no additional processing fees for scheduled payments or if a shopper makes a late payment. Plus, merchants who accept Afterpay see a 58-percent increase in average order values.

Heard enough? Add Afterpay to your form now!

Let’s take a look at how to add this popular BNPL option to your forms, plus top products purchased by Gen Z and millennial shoppers with Afterpay in 2023.

Did you know?

Afterpay is available in Australia, Canada, New Zealand, and the United States. In the United Kingdom, Afterpay is known as Clearpay. Worldwide, 22 million active shoppers use Afterpay and Clearpay.

How Gen Z and millennials use Afterpay

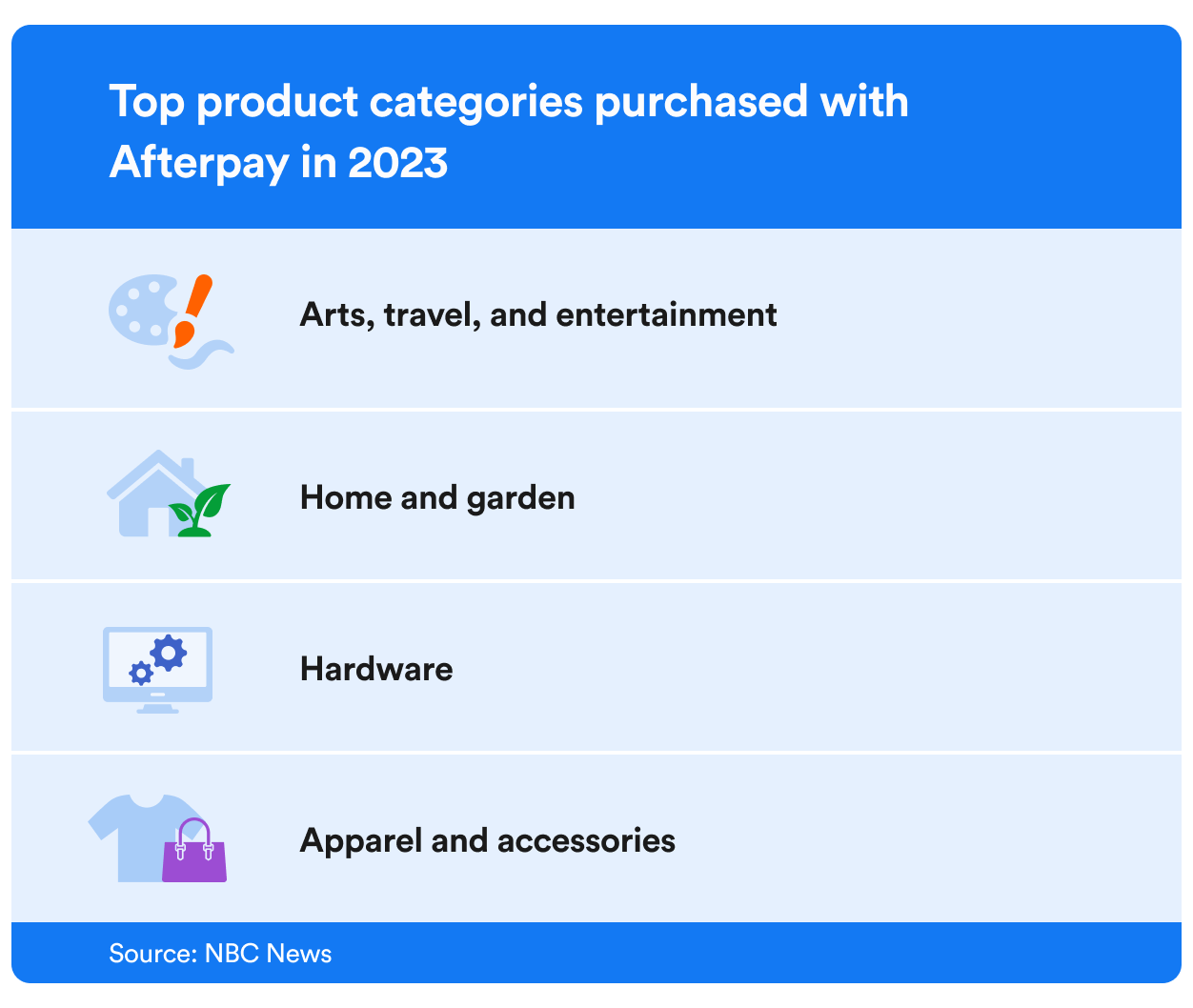

What do Gen Z and millennials buy with Afterpay? According to a 2024 article on Afterpay and the BNPL industry, the No. 1 industry category for these types of purchases in 2023 was arts, travel, and entertainment.

Additionally, spending on everyday items with Afterpay surged in 2023. Contact lenses, garbage bags, laptop parts, and more saw triple-digit growth.

How to install Afterpay

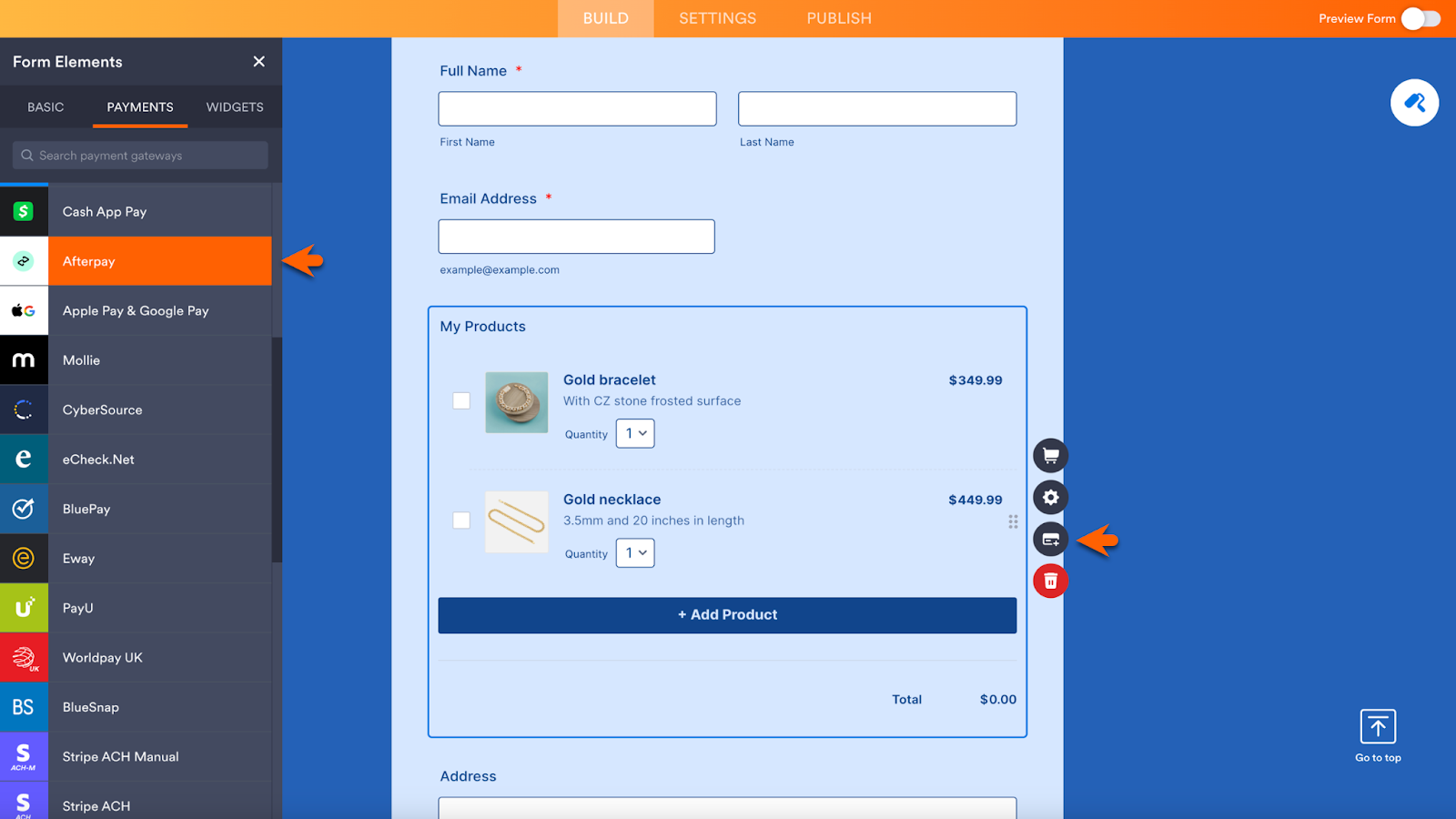

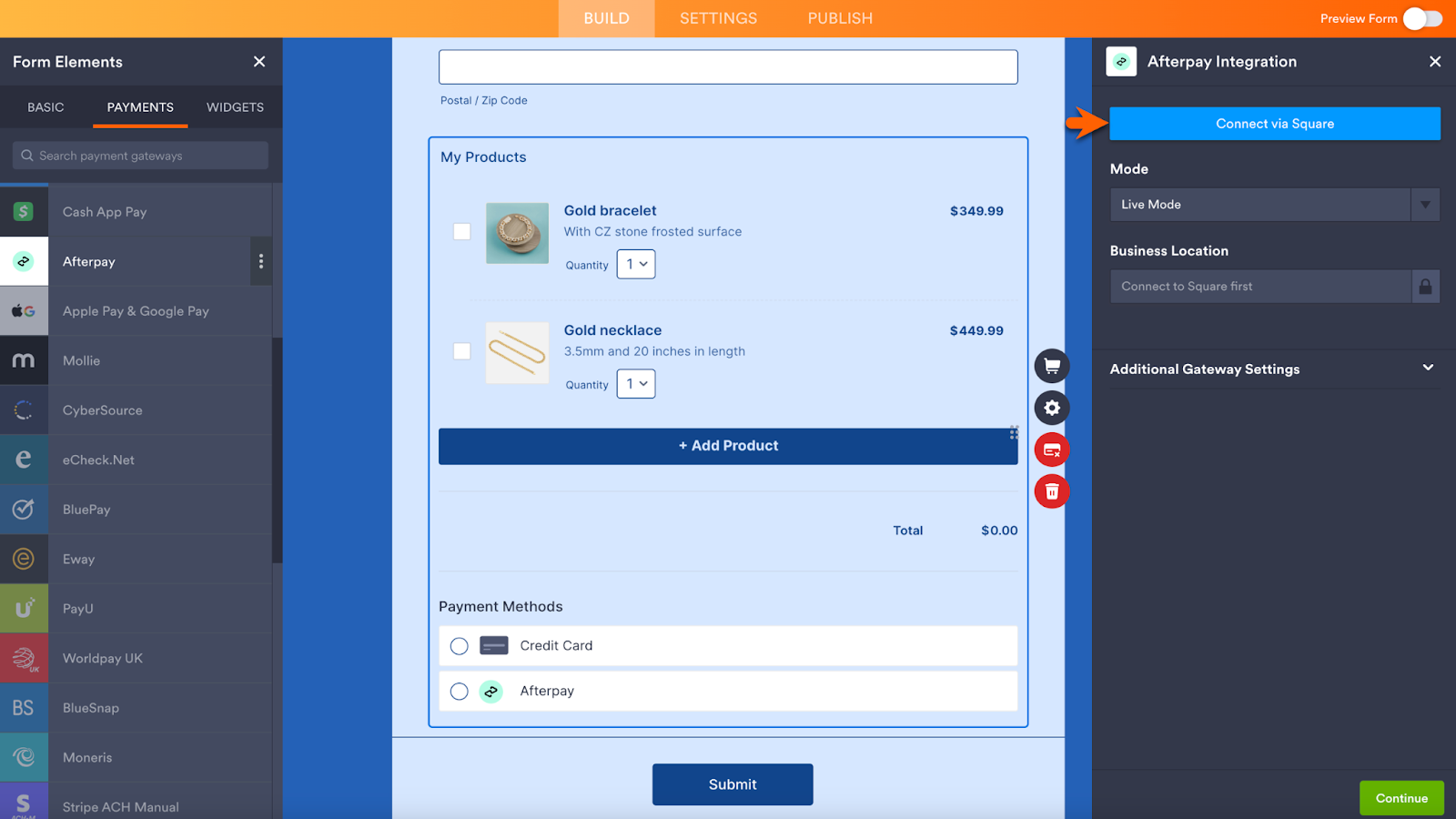

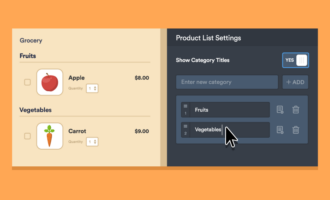

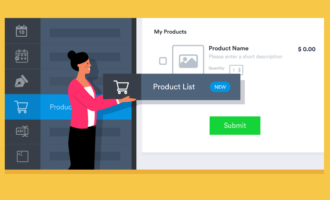

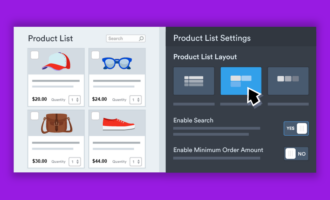

To add Afterpay to your payment form, go to the Payments section of the Form Elements menu in the Form Builder. Click on Afterpay. A Product List element will be added to your form, so you can sell products.

If there’s already a Product List element on your form, click the Add Integration icon to the right of the Product List. A popup will display all the payment integrations to choose from, including Afterpay.

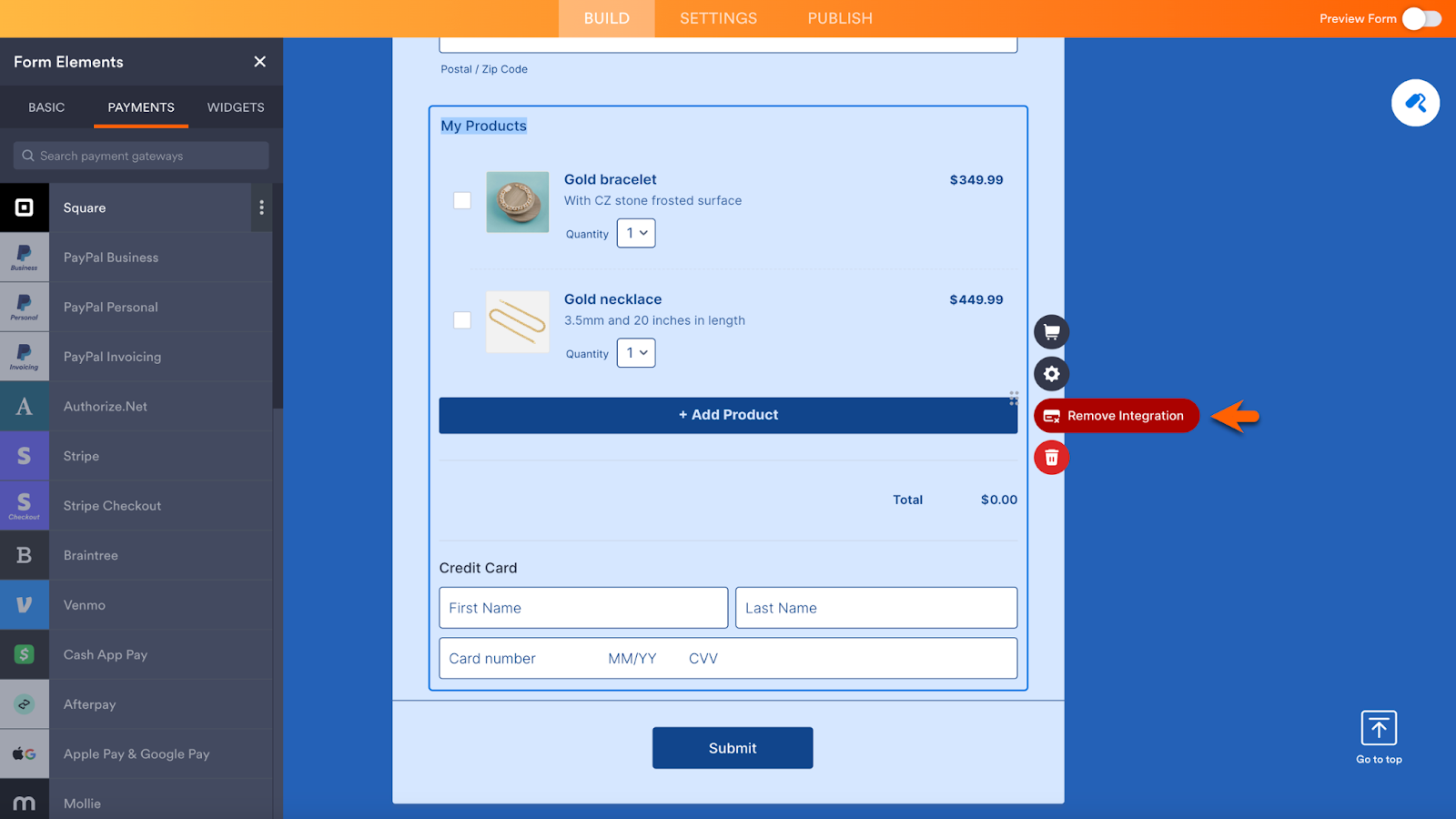

If you’ve already connected a Product List to a payment integration, the Add Integration icon enables you to remove it and replace it with Afterpay.

What happens if an Afterpay shopper misses a payment?

Afterpay is interest free — but a shopper can be charged late fees for missed payments.

Sellers aren’t impacted when a shopper misses a payment. They receive the full price of goods and services sold at checkout, and they aren’t charged additional fees when a shopper is late with a payment.

Afterpay will prevent a shopper who has missed a payment from buying anything else with Afterpay until their payments are up to date. The shopper’s spending limit may also be decreased.

Afterpay may prohibit shoppers who have outstanding balances for an extended period of time from using the service.

When Afterpay is selected, a menu will open on the right side of the screen. Click Connect via Square to sign into your Square account or create a new account.

Note that the Afterpay payment option doesn’t support subscription or authorization only payments. The amount shoppers can spend on purchases is determined by Afterpay when they sign up for an Afterpay account.

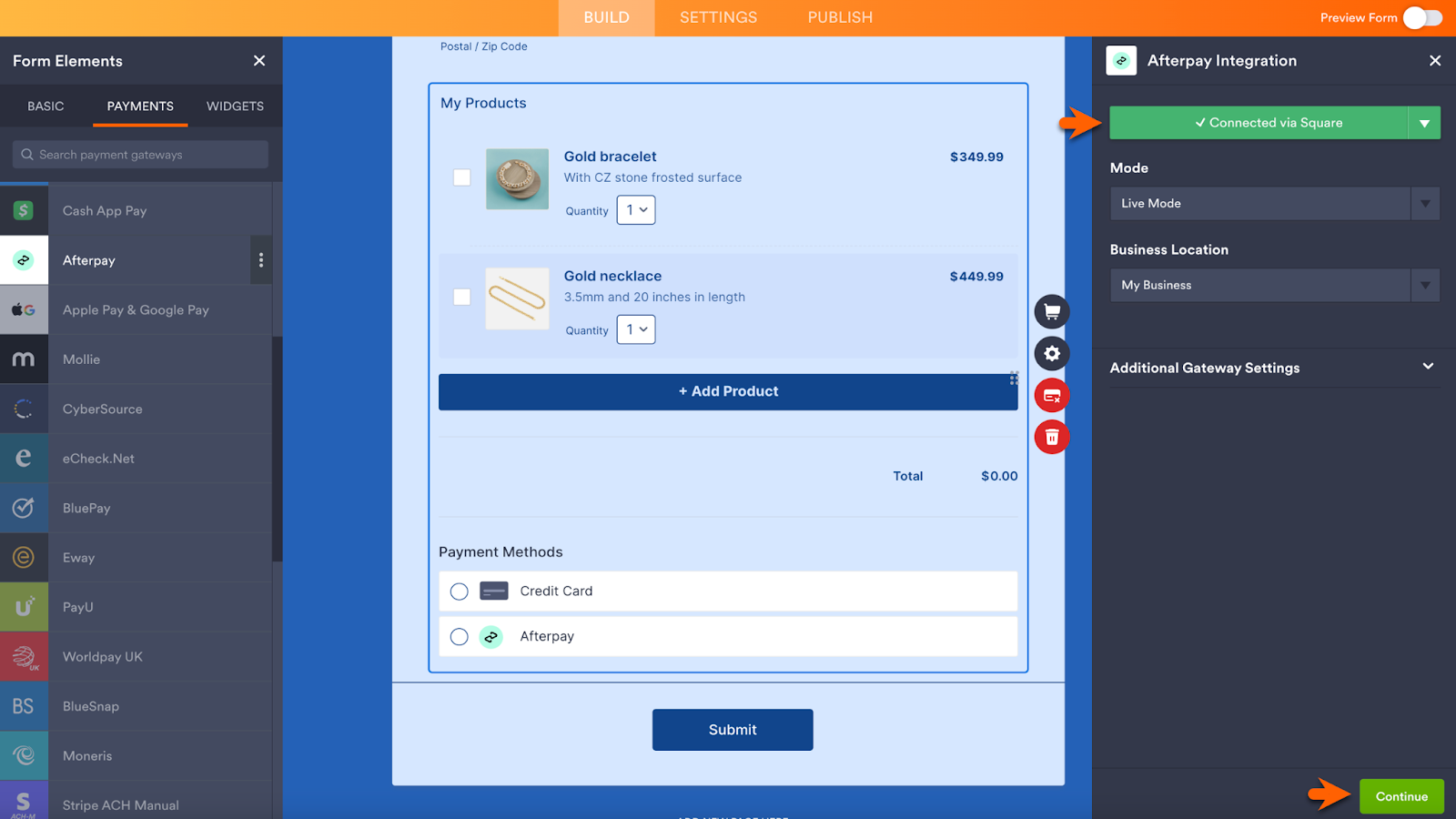

After you log in with Square, the Connect via Square button will change to Connected via Square (and turn green). Be sure to click the Continue button below to complete the integration setup.

Interest rate margins hit all-time high

According to data released in 2024 by the Consumer Financial Protection Bureau, credit card interest rate margins hit an all-time high in 2023. The interest rate margin is the difference between the average APR and the prime rate, a benchmark most banks use to set rates.

From late 2013 to 2023, the average APR on credit cards that charge interest has nearly doubled, from 12.9 percent to 22.8 percent. That’s the highest level since the Federal Reserve began recording this data in 1994.

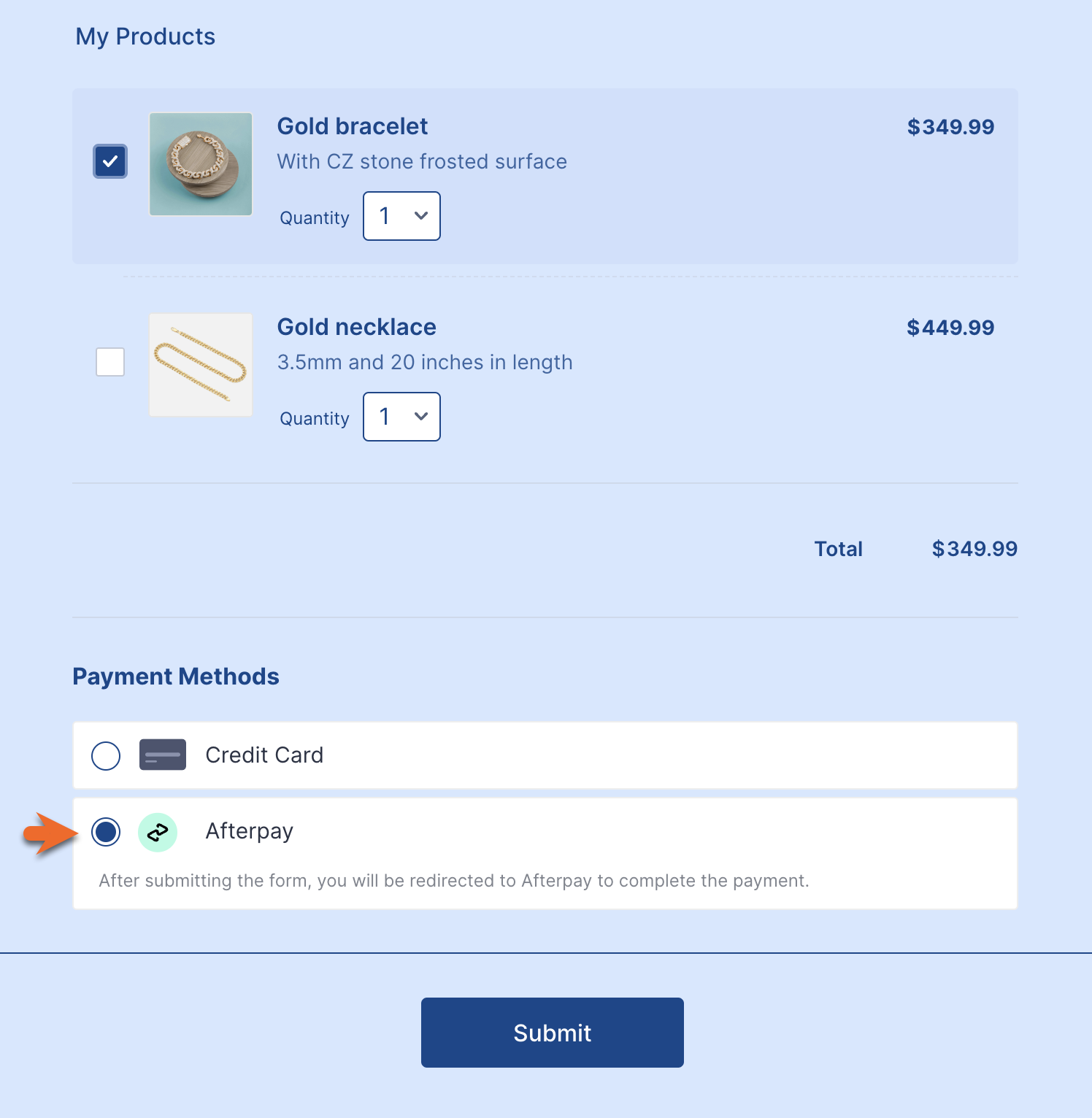

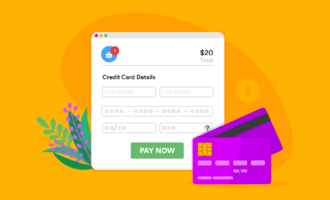

When shoppers choose Afterpay and submit the form, they will be redirected to Afterpay to complete the purchase.

The shopper’s payment plan is displayed before they make the purchase, complete with the amount of each payment and the date they will be charged.

A record of transactions made with Afterpay will appear in the seller’s Square account. Additionally, submission data is automatically stored in Jotform Tables.

BNPL makes a big impact on Black Friday & Cyber Monday sales

Modern BNPL plans are positively affecting Black Friday and Cyber Monday sales. According to Adobe Analytics, U.S. shoppers used BNPL to make $16.6 billion in purchases in 2023, a 14 percent year over year increase.

PYMNTS reports that U.S. shoppers who used BNPL during checkout spent 48 percent more on Black Friday than shoppers using other methods.

As for Cyber Monday, Adobe Analytics found that consumers used BNPL to buy $940 million in goods while shopping online. This represents a 42.5 percent year over year increase.

Add more checkout options with Square

Jotform users asked for a way to add Afterpay to their forms, and our developers delivered. But we didn’t stop there.

We know that providing multiple checkout options makes it more likely that shoppers will see their preferred way to pay and complete their purchase. Jotform’s Square integration not only provides a way to add Afterpay to your form, it also allows for other payment options including Apple Pay and Google Pay.

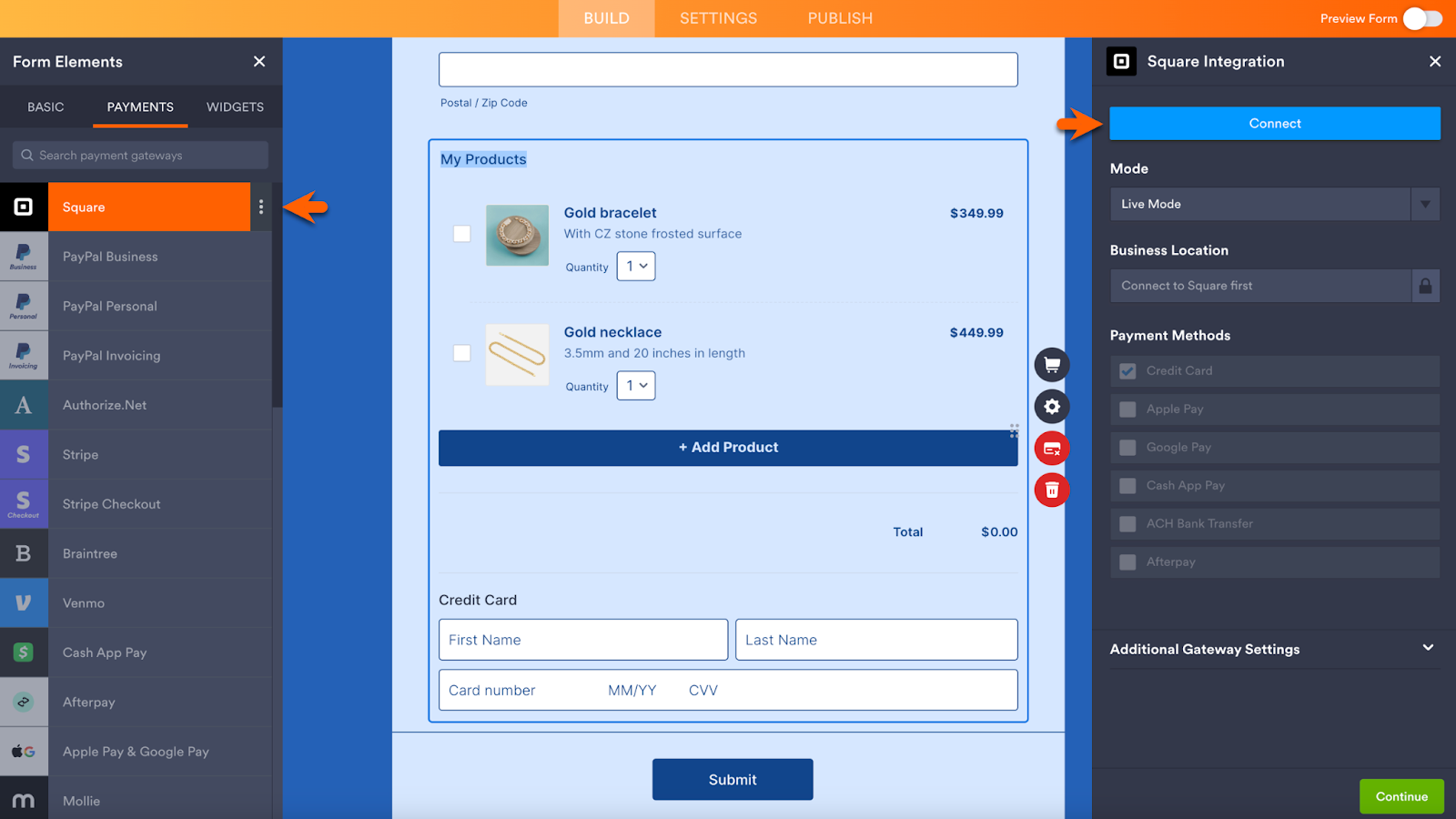

To add Afterpay and more to your form via Square, go to the Payments section of the Form Elements menu in the Form Builder. Click on the Square integration to open the integration menu. Click the blue Connect button to log into your Square account or create a new one.

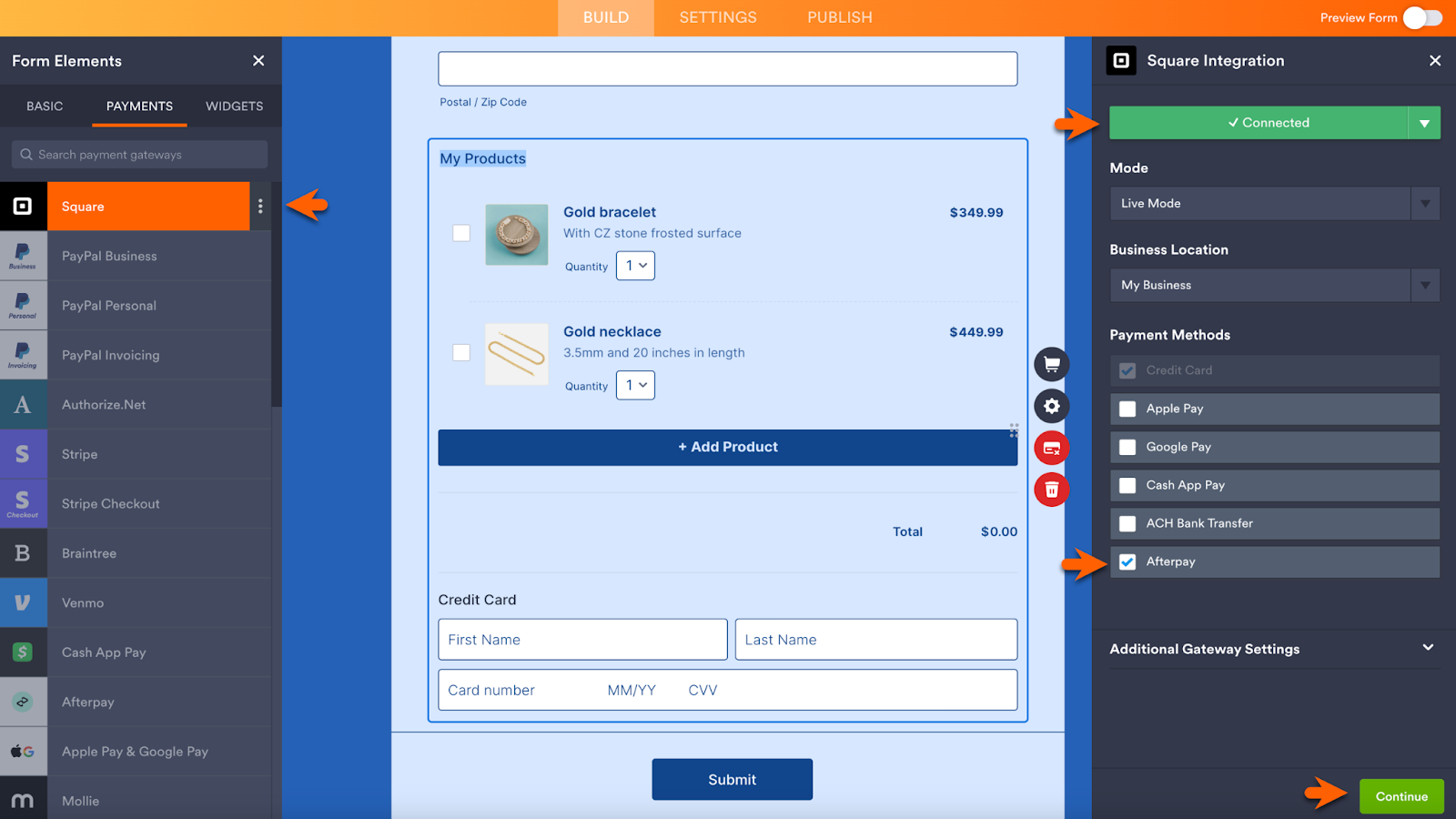

Once Square and your form are connected, use the Payment Methods section to choose from five popular payment options. In the example below, Afterpay is selected, along with the credit card option, which is selected by default. After selecting the preferred payment methods, click the Continue button to finish setting up the integration.

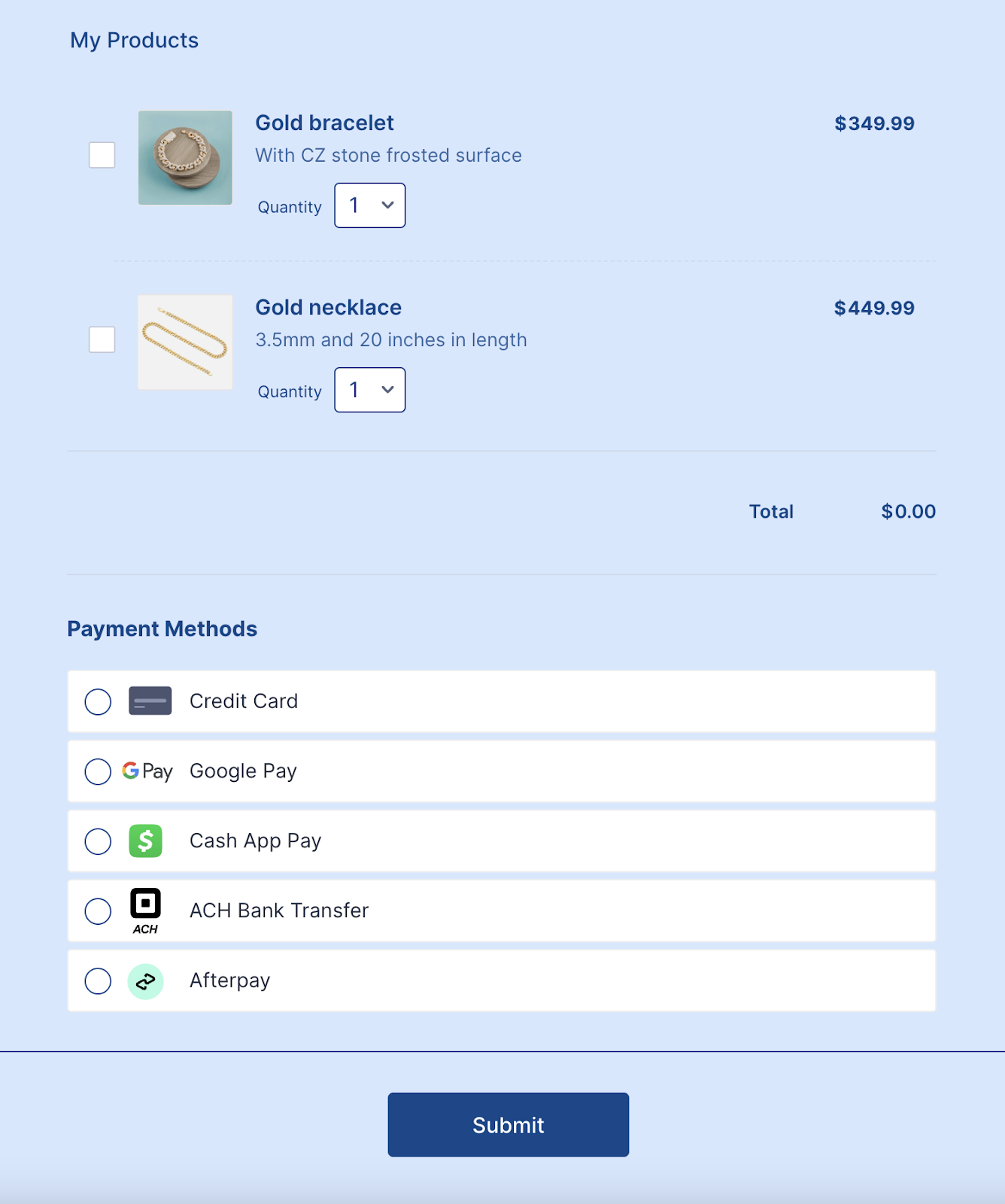

Each payment method selected during the integration setup will now appear on your form, in addition to the default credit card option. In the example below, five payment options are viewable, including ACH Payments.

Conclusion

Gen Z and millennials use BNPL options like Afterpay more than other generations. The same shoppers often bypass credit cards, largely due to high interest rates — the younger the shopper, the less likely they are to use a conventional credit card, according to PYMNTS.

Providing Afterpay alongside credit cards at checkout can help any business or organization usher a wide array of shoppers through checkout.

With Afterpay, your form will have all of those options and more. For Jotform users who already use Square, it’s time for an update. For those who have yet to integrate Square with Jotform, your timing couldn’t be better. Head to the Form Builder now to add payment options to your form that are ideal for today’s credit landscape.

Send Comment:

2 Comments:

More than a year ago

Excellent post. I absolutely love this site.thanks

More than a year ago

How I receive payment