Top 5 AI accounting software

- Bookeeping.ai: Best AI accounting tool for automated transaction categorization

- Vic.ai: Best AI accounting tool for automated invoice processing

- Intuit Assist (TurboTax): Best AI accounting tool for seamless tax filing

- Datarails: Best AI accounting tool for auto-generated financial decks

- Rydoo: Best AI accounting tool for automated expense auditing

You didn’t get into business or accounting to spend hours reconciling transactions, tagging expenses, or formatting reports. It’s inefficient and, frankly, not the best use of your time. Yet for many teams, those manual tasks are still part of their daily routines.

AI accounting automation tools are changing all that. They can automate the busywork and reduce mistakes, so you can focus on the more strategic work.

In this guide, I’ve rounded up the best AI accounting software tools for 2025 that can help you work faster and smarter.

What makes great AI accounting software?

The best AI accounting apps have a few things in common. First, they offer real-time automation, handling tasks like categorizing transactions or syncing data without delays. Then, they learn from your behavior and improve over time, offering smarter, more personalized suggestions. Many also surface predictive insights to help you make faster, better financial decisions.

Beyond the AI itself, a good automated accounting platform should include practical features like multi-account support, strong integrations (with banks, payroll, invoicing tools, and more), and audit trails that log every change. Security and data privacy are essential, and the best tools make it easy to export clean, usable data when you need it.

How this list was tested and selected

I researched, watched demos, and tested over 12 tools to find the ones that offer real AI functionality — not just dashboards or rules-based automation. I specifically looked for tools designed for accountants and finance teams at small to mid-sized businesses (SMBs) rather than enterprise software or tools built for accounting firms.

Next, I evaluated each smart accounting tool across specific tasks, such as invoice processing, transaction categorization, tax prep, expense management, and financial analysis, keeping only the ones that handled those tasks well. I paid close attention to ease of setup, accuracy, quality of AI suggestions, and whether the tool actually saved time.

If a tool’s AI features felt vague or too generic (like something ChatGPT could do on its own), I cut it. I also ruled out anything that didn’t integrate well with other essential tools or just didn’t work for SMB accounting workflows.

Best AI accounting software in 2025: Quick comparison

| Tool name | Best for | AI feature | Integrations | Pricing |

|---|---|---|---|---|

| Bookeeping.ai | Automated bookkeeping | Real-time transaction categorization and financial statement update | 5,000-plus bank feeds, Stripe, email | 30‑day free trial; $29 per month (Start), $49 per month (Pro), $79 per month (Scale) |

| Vic.ai | High-volume accounts payable automation | AI-powered invoice coding, purchase order (PO) and expense matching, and automated approvals | Workday, Sage Intacct, Oracle, and Microsoft Dynamics | Custom pricing |

| Intuit Assist (TurboTax) | DIY or guided tax filing | Personalized tax guidance, form population, and error checks | Built into TurboTax, imports from payroll apps and documents | $0–$149 (self-serve), $89–$219 (expert help), $139+ (full service) |

| Datarails | Automated financial planning and analysis | Financial analysis, summaries, and deck generation | Excel, 200-plus ERP/CRM tools | Custom pricing |

| Rydoo | Expense management and local compliance | Smart Audit for analyzing expenses and flagging non-compliant or fake claims | 35-plus tools including NetSuite, Wise, Workday, TravelPerk, and QuickBooks. | From $9 per user per month (Essentials), $11 per user per month (Pro); custom pricing for business and enterprise |

The best AI accounting software in 2025

1. Bookeeping.ai: Best AI accounting tool for automated transaction categorization

If you’re an SMB, start-up, or in-house finance professional looking to automate time-consuming bookkeeping tasks like categorizing and reconciling transactions, Bookeeping.ai is a great pick. Once you sign up and connect your data, the AI bookkeeping software assigns you an AI agent named Paula. Within seconds, Paula categorizes your transactions, prepares real-time profit and loss (P&L) and balance sheet reports, and shows you exactly where your money is going. What would normally take hours to do manually is handled in under a minute.

After Paula finishes categorizing, you just need to verify that everything looks correct. Once you confirm, she remembers and applies those rules moving forward.

You can interact with Paula through a simple chat-style interface by clicking the button at the bottom of the screen. You can ask her to generate invoices, summarize documents, or pull up specific transactions. She also audits your books 24-7, assigns you a score, and flags any missing items like receipts or forms.

The dashboard is clean and easy to navigate, and it updates live as Paula works. Bookeeping.ai integrates with over 5,000 banks in the US and Canada, Stripe, your email (for receipt scanning), and more. You can also export your data as a CSV or PDF file anytime.

Pros

- Real-time updates to your P&L and balance sheet as Paula learns and processes transactions

- Mobile app available so you can manage tasks on the go

- Switch between different AI models to suit your specific accounting needs

Cons

- You’ll need to review and train Paula a bit early on, as she might wrongly categorize some transactions

Pricing

- 30-day free trial available on all plans

- Start plan: $29 per month

Includes all AI accounting automation features, unlimited transactions, unlimited invoices, 2 bank connections, 2024 bookkeeping catchup, 2 team members, ChatGPT, and AI support - Pro plan: $49 per month

Includes everything in Start, plus 4 bank connections, last 3 years’ bookkeeping catchup, 5 team members, ChatGPT and Claude access, and AI plus human support - Scale plan: $79 per month

Includes everything in Pro, plus 6 bank connections, last 5 years’ bookkeeping catchup, 10 team members, unlimited ChatGPT and Claude access, and priority AI plus human support

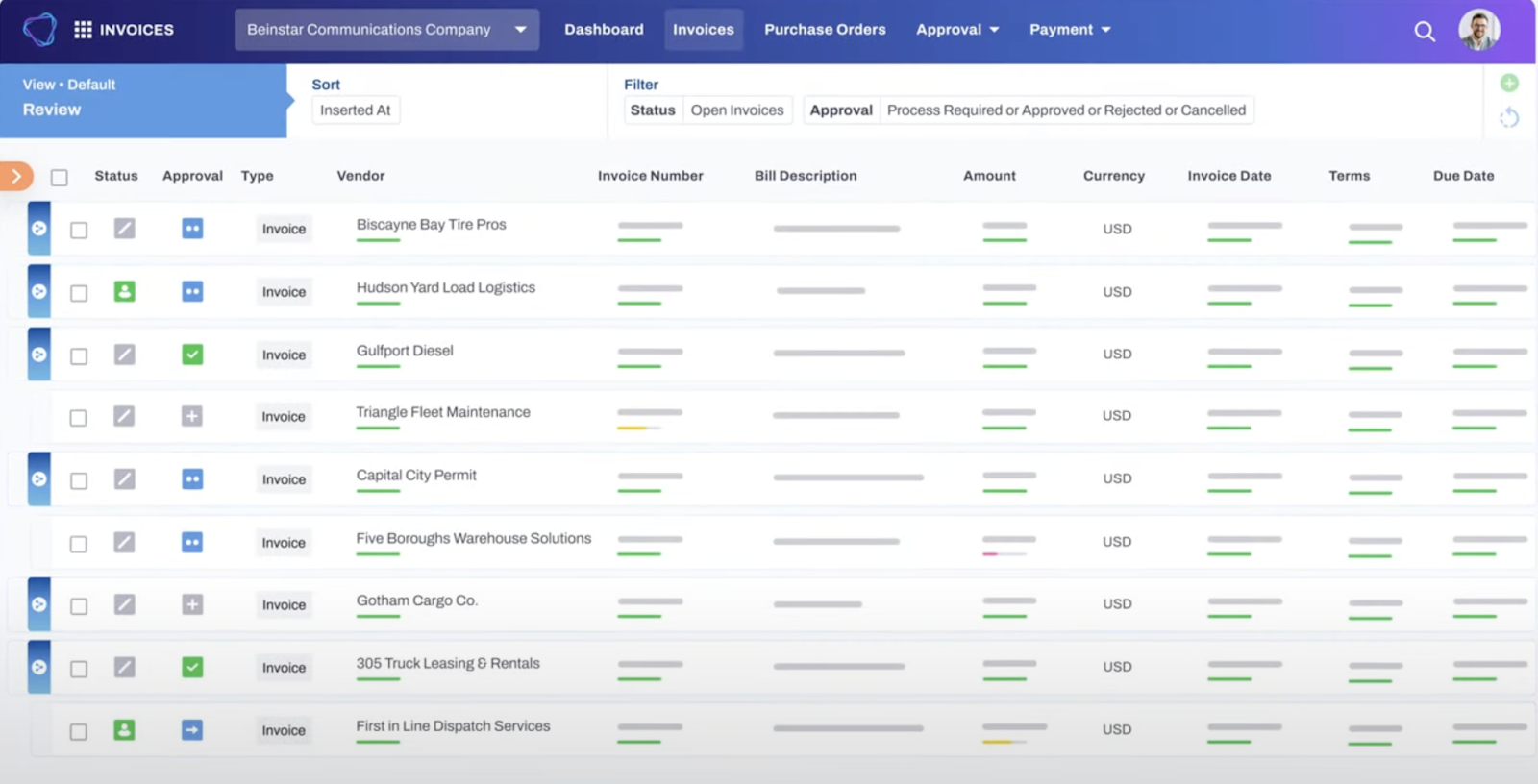

2. Vic.ai: Best AI accounting tool for automated invoice processing

Vic.ai is an AI finance management tool that helps finance and accounting teams manage high invoice volumes and reduce manual work across the entire accounts payable (AP) process. It uses computer vision and deep learning to process, code, and approve invoices automatically. This helps reduce errors and speeds up processing.

You can review purchase order (PO) and expense invoices from the Invoices tab. A green icon means the AI found a match within tolerance. A double green line indicates that it has matched the PO even though the number was missing. A red icon signals an issue, such as a closed PO, missing reference, or quantity mismatch. Click into any invoice to see the exact mismatch highlighted at the line-item level. The AI also makes predictions at both the header and line-item levels of invoices. If the AI is confident, you’ll see a green bar and autopilot icon. This means the invoice can go straight to approval or payment without further human review.

You can filter the dashboard by vendor, amount, document type, or status. Vic.ai continuously syncs data with your enterprise resource planning (ERP) system in real time and supports major systems like Workday, Sage Intacct, Oracle, and Microsoft Dynamics. It also offers an open application programming interface (API), giving teams the flexibility to connect with any ERP or accounting platform and automate workflows end-to-end.

Pros

- Makes invoice processing faster, and it’s often accurate

- Supports zero transaction fees for business-to-business (B2B) payments in the US and early payment discount savings

Cons

- Initial setup can be complex, depending on your ERP integration

Pricing

- Not publicly available

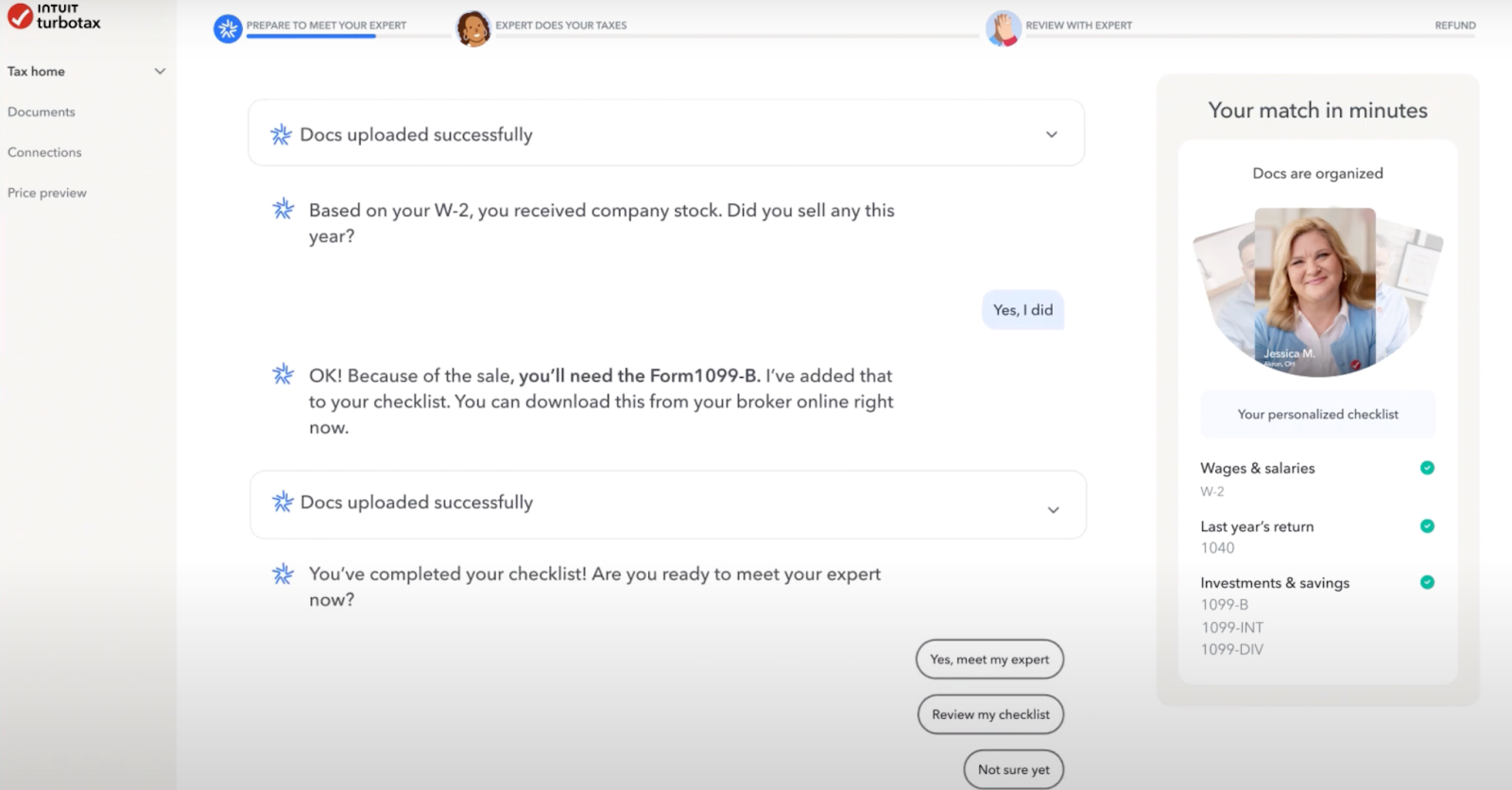

3. Intuit Assist (TurboTax): Best AI accounting tool for seamless tax filing

Intuit Assist is a generative AI assistant built into all Intuit products, including QuickBooks, Credit Karma, and TurboTax. Here, we’re focusing on the TurboTax version, which helps individuals, solopreneurs, and SMBs file their tax returns. It combines AI-powered guidance with human expert support to walk users through the entire filing process, making it faster, easier, and more accurate.

When you start filing, Intuit Assist guides you through onboarding, reads forms like W-2s and 1040s, and creates a personalized checklist that updates as you upload more forms. It flags missing data, asks follow-up questions based on its findings, and automatically fills in relevant tax forms. It also spots potential errors and helps resolve them before submission.

The assistant helps you find opportunities for reducing taxes, explains outcomes such as why you’re receiving a refund or a balance due, and summarizes the key factors affecting your return at the end of the process. If you’re stuck, you can ask follow-up questions or connect with a live expert at any time.

The dashboard includes a progress tracker that shows what has been completed versus what remains missing. Intuit Assist updates the experience dynamically based on your input. It works within TurboTax Online and mobile, supports seamless data imports from documents, payroll apps, and prior returns, and lets you export your full return as a PDF.

Pros

- Combines AI-powered guidance with human expert support

- Runs real-time accuracy checks while you complete your return

- Delivers personalized, trustworthy, and accurate support throughout the tax filing process because it’s powered by GenOS, which is trained on a massive set of financial and tax data

Cons

- Only works within TurboTax, not as a standalone smart accounting tool

- Limited to the US and Canada only — not available in other countries

Pricing

- File your own taxes: $0–$149

Includes upload or import of tax documents, Intuit Assist for real-time help and explanations, and CompleteCheck for guaranteed accurate calculation - File taxes with expert help: $89–$219

Includes live chat with tax experts, unlimited help, and final expert review at no extra cost - Let an expert file your taxes: Starts at $139

Includes local tax expert, connection from anywhere at anytime, and final expert review before filing

4. Datarails: Best AI accounting tool for auto-generated financial decks

Datarails is a financial planning and analysis (FP&A) platform with a standout AI feature: Genius by Datarails, the world’s first full generative AI assistant for FP&A.

One of the platform’s most impressive tools is Storyboards by Genius, which turns your dashboards into fully written, presentation-ready decks in just two clicks. The AI autogenerates charts, commentary, and insights based on your real-time financial data. So, instead of spending hours building 50-slide decks, you get a live, up-to-date presentation you can share instantly. If the underlying data changes, your storyboard updates automatically — no manual edits needed.

Another feature of the automated accounting platform is Insights by Genius, which analyzes your financial key performance indicators (KPIs) and delivers tailored summaries and insights based on what matters most to your business. Once you have those insights, you can turn them into a presentation using Storyboards.

If you’re presenting live, Chat by Genius lets you interact with your data during the presentation. You can ask the chatbot questions, use preset queries, and even add AI-generated answers directly to your dashboard with a single click. Chat also has complete and consolidated financial data from across your company, allowing you to ask it questions at any time, not just during presentations.

Together, these tools help chief financial officers (CFOs), controllers, and finance teams reduce manual work, tell clearer financial stories, and prepare for meetings more efficiently. You can access Datarails through a web interface, Excel add-on, or mobile app. The dashboard supports filters, drill-downs, and export options (PDF, PowerPoint) and integrates with over 200 tools.

Pros

- Fully integrated AI tools for creating and presenting financial decks

- Real-time data sync during presentations

Cons

- Steeper learning curve for beginners or small business users

- Requires setup time and some team training

Pricing

- Custom pricing available based on company size and needs — contact Datarails for a quote

5. Rydoo: Best AI accounting tool for automated expense auditing

Rydoo is an expense management platform with an AI-powered finance management feature called Smart Audit, which runs multiple checks on every employee-submitted expense. It automatically flags noncompliant claims like unauthorized upgrades or alcohol, as well as duplicate or fake receipts, attendee conflicts, and suspicious transactions to help finance teams prevent fraud with less manual effort.

Approvers see flagged issues in real time via the app dashboard and can quickly approve, reject, or comment on expenses. Smart Audit adapts to your company’s expense policy, making it easy to automate low-risk claims while maintaining control over exceptions.

This AI expense tracker is especially useful for mid-sized to large businesses that handle a high volume of claims and want to cut down on manual review. The dashboard is clean and mobile-friendly, with a live feed of incoming expenses and status updates. Rydoo integrates with over 35 tools — NetSuite, Wise, Workday, TravelPerk, QuickBooks, and more — across various categories, including human resources, ERP, travel, and finance. You can export reports in PDF or Excel formats, and admins can configure data fields and templates to match internal reporting needs.

Pros

- AI expense tracker automatically detects AI-generated or fake receipts

- Translates receipts into 18 languages

- Mobile app offers built-in receipt scanner

Cons

- Features may feel like overkill for freelancers or very small businesses

Pricing

- Essentials plan ($9 per user per month, billed annually)

Includes mobile receipt scanner, unlimited expenses and mileage tracking, basic integrations, single approval flow, legal and tax compliance, multicountry certified paperless expensing, PDF and Excel exports, and export templates - Pro plan ($11 per user per month, billed annually)

Includes all essential features plus per diems, multilevel approvals, online accounting integrations, automated reconciliation, customizable policies and input fields, and multicountry local compliance - Business plan (custom pricing)

Includes all Pro features plus Rydoo Cards, secure file transfer protocol (SFTP), API access, custom bank feeds, and priority support - Enterprise plan (custom pricing)

Includes all Business features plus Rydoo Smart Audit, advanced approval workflows, insights dashboard, single sign-on (SSO), HR Connect, extended sandbox, and scheduled exports

Good accounting software automates more than math

The goal of AI accounting tools is to free up your team’s time so you can focus on strategic work, not tedious busywork. That’s why these tools do more than just automate calculations. They flag errors before they become problems, surface insights you might’ve missed, and keep everything organized without endless spreadsheets or back-and-forth.

If your current workflow feels slow or manual, select from one of the tools I’ve reviewed here. Be sure to choose one that fits your team size, systems, and needs. Whether you’re running a lean operation or a growing finance team, there’s likely an AI bookkeeping software that’ll save you hours and reduce errors in your work.

This article is for small to mid-sized business owners, startup founders, accountants, and in-house finance teams who want to save time, reduce errors, and streamline bookkeeping, tax prep, and financial reporting with AI-powered accounting software.

Send Comment: