As your business grows, simple spreadsheets and endless emails just won’t cut it anymore. You might realize that an invoice has been stuck in your drafts folder for months, or you forgot to fill out a tax form. Or a sticky note with an employee’s new bank information got buried on your desk, so they didn’t get paid on time.

With so much to juggle — and so many ways to make mistakes — it’s no surprise that 58 percent of finance leaders are turning to automation to lighten their workloads. Automating tasks like data entry can save hours every month. Plus, it reduces errors and helps protect your data. Here’s how to set up a simple finance automation system for your business.

What is financial process automation?

Financial process automation uses artificial intelligence and other technologies to complete routine tasks.

Constantly struggling to remember if you sent an invoice in August or September? Automate payment reminders so you never forget an overdue bill. Offloading minor tasks like these lets you save time and mental energy for bigger responsibilities, like strategizing for next quarter.

Types of finance automation

You might be fantasizing about handing off your to-do list to a genius AI assistant, but automation doesn’t always look like that. Here are three kinds to consider.

Business process automation (BPA)

Many businesses use software to automate entire workflows, especially accounting tasks. Spending too much time calculating overtime and approving vacation requests? Use a payroll automation system so you can spend less time hunched over your calculator.

Robotic process automation (RPA)

Working on a smaller scale, robotic process automation uses bots to handle specific repetitive tasks. For instance, you could set up a bot that automatically emails clients when their invoices are seven days overdue.

Intelligent automation (IA)

The most advanced type of automation uses AI and machine learning to handle more complex tasks. It’s especially useful for complex data analysis. Instead of poring over spreadsheets for days, you can use intelligent automation tools to instantly spot trends and get budgeting recommendations.

What to automate first

Don’t try to automate your entire workflow overnight — that’s too disruptive. Start with a handful of tasks that will provide the most value to your business and employees. Here are some ideas.

| Area | Tasks to automate | Helpful templates and resources |

|---|---|---|

| Bookkeeping | Automatically input and compile data with no typing necessary | Client intake form |

| Budgeting | Track expenses and income every month | Monthly budget template |

| Employee onboarding | Collect information from new team members and schedule their training | New hire onboarding form |

| Enterprise resource planning (ERP) | Organize all your company’s data and workflows in one place | Jotform API |

| Financial planning and analysis | Analyze your financial performance and get AI recommendations to improve it | Cash flow analysis form |

| Fraud detection | Spot inventory theft, fake expense claims, and other fraud | Fraud report form |

| Invoicing | Bill clients, track payments, and follow up on overdue invoices | Invoice template |

| Procurement | Generate purchase orders and communicate with vendors automatically | Procurement request form |

5 step financial automation plan

You wouldn’t start buying equipment or hiring employees without a concrete plan. The same principle applies to finance automation. Follow these steps for the smoothest rollout.

1. Map your processes

Lay the groundwork for automation by diagramming your existing workflows. Otherwise, you’ll be blindly guessing what you need to automate — and possibly making things less efficient if you choose incorrectly.

Whether it’s through an intensive, company-wide look at every stage of your financial processes or simply one big brainstorming session, account for each step and stakeholder involved in your accounting procedures.

Use a flow chart to track how you collect and report data, then highlight the stages you can automate. These flow charts will eventually become guides to creating automated workflows.

Jotform’s convenient templates can help you outline and automate existing workflows

- Budget approvals: Map out who needs to review your budget requests, and build approval pipelines. With Jotform’s Budget Approval Process Workflow Template, you can automatically push proposals through each stage and send reminders so they don’t get buried in a busy executive’s inbox.

- Invoicing: Make sure your freelancers get paid on time by automatically sending incoming invoices to the right people. Use the Invoice Approval Workflow Template to route and track bills.

- Purchase requisition: Stick to a tight budget by requiring departments to get purchases pre-approved by your finance team. Collect all the necessary details with Jotform’s Purchase Requisition Form.

Once you understand what every workflow involves, you’ll quickly spot opportunities for automation. For example, you may realize that no one’s in charge of notifying freelancers when there’s a problem with their invoice. By sending an automatic follow-up email, you can help them correct any mistakes instead of getting stuck in billing purgatory for months.

2. Prioritize by ROI and impact

You may be eager to automate all your processes at once. But that’s just not practical.

Tackle your most pressing needs first. Look at your most time-consuming tasks to see if they can be automated. Does your finance team spend every Friday afternoon chasing down missing timesheets and fixing missed punches? Automate those tasks with a tool like Jotform’s Punch In Out Timesheet App. Your employees will be thrilled by all the time they save. Then they can use those afternoons for more critical tasks, like prepping for the following week.

Consider the return on investment for each task, too. Formatting reports to fit your picky CEO’s preferences might be tedious — but the business won’t go broke if your margins aren’t exactly one inch. On the other hand, sending late invoices can dry up your cash flow and annoy clients. Put automating invoices at the top of your to-do list, and save the reports for later.

And don’t forget to ask your finance team for suggestions. You might assume that they need help with onboarding, but they’re actually drowning in expense reports. With their input, you can focus on automating the tasks that will make the biggest difference in their day-to-day routines.

3. Choose the right solution

Once you’ve picked a few high-priority tasks to automate, you need the software to make it happen.

Start by looking for platforms that fit your long-term business goals. Do you only want to automate a handful of tasks? Simple RPA software might fit the bill perfectly. But if you’re planning on widespread automation, choose a vendor who can be a true partner through implementation. For example, a partner vendor might train your team or help integrate tools with your existing tech stack.

Pay close attention to specific features, too. The best finance automation tools

- Can automate most or all the tasks on your wish list

- Make it easy to build custom workflows

- Are scalable, so they can grow alongside your business

- Fit your budget

- Have a user-friendly interface

- Come with built-in analytics and reporting tools

Whichever software you choose, make sure that it’s a low-code or no-code solution, so all employees can use it, no matter their technical expertise.

Vendors should also offer resources to get everyone up to speed quickly. For instance, Jotform Academy has free online courses to help users master the platform. Training materials like these can make the difference between a smooth transition and a chaotic one that leaves everyone confused and grumpy.

4. Pilot, measure, and refine

Before sharing your new software with your entire company, test it out with a small group. Ask your sales department to submit their expense reports to your automated form, or send automated invoices to a few clients.

These experiments will help you catch any bugs before you bring the whole team on board. Plus, it’s easier to win over resistant employees if other people are already raving about how much time they’re saving.

As you launch your tool, collect data to make sure your finance automation efforts are paying off. Here are a few helpful metrics:

- Employee satisfaction

- Number of data-entry errors

- ROI

- Productivity

- Total number of hours saved

Use this information to tweak your processes as necessary. For example, automating payroll might lead to a spike in missed paychecks if new employees don’t get added automatically. With continuous monitoring, you can correct these mistakes early.

5. Fit checkpoint: Is this process ready for automation?

Experimenting with new technology can be downright thrilling, but pause before you get too far down the rabbit hole. Just because you can automate something doesn’t necessarily mean you should.

Tasks are probably a great fit for automation if

- They’re repetitive and unchanging

- They’re taking up a significant portion of your team’s time

- Most people involved feel enthusiastic about automating them

Avoid automating tasks that

- Your employees rarely spend time on, like approving international travel when most trips are domestic

- Are prone to errors

- Require human intervention, like deciding whether an employee deserves a raise

Consider your team’s opinions, too. They may prefer to keep handling certain tasks, such as payroll, if they feel anxious about giving up control.

Of course, that doesn’t mean you need to give up on automating that task forever. Review your workflows every six months or so to see what you can adjust. Who knows? Technology might catch up, or your team could start taking more international trips. These changes could open the door to more automation.

Challenges and how to avoid them

Automation simplifies processes, but it can also cause friction in your company. Luckily, most issues are avoidable with savvy planning.

Employee resistance is one common hurdle. Some team members might be relieved to lessen their workload, but others may worry about how automations will affect their positions. Reassure them that your new workflows will help, not replace, them.

Some businesses also struggle to get executive buy-in. They may believe finance automations aren’t necessary — “our payroll works fine” — or are too expensive. Consider running a small trial with a free or affordable tool so you have hard data to back up your request.

A lack of resources could hold back your company, too. The cost of automation software is only the beginning. You also need time and money to upskill employees. Reduce the impact of the transition by choosing a vendor with free training resources.

And don’t forget about data concerns. The last thing you want to do is leak your sensitive financial information. Be sure to pick a platform with robust cybersecurity measures and a track record of protecting client data.

Jotform in finance automation

The right tools make automation seamless, and Jotform offers a number of them. Here are a few ways the platform can assist with your financial processes.

Product capabilities

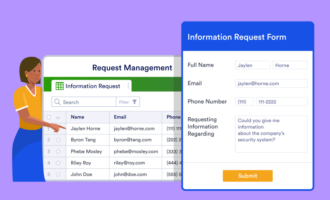

Jotform lets you build customizable forms to gather financial data. This information is the foundation for your automated processes. For example, you could create forms to collect vendor info and expense reports automatically — much easier than letting them pile up in your inbox.

Manage this data with simple workflows. Say, for instance, you use a form to collect timesheets. Jotform’s Timesheet Approval Workflow template reviews each submission and forwards it to the appropriate HR manager. Or, if something’s incorrect — like a 33-hour entry for Tuesday — the system will send it back to the employee to fix. That way, the HR manager only needs to approve pre-screened timesheets.

The platform also organizes convenient Tables, which pull from your Finance Sheet templates. These tools allow you to organize and manage financial records in one place. Instead of sifting through a pile of paper forms, you can quickly see who didn’t submit their timesheet or tax forms.

Jotform also integrates with popular accounting and ERP software, including QuickBooks and Netsuite. This means less time wasted sending information between departments — or worse, entering the same data into multiple systems.

Build it with Jotform

You don’t need a Ph.D. in computer science to start creating automated workflows. Jotform lets you build them in minutes — no coding knowledge necessary.

Say, for instance, you want to automate your approval process to cut down on a flurry of back-and-forth emails. Here’s how:

- Open the Workflows template in your Jotform dashboard.

- Build a workflow. You can start from scratch or customize a template to fit your company’s needs.

- Select one of your forms — such as a vacation request form — as the starting point of your workflow.

- Add approvers, such as your HR manager or a department head. They’ll automatically receive a notification every time someone submits a form.

- Give your approver options, such as approve, deny, or send a follow-up email.

- Select what happens for each outcome. For example, an approval might trigger an automatic email to the employee saying, “Your vacation time has been approved. Happy travels!” On the other hand, a denial could lead to an explanatory email.

- Publish your form to start receiving and approving requests.

Once your form goes live, ask employees for feedback about their experiences. They might feel confused about a field — “How much detail do I need to include in the request box?” Or they might prefer more dropdown menus to speed up their requests. With a few tweaks, you can satisfy users on both ends of the workflow.

Revamp your financial processes

Every dollar counts, especially for a small or growing business. With financial process automation, you can improve how you handle every expense and revenue stream.

Automation can also make a huge difference in your team’s daily routines. When tasks run smoothly in the background, you won’t have to lift a finger. That maximizes the value of all your processes while minimizing frustration and stress.

The result? Your finance department can become more streamlined, productive, and engaged. See the difference for yourself by creating a free Jotform workflow today. Or get in touch with our sales team to learn more about how we can help you supercharge your productivity.

This guide is for finance and operations leaders at growing SMBs and mid-market teams—controllers, accountants, payroll/HR admins, RevOps, and founder-led businesses—who’ve outgrown spreadsheets and email chains and need a practical, no-code path to automation.

Send Comment: