Top 6 AI finance tools

As someone who has spent years writing about personal finance, retirement planning, and crypto, I’ve seen how technology can transform money management. My experience evaluating financial tools and trends gives me a front-row seat to the artificial intelligence (AI) revolution in finance. Below, I dive into the six best AI finance tools that are making waves in 2025, helping you save time and make smarter decisions with your cash.

Whether you’re trying to regain control of your personal budget or simply want a better way to manage your small business’ finances, these AI accounting tools and finance automation solutions will help you achieve your goals. I’ll unpack what AI agents are and discuss the benefits of AI that each of these tools provides.

What is AI in finance?

AI in finance refers to using artificial intelligence to automate and support financial tasks, such as budgeting and trading. It leverages machine learning, natural language processing (NLP), and automation to analyze data, detect patterns, and make decisions. There are AI finance tools for personal use, financial professionals, investors, and small business owners.

AI models are the backbone of finance AI software. These models are becoming increasingly sophisticated, which makes it tough to narrow down the best AI for finance. There are just so many tools out there. To cut through the noise, I focused on factors such as:

- Versatility

- User-friendliness

- Use cases

- Features and tools

- Accuracy

- Ease of adoption

I tried to include a good mix of AI finance tools to address the needs of individuals, small businesses, investors, and larger companies. My list includes AI budgeting software that can be used for personal finances or to scale a small business. I also looked at AI investment platforms to support wealth-building goals.

That’s the beauty of AI finance tools. There are so many subsets of solutions that you can find software for just about any use case. When you want to get smarter with money management, artificial intelligence is the answer.

The best AI finance tools

Here’s a curated list of the top six AI finance tools for 2025, each of which excels in specific areas like automation, investing, budgeting, and data analysis. Kicking things off with Jotform AI Agents, one of the most versatile AI financial tools on the market today…

1. Jotform AI Agents

Jotform AI Agents are smart assistants that make financial data collection a breeze. Whether you’re processing loan applications, expense reports, or budget requests, these AI agents automate form-filling without coding. Jotform offers dozens of pre-built AI agent templates that you can quickly customize to your needs:

- Finance AI Agents: One of my personal favorite options. These AI-powered assistants make it easy to gather accurate information quickly. You can collect customer data, process applications, and get more done.

- Finance Support Specialist AI Agent: Assists clients with financial inquiries by guiding them through account management. They also help with transaction tracking and assist users with self-service using the power of AI. These agents can answer simple inquiries and drastically reduce the workload on your support team.

- Donation Processing Manager AI Agent: Streamlines the donation process by guiding contributors through donation steps, payment options, and receipt generation. These are just a few of the support agents you can tap into with Jotform.

Virtual agents are just one facet of Jotform’s AI-centric solutions. The platform also includes drag-and-drop tools, which use AI to help you build and customize agents more efficiently. The smart forms promote higher audience engagement and simplify data collection, ensuring you have the insights necessary to process applications and deliver prompt service.

Best for: Collecting financial data quickly and improving customer experience

Developer: Jotform

Key features: AI agents for multiple tasks, no-code form creation, real-time data collection, data validation

Pros: Simple to use without the need for coding, can be customized for a variety of tasks

Cons: Less suited for trading or advanced analytics, limited functionality for offline use

Plans/pricing: Free plan available, paid plans start at $34 per month, custom pricing available for enterprises

G2 rating: 4.7

2. Betterment

Betterment is a robo-advisor that uses artificial intelligence models to build your investment portfolio based on the goals you select. The application will automatically rebalance your portfolio to help reduce your tax burden and adapt to changes in the market. Features like fractional shares ensure all your money is invested wisely. The annual fees start at just 0.25 percent with a $250 recurring monthly deposit. It’s perfect for beginners or those seeking passive investing.

One of my favorite features is Betterment’s tax-loss harvesting, which helps users cover their taxable advisory fees via tax savings. According to Betterment, nearly 70 percent of its users take advantage of the tax-loss harvesting tool to offset their advisory fees. The platform’s automation tools help you optimize your investments, save time, and stay one step ahead of market trends.

If you have complex financial needs, such as passing a business on to your inheritors or estate planning, I would suggest a traditional wealth management advisor. Betterment is more suited for general investing and wealth building. Either way, I recommend giving it a try. The low-cost nature of Betterment makes experimenting with the platform low risk.

Best for: Automated investing and portfolio management

Developer: Betterment

Key features: AI-driven robo-advisor, automating rebalancing and tax-loss features, goal-based financial planning, low-cost exchange-traded funds (ETFs) and fractional shares, ability to use crypto

Pros: Much cheaper than a human advisor, user-friendly app, tax optimization tools, customizable portfolios, goal-tracking features

Cons: Not ideal for more complex financial planning, limited human interaction

Plans/pricing: Starting from $4 monthly, 0.25 percent annual fee with a balance between $20K-1M

G2 rating: 4.2

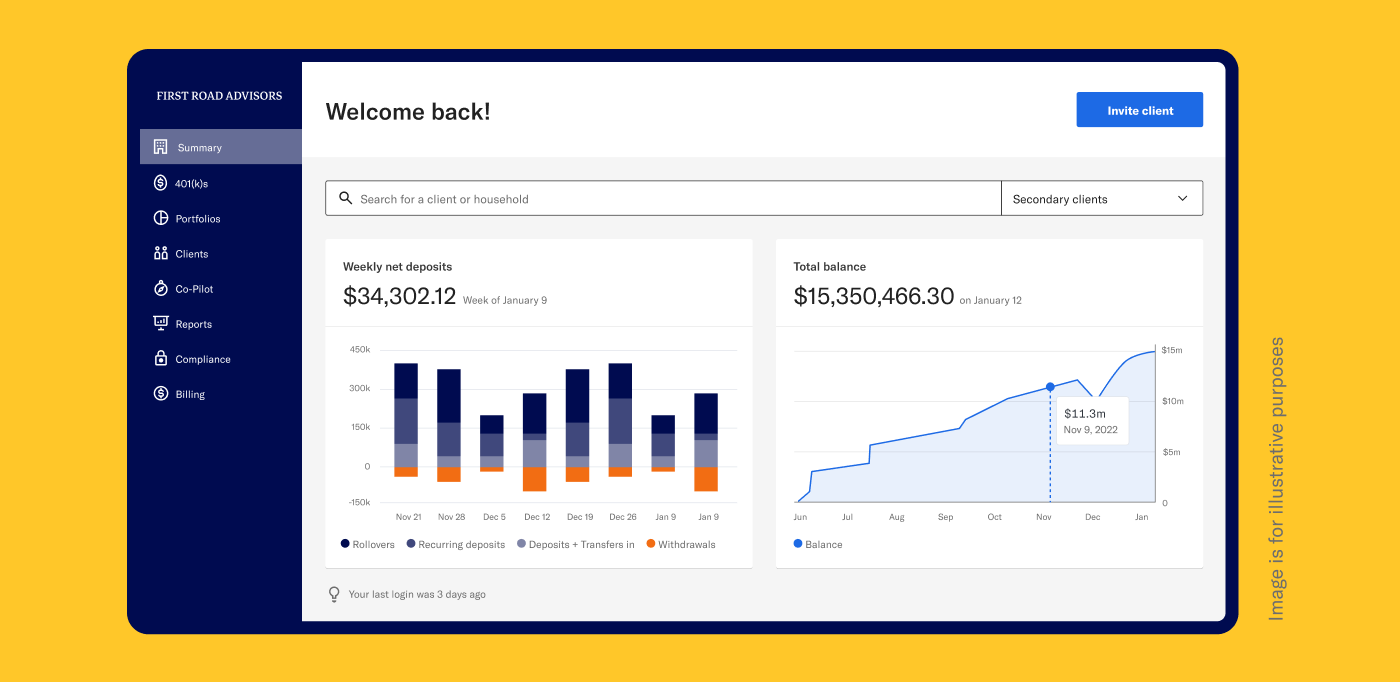

3. Wealthfront

Wealthfront’s AI-driven platform excels in tax-efficient investing. It uses sophisticated algorithms to rebalance portfolios and harvest tax losses daily. The platform also forecasts your net worth based on your financial habits, which can help encourage you to keep investing. Wealthfront has one of the lowest fee schedules of any AI finance tools for investing.

Overall, I enjoyed my experience with Wealthfront. The platform is incredibly user-friendly, and the no-nonsense advisory fee means a negligible monthly cost. The automatic rebalancing feature adjusts your funds as the market moves to keep the portfolio in line with your goals.

The biggest drawback to Wealthfront is that some users may find it over-automated. If you enjoy taking calculated risks and managing your own portfolio, Wealthfront may not be for you. That’s because it makes all of the major decisions for you based on your chosen goals.

You won’t be able to access a human advisor within the Wealthfront ecosystem. The platform is all automation and AI. Some more sophisticated solutions combine artificial intelligence with human advisors, allowing them to handle more complex portfolios. The downside to those platforms is that they are more costly.

However, with zero account fees and no minimum balance needed, it’s definitely worth a try. You can start earning with just $1.

Best for: Tax-efficient investing and financial planning

Developer: Wealthfront

Key features: AI-powered portfolio rebalancing, tax-loss harvesting, risk management, AI-based financial planning, low-cost ETF portfolios, goal-based investing support

Pros: Advanced tax optimization, low 0.25 percent management fee, robust financial planning tools

Cons: No human advisor access, ETF portfolios are limited

Plans/pricing: Wealthfront charges a 0.25 percent annual advisory fee

G2 rating: 4.7

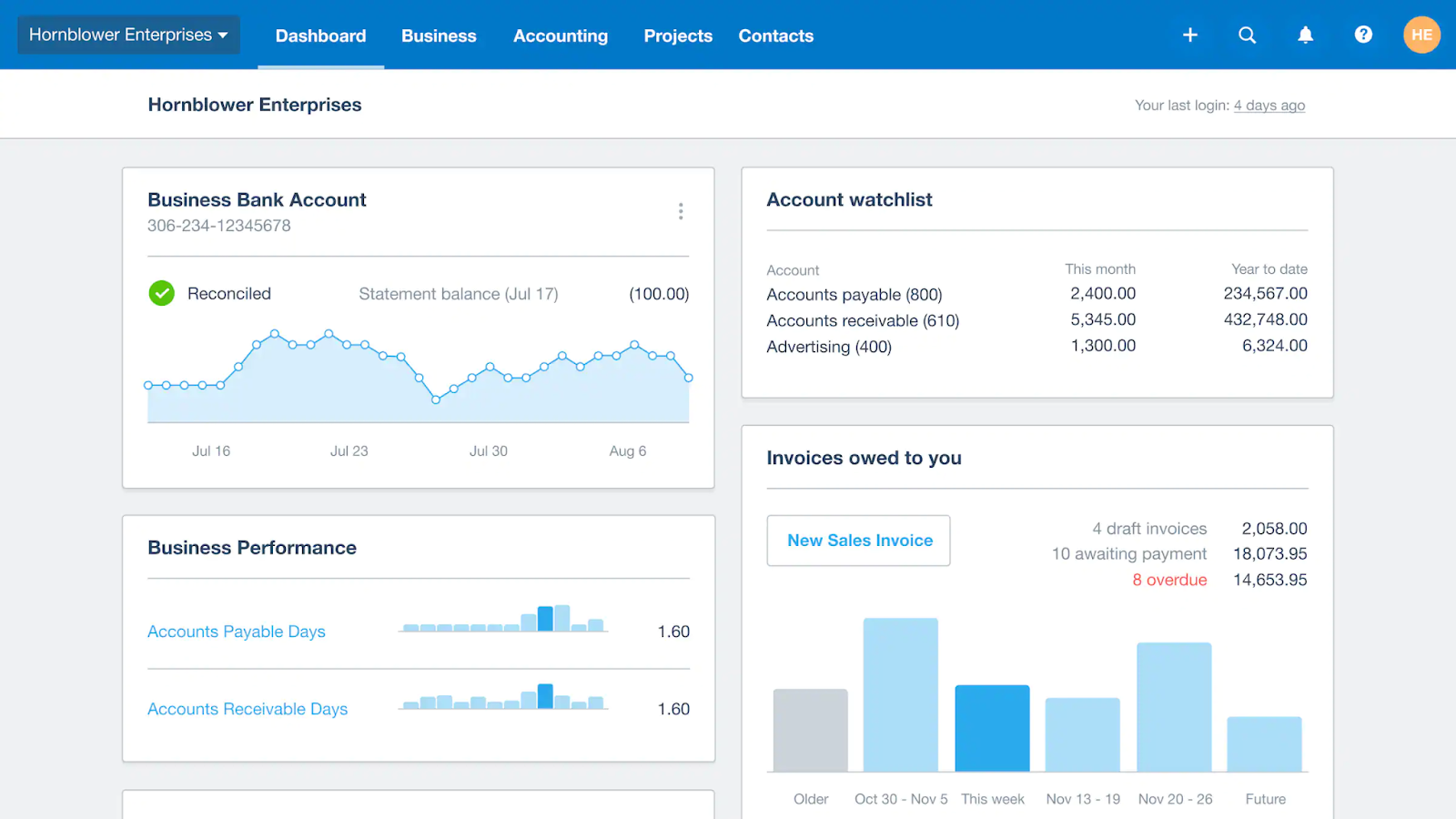

4. Xero

Xero is an accounting solution for small business owners. The platform uses artificial intelligence to help you perform invoicing and reconciliation tasks more efficiently. You can implement Xero at a fraction of the cost of a human bookkeeper and gain a better view of your cash flow. I appreciate all of the integrations that Xero offers, which make it easy to connect the app with software you are probably already using.

The Xero platform proves that AI isn’t just for big businesses, with a number of affordable pricing plans and regular discounts available. However, I would recommend a higher subscription tier so you can access all of Xero’s advanced AI features.

The platform’s main shortcoming is its lack of reporting depth, making it a bad fit for businesses with complex revenue cycles. On the other hand, it’s great for small businesses that need an efficient accounting solution.

Best for: Small business accounting and bookkeeping

Developer: Xero

Key features: AI-powered bookkeeping automation, invoicing and reconciliation tools, multi-currency support, real-time financial dashboards, integration with dozens of apps

Pros: Streamlined accounting tasks, mobile app for on-the-go management, strong integration infrastructure, user-friendly experience for small businesses

Cons: Higher pricing for advanced features, limited reporting depth

Plans/pricing: Plans starting from $20 per month

G2 rating: 4.3

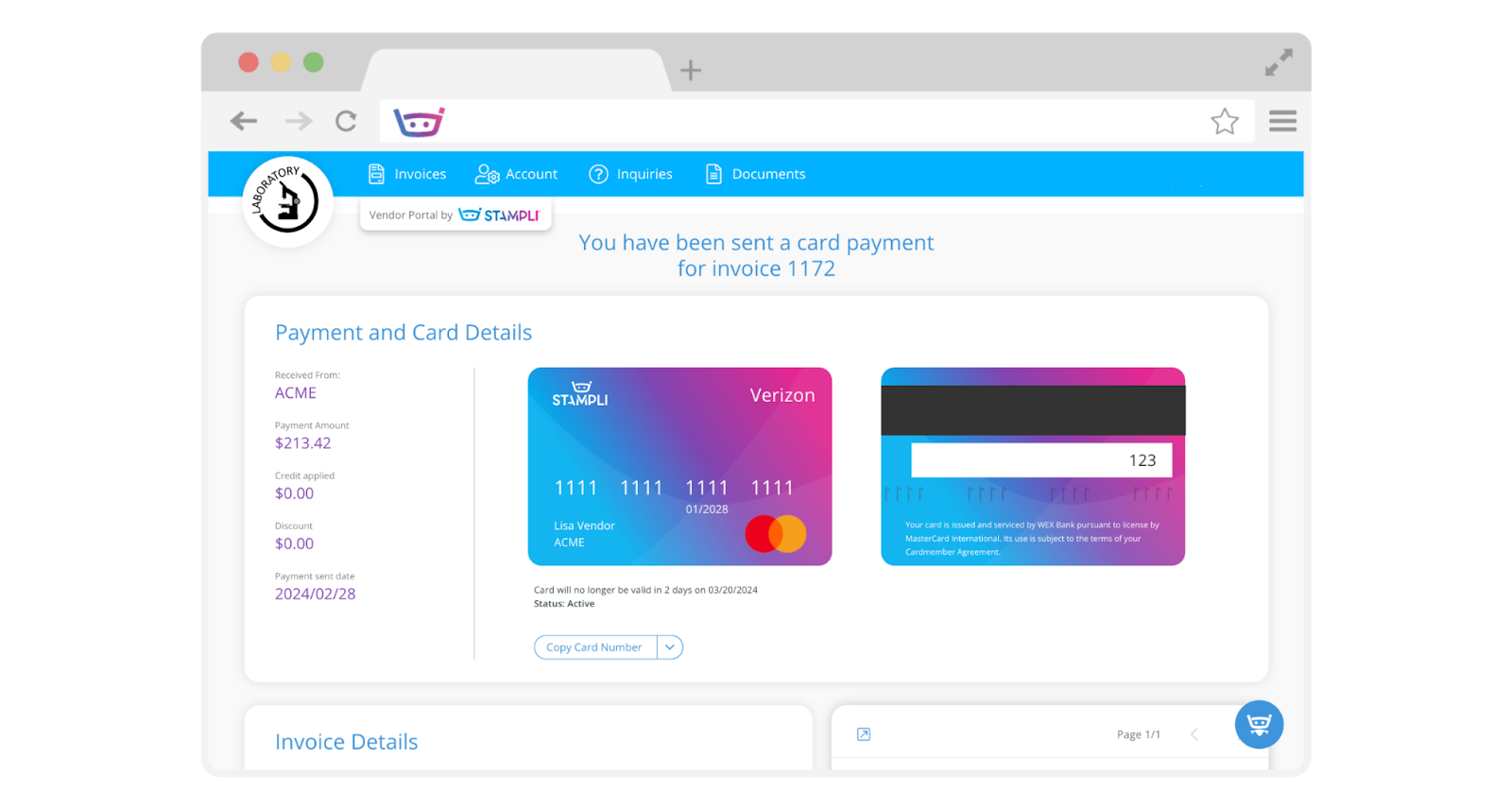

5. Stampli

Stampli’s AI, Billy the Bot, automates accounts payable by extracting data from invoices and detecting fraud or duplicates. Its real-time audit trails and team collaboration features streamline approvals. The platform integrates with QuickBooks, NetSuite, and lots of other powerful applications. It’s a game-changer if you are drowning in invoices and need a practical solution to dig your way out.

I was surprised how easy the platform is to use. Billy the Bot, which Stampli describes as a “funny little blue guy”, always seems to be around when you need him. The bot codes key data and assigns the information to the correct general ledger accounts to promote financial accuracy. It auto-detects duplicates so you don’t pay vendors twice. Billy also identifies discrepancies so you can take a closer look.

The best part is that Stampli is highly customizable. It uses your company policies to determine the appropriate approval route. You’ll also receive reminders when an invoice is pending approval, which helps prevent bottlenecks and protect your cash flow.

Unfortunately, you have to request a quote from Stampli — they don’t have any general pricing information available. However, Billy the Bot and Stampli are definitely worth a look. The little bot is extremely efficient and can save you countless hours every week.

Best for: Accounts payable automation

Developer: Stampli

Key features: AI for invoice processing, real-time audit trails, fraud and duplicate payment detection, integration with QuickBooks and NetSuite, interactive tools

Pros: Fast invoice processing, helps to reduce errors, offers multiple enterprise resource planning integrations, provides a collaborative platform

Cons: Pricing based on invoice volume, limited to AP workflows

Plans/pricing: Request a quote

G2 rating: 4.7

6. Booke AI

Booke AI simplifies bookkeeping by automating transaction categorization and reconciliation. The platform’s optical character recognition technology can “read” paper invoices and pull relevant data. It will save you time and energy while reducing the load on your accounting team. Booke AI’s optical character recognition (OCR) capabilities are robust, but it may struggle with handwritten information. Booke AI is compatible with QuickBooks and Xero.

The basic bookkeeping platform doesn’t include the more advanced AI tools, which means you’ll have to put out more money for a higher plan if you want to be able to access OCR capabilities. But it’s worth the extra cost if you process lots of invoices and want a faster revenue cycle.

If you are a small business owner, you’ll appreciate the platform’s affordability and user-friendly design. You can implement and start using Booke AI in no time — the learning curve is minimal, and the menu will feel familiar.

However, I recommend reviewing complex invoices you put through the system, especially early on, ensuring Booke AI is accurately capturing and sharing the right information. While I didn’t have any issues with the OCR capabilities, it is important to verify that the AI is working properly before you give it more autonomy. Overall, Booke AI is a solid choice for startups, freelancers, and small businesses that are already using QuickBooks or Xero.

Best for: Bookkeeping automation for small businesses

Developer: Booke AI

Key features: AI-driven transaction categorization, smart document data extraction, 24/7 automated reconciliation, proactive error detection, integration with QuickBooks and Xero

Pros: Saves time on bookkeeping, affordable pricing, easy integration process, reduces errors

Cons: OCR struggles with complex invoices, limited advanced analytics

Plans/pricing: Bookkeeping platform starts at $20 per month, AI bookkeeper is $50 per month

G2 rating: N/A

Why these AI finance tools matter

These six AI finance tools can make managing your money much easier. While each platform addresses unique needs, all of them leverage artificial intelligence to automate redundant tasks and help you get more done. You can use them to reduce errors, save time, and gain better insights into your money.

Of the AI finance tools on my list, Jotform is the most versatile. With it, you can automate customer-facing forms and remove friction from important interactions, such as self-service and information gathering.

If you need to achieve more but aren’t ready to expand your team, check out Jotform. The versatile platform is a true force multiplier. You can get more done without taking on bloated payroll expenses or navigating the hassles of hiring in today’s scarce talent market. That’s the beauty of Jotform’s AI finance tools. Get started for free today.

This article is intended for anyone exploring AI finance tools for personal or business use, including individuals managing budgets, small business owners, and finance professionals who are looking to compare platforms.

Photo by Towfiqu barbhuiya on Unsplash

Send Comment: